2023-05-19 06:35:00

Samsung Electronics and SK Hynix break the ‘highest price of the year’ in two days

I thought ‘when’ I would live even if I knew it was the bottom… “It’s regarding time”

Memory inventory that drove losses… At least the direction changes

Memory anyway ‘seonbanyoung’ stock… Outsider SK hynix returns one following another

Indicators pointing to business recovery within a year… Could the oversupply end?

-

Samsung Electronics and SK Hynix both recorded the highest prices of the year. This is because the signal that memory semiconductor inventories, which even drove Samsung Electronics into a loss, is passing through the worst has become clearer. It is evaluated that the consensus that ‘the time has come’ is growing among investors who knew that the stock price was at a bottom, but did not know when it would rebound.

On the 19th, shares of Samsung Electronics closed at 68,400 won, up 3.32% from the previous day. It hit a new high so far this year. After hovering around 65,000 won for more than a month since April, it rose 1.8 percent the day before, and then changed the record for two days in a row this year. If the stock price rises by only 1-2 percentage points from now, it can return to the 70,000 won level in a year.

The same goes for SK Hynix. On this day, it also rose more than 4% compared to the previous day. The closing price was 97,300 won, up 3.95 percent. Like Samsung Electronics, the stock price, which hit the bottom at the beginning of the year and partially recovered, has been sluggish since April, but has reached its highest price two days in a row. There is an expectation that it can aim to return to the 100,000 won level in regarding a year.

-

In the market, following a long wait, it is finally time to get on top of Samsung Electronics and SK Hynix.

The story that the stock prices of both companies hit bottom has been openly discussed among institutions. Throughout last year, companies and investors fought for the truth over the memory semiconductor industry. In the end, inventory that exceeded the normal level dragged down the share price. Samsung Electronics’ deficit in the semiconductor sector in the first quarter of this year and the news of de facto production cuts therefollowing, the market has been agonizing over the timing of the purchase.

An official in the investment industry said, “Everyone spoke in one voice that Samsung Electronics would make a profit if it was in the red, but the question was ‘when’. At the beginning of the year, when the chat GPT boom began, the buying and selling sales were fierce “As a result, the key was how actively Samsung Electronics would participate in production cuts and when inventory would reach peak out,” he said. “Now, the two conditions are met.”

Samsung Electronics joined the production cut process in April. In the market, there are signs that stocks will not be piled higher than they are now. As the remaining two conditions were met, institutions began to briskly stock Samsung Electronics and SK Hynix.

There are still not many voices that are optimistic that the memory semiconductor industry will turn to a clear recovery in the second half of the year. Inventory of memory semiconductor suppliers and customers, including Samsung Electronics, is currently over 30 weeks. It takes time to exhaust to the normal stock level of around 16 weeks. It is interpreted as a phase in which the direction of memory semiconductor inventories, which had only been piling up, has begun to change to decrease.

-

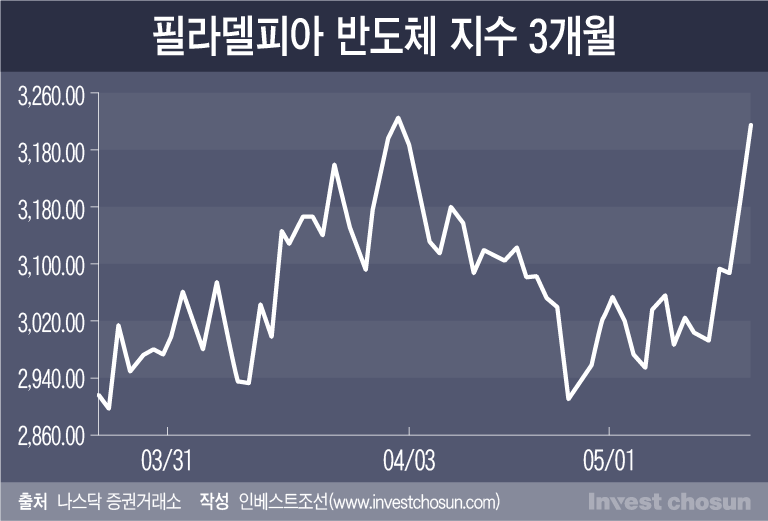

Share prices of memory semiconductor companies reflect industry conditions in advance. Stock prices of Samsung Electronics and SK Hynix tend to fluctuate six months to a year ahead of changes in industry conditions. The Philadelphia Semiconductor Index, which precedes the high-tech manufacturing industry, including semiconductors, also began to turn upward.

Samsung Electronics, which made the decision to cut production last, also promised to flexibly adjust production to meet demand. This means that if the effect of production cuts in the second quarter does not meet expectations, additional adjustments can be made in the second half. It is believed that Samsung Electronics, the dominant operator in the market, is implying that it will advance the timing of business recovery.

In the related industry, it is understood that the demand for DDR5 DRAM, which is gradually showing its presence, has provided a space for memory semiconductor companies, including Samsung Electronics, to flexibly take production plans. Last year, the share of DDR5 products in the DRAM market was only 3%, but it is expected to exceed double digits starting this year. Large data center operators have been reconsidering the timing of facility investment, but it is also a situation where they have to switch anyway.

It is an observation that the stock prices of both companies are likely to continue their upward trend as indicators indicating the possibility of an industry recovery increase.

Foreign investors have been sweeping SK Hynix stocks for four consecutive trading days since the 16th. After buying 2.4 million shares on the 16th, on the 17th and 18th, more than 1 million shares were purchased consecutively. It is the first time in the past year that a foreigner has purchased more than 1 million shares of SK Hynix on several consecutive trading days. Currently, foreigners are also buying more than 5 million shares of Samsung Electronics for two days in a row.

A researcher in charge of semiconductors at a securities company said, “There are still more conservative views among companies on facility investment plans, but if tech companies focus on server investment, etc., the memory industry will soon turn around.” There was a difference in timing due to variables such as an interest rate hike, but as Samsung Electronics explained to investors last year, there is a possibility that memory oversupply will suddenly turn into a shortage within several years.”

Invest Chosun Paid Service Posted on May 19, 2023 at 15:34

1684482539

#Samsung #Electronics #Hynix #waited #year.. #Tunnel #Visible #Memory #InventoryInvest #Chosun