2nd Quarter Jumped 1452% Compared to Last Year

AI Demand Increases, DS Division Operating Profit Reaches 6 Trillion Won

LG Electronics Also Has a Strong Home Appliance Business with Operating Profit of 1.2 Trillion Won

May Current Account Surplus Highest in 32 Months

Employees are walking around the Samsung Electronics Seocho building in Seocho-gu, Seoul on the 5th, when Samsung Electronics recorded an ‘earnings surprise’ in the second quarter. Reporter Song Eun-seok [email protected]

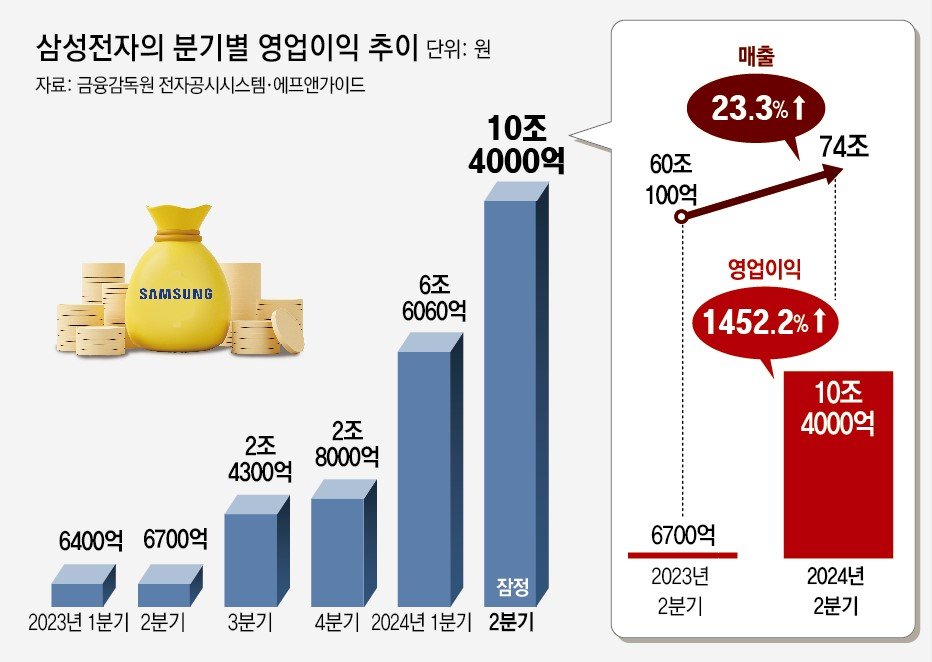

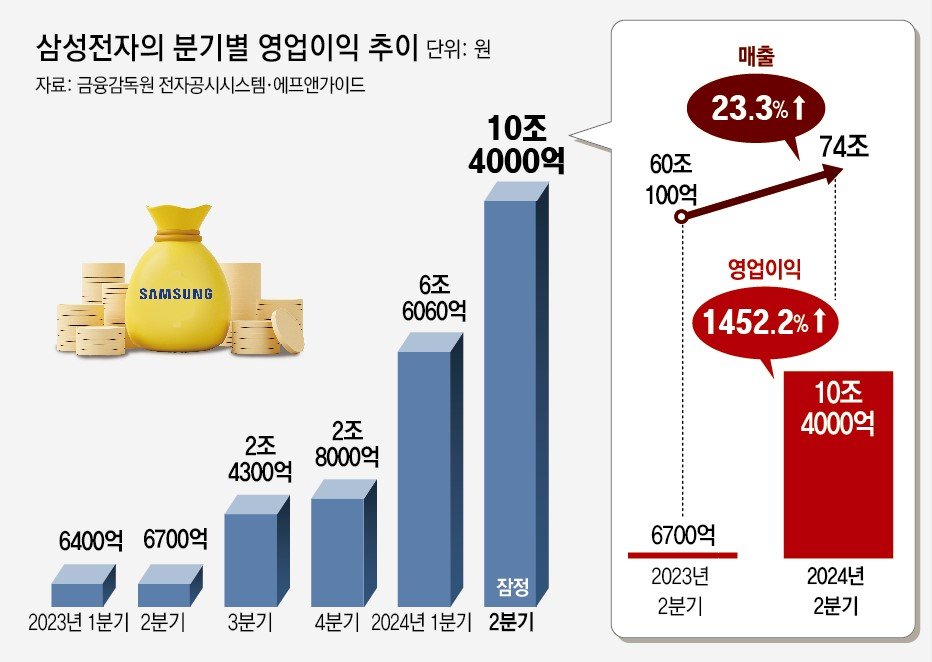

Samsung Electronics, riding the semiconductor boom due to the expansion of the artificial intelligence (AI) market, recorded an ‘earnings surprise’ by posting operating profit of over 10 trillion won in the second quarter (April-June). This far surpassed the securities industry’s forecast of 8.3 trillion won. Amid the recovery in the home appliance and TV markets, LG Electronics also recorded operating profit of over 1 trillion won in the second quarter, the highest ever for the second quarter.

Samsung Electronics provisionally announced on the 5th that its consolidated sales for the second quarter were 74 trillion won and operating profit was 10.4 trillion won. This is a great performance that surpasses the annual operating profit (6.57 trillion won) earned over the past year. Sales increased by 23.3% and operating profit increased by 1,452.2% compared to the same period last year.

The electronics industry is analyzing that the semiconductor market is gradually recovering and the recent surge in AI demand has led to a full-fledged rebound in the memory semiconductor market. Initially, the investment industry estimated that Samsung Electronics’ semiconductor (DS) division would have posted operating profits of 4-5 trillion won in the second quarter, but due to the earnings surprise, the estimate was revised upward to 6 trillion won or more in operating profits in the DS division alone. In the third and fourth quarters, Samsung Electronics is expected to continue its upward trend in performance by posting operating profits in the 10 trillion won range.

On this day, LG Electronics also announced that it recorded consolidated sales of 21.7009 trillion won and operating profit of 1.1961 trillion won in the second quarter. Operating profit increased by 61.2% year-on-year, and sales also grew by 8.5% year-on-year, the best performance in the second quarter. The growth was driven by the recovering home appliance market and increasing sales of premium organic light-emitting diode (OLED) TVs, especially in Europe.

The semiconductor boom and the electronics industry’s good performance are also reflected in the current account. The current account surplus for May announced on this day was $8.9225 billion (approximately KRW 12.3175 trillion), the largest in two years and eight months. In particular, semiconductor exports surged 53% year-on-year, leading the overall export growth.

KOSPI also rose 1.32% on the day, breaking its all-time high for two consecutive days. As of the closing price of the day, Samsung Electronics’ stock price surged 2.96% from the previous day to 87,100 won. It is a 52-week high and the highest price in 3 years and 5 months since January 25, 2021 (89,400 won). LG Electronics also closed at 118,000 won, up 2.69%.

AI Winds Drive Semiconductor Upcycle… Samsung Electronics’ Operating Profits Increase 16-fold in One Year

[반도체 서프라이즈]

2nd quarter operating profit 10.4 trillion won

Estimated operating profit of 6.6 trillion won in the semiconductor sector… Recovery in DRAM prices – AI server demand

Next-generation HBM expected to drive performance in the second half of the year… AI-equipped Galaxy Z Flip to be released next week

Samsung Electronics’ provisional operating profit for the second quarter of this year (April-June) skyrocketed by regarding 16 times year-on-year, largely due to the recovery in the semiconductor industry caused by the expansion of the artificial intelligence (AI) market. It is the first time in seven quarters since the third quarter of 2022 (July-September, KRW 10.85 trillion) when the semiconductor downcycle began that Samsung Electronics posted quarterly operating profit of over KRW 10 trillion. As the memory semiconductor market enters a full-fledged upward phase, there is analysis that the company will continue its good performance in the second half of the year.

● Expected to be worth over 6 trillion won in the semiconductor sector

As it is a provisional performance, Samsung Electronics did not disclose specific performance by business division on the 5th. However, according to securities and electronics industry sources, it is estimated that the semiconductor (DS) division posted operating profit of 6.6 trillion won, Samsung Display posted 550 billion won, and the device experience (DX) division, which includes home appliances, TVs, and mobile devices, posted operating profit of around 2.9 trillion won.

Samsung Electronics’ DS division has been on a downward trend since recording an operating profit of KRW 9.98 trillion in the second quarter of 2022, taking a direct hit from the semiconductor downcycle. It has been in the red for four consecutive quarters since last year, and its annual operating loss was KRW 14.88 trillion. It has only succeeded in turning a profit this year, posting an operating profit of KRW 1.9 trillion in the first quarter (January to March).

The industry sees this semiconductor performance as being due to the recovery of DRAM prices following the memory industry’s cutbacks last year, as well as the increased demand for AI servers. AI servers, which must quickly process large amounts of data, require high-value-added high-bandwidth memory (HBM), as well as ultra-high-performance DRAM and NAND. Analysis shows that the increase in demand and the increase in the average selling price of each product have contributed significantly to the improved performance of the DS division. The average fixed transaction price of DRAM and NAND flash memory recovered to the level of the end of 2022, reaching $2.10 and $4.90, respectively, as of last month.

The next-generation HBM products, which are just before mass production, are expected to drive Samsung Electronics’ second-half (July-December) performance. Samsung Electronics is conducting quality tests with customers such as Nvidia ahead of mass production of the 12-layer ‘HBM3E’ product, the 4th-generation HBM. On the 4th, Samsung Electronics’ DS division established a separate HBM development team to further strengthen its research and development of next-generation HBM.

● AI-armed ‘Galaxy Z Flip and Fold 6’ to be released next week

In business divisions other than semiconductors, Samsung Display improved its performance by increasing its supply of organic light-emitting diode (OLED) displays to major customers. The Visual Display (VD) division, which is in charge of the TV business, and the Digital Appliances (DA) division are analyzed to have contributed to the recovery by increasing sales of premium TVs and air conditioners during the peak season. The Mobile Experience (MX) division, which is in charge of smartphones, is estimated to have seen its performance in the second quarter slow down somewhat due to rising component prices and the off-season without new product launches.

Samsung Electronics will unveil its new foldable smartphones, the Galaxy Z Flip and Fold 6, on the 10th (local time) in Paris, France. Like the Galaxy S24 series, which was introduced as the first AI smartphone in January, it will be equipped with Samsung Electronics’ own AI functions. As it is entering the market ahead of its rival Apple’s iPhone 16, which will be released in September, attention is focused on whether it will drive growth in the second half of the year.

According to financial information company F&Guide on this day, Samsung Electronics’ operating profit for the third quarter is expected to continue its upward trend at 11.79 trillion won, and for the fourth quarter (October to December), at 12.74 trillion won. Chae Min-sook, a researcher at Korea Investment & Securities, analyzed, “Since the second quarter was an off-season for the smartphone market, but still recorded good results, the increase in performance will continue to expand as the IT market enters its peak season in the second half.”

Reporter Kwak Do-young [email protected]

Reporter Lee Dong-hoon [email protected]

2nd quarter jumped 1452% compared to last year

AI demand increases, DS division operating profit reaches 6 trillion won

LG Electronics also has a strong home appliance business with operating profit of 1.2 trillion won

May current account surplus highest in 32 months

Employees are walking around the Samsung Electronics Seocho building in Seocho-gu, Seoul on the 5th, when Samsung Electronics recorded an ‘earnings surprise’ in the second quarter. Reporter Song Eun-seok [email protected]

Samsung Electronics, riding the semiconductor boom due to the expansion of the artificial intelligence (AI) market, recorded an ‘earnings surprise’ by posting operating profit of over 10 trillion won in the second quarter (April-June). This far surpassed the securities industry’s forecast of 8.3 trillion won. Amid the recovery in the home appliance and TV markets, LG Electronics also recorded operating profit of over 1 trillion won in the second quarter, the highest ever for the second quarter.

Samsung Electronics provisionally announced on the 5th that its consolidated sales for the second quarter were 74 trillion won and operating profit was 10.4 trillion won. This is a great performance that surpasses the annual operating profit (6.57 trillion won) earned over the past year. Sales increased by 23.3% and operating profit increased by 1,452.2% compared to the same period last year.

The electronics industry is analyzing that the semiconductor market is gradually recovering and the recent surge in AI demand has led to a full-fledged rebound in the memory semiconductor market. Initially, the investment industry estimated that Samsung Electronics’ semiconductor (DS) division would have posted operating profits of 4-5 trillion won in the second quarter, but due to the earnings surprise, the estimate was revised upward to 6 trillion won or more in operating profits in the DS division alone. In the third and fourth quarters, Samsung Electronics is expected to continue its upward trend in performance by posting operating profits in the 10 trillion won range.

On this day, LG Electronics also announced that it recorded consolidated sales of 21.7009 trillion won and operating profit of 1.1961 trillion won in the second quarter. Operating profit increased by 61.2% year-on-year, and sales also grew by 8.5% year-on-year, the best performance in the second quarter. The growth was driven by the recovering home appliance market and increasing sales of premium organic light-emitting diode (OLED) TVs, especially in Europe.

The semiconductor boom and the electronics industry’s good performance are also reflected in the current account. The current account surplus for May announced on this day was $8.9225 billion (approximately KRW 12.3175 trillion), the largest in two years and eight months. In particular, semiconductor exports surged 53% year-on-year, leading the overall export growth.

KOSPI also rose 1.32% on the day, breaking its all-time high for two consecutive days. As of the closing price of the day, Samsung Electronics’ stock price surged 2.96% from the previous day to 87,100 won. It is a 52-week high and the highest price in 3 years and 5 months since January 25, 2021 (89,400 won). LG Electronics also closed at 118,000 won, up 2.69%.

AI Winds Drive Semiconductor Upcycle… Samsung Electronics’ Operating Profits Increase 16-fold in One Year

[반도체 서프라이즈]

2nd quarter operating profit 10.4 trillion won

Estimated operating profit of 6.6 trillion won in the semiconductor sector… Recovery in DRAM prices – AI server demand

Next-generation HBM expected to drive performance in the second half of the year… AI-equipped Galaxy Z Flip to be released next week

Samsung Electronics’ provisional operating profit for the second quarter of this year (April-June) skyrocketed by regarding 16 times year-on-year, largely due to the recovery in the semiconductor industry caused by the expansion of the artificial intelligence (AI) market. It is the first time in seven quarters since the third quarter of 2022 (July-September, KRW 10.85 trillion) when the semiconductor downcycle began that Samsung Electronics posted quarterly operating profit of over KRW 10 trillion. As the memory semiconductor market enters a full-fledged upward phase, there is analysis that the company will continue its good performance in the second half of the year.

● Expected to be worth over 6 trillion won in the semiconductor sector

As it is a provisional performance, Samsung Electronics did not disclose specific performance by business division on the 5th. However, according to securities and electronics industry sources, it is estimated that the semiconductor (DS) division posted operating profit of 6.6 trillion won, Samsung Display posted 550 billion won, and the device experience (DX) division, which includes home appliances, TVs, and mobile devices, posted operating profit of around 2.9 trillion won.

Samsung Electronics’ DS division has been on a downward trend since recording an operating profit of KRW 9.98 trillion in the second quarter of 2022, taking a direct hit from the semiconductor downcycle. It has been in the red for four consecutive quarters since last year, and its annual operating loss was KRW 14.88 trillion. It has only succeeded in turning a profit this year, posting an operating profit of KRW 1.9 trillion in the first quarter (January to March).

The industry sees this semiconductor performance as being due to the recovery of DRAM prices following the memory industry’s cutbacks last year, as well as the increased demand for AI servers. AI servers, which must quickly process large amounts of data, require high-value-added high-bandwidth memory (HBM), as well as ultra-high-performance DRAM and NAND. Analysis shows that the increase in demand and the increase in the average selling price of each product have contributed significantly to the improved performance of the DS division. The average fixed transaction price of DRAM and NAND flash memory recovered to the level of the end of 2022, reaching $2.10 and $4.90, respectively, as of last month.

The next-generation HBM products, which are just before mass production, are expected to drive Samsung Electronics’ second-half (July-December) performance. Samsung Electronics is conducting quality tests with customers such as Nvidia ahead of mass production of the 12-layer ‘HBM3E’ product, the 4th-generation HBM. On the 4th, Samsung Electronics’ DS division established a separate HBM development team to further strengthen its research and development of next-generation HBM.

● AI-armed ‘Galaxy Z Flip and Fold 6’ to be released next week

In business divisions other than semiconductors, Samsung Display improved its performance by increasing its supply of organic light-emitting diode (OLED) displays to major customers. The Visual Display (VD) division, which is in charge of the TV business, and the Digital Appliances (DA) division are analyzed to have contributed to the recovery by increasing sales of premium TVs and air conditioners during the peak season. The Mobile Experience (MX) division, which is in charge of smartphones, is estimated to have seen its performance in the second quarter slow down somewhat due to rising component prices and the off-season without new product launches.

Samsung Electronics will unveil its new foldable smartphones, the Galaxy Z Flip and Fold 6, on the 10th (local time) in Paris, France. Like the Galaxy S24 series, which was introduced as the first AI smartphone in January, it will be equipped with Samsung Electronics’ own AI functions. As it is entering the market ahead of its rival Apple’s iPhone 16, which will be released in September, attention is focused on whether it will drive growth in the second half of the year.

According to financial information company F&Guide on this day, Samsung Electronics’ operating profit for the third quarter is expected to continue its upward trend at 11.79 trillion won, and for the fourth quarter (October to December), at 12.74 trillion won. Chae Min-sook, a researcher at Korea Investment & Securities, analyzed, “Since the second quarter was an off-season for the smartphone market, but still recorded good results, the increase in performance will continue to expand as the IT market enters its peak season in the second half.”

Reporter Kwak Do-young [email protected]

Reporter Lee Dong-hoon [email protected]