O Carnaval it is one of the most anticipated holidays of the year and, following a year of more timid schedules due to the Covid-19 pandemic, the party promises to cheer up revelers in thousands of street blocks across the country. However, it is important to be careful, especially with your cell phone, as there is a considerable increase in robberies and thefts at that time. Look 10 tips how to take care of your personal items during Carnival.

1. Always lock password

Before leaving the house, activate the cell phone lock password. The numeric combination, biometric or facial authentication are protection options that must be activated right at the entrance. This is the first fundamental layer of protection to keep your data and information away from unauthorized access.

In addition, set the device so that the screen is automatically locked in the shortest possible time, if you are not moving.

2. Write down the device’s IMEI

Write down your phone’s IMEI in a safe place. The code is essential to request the device to be blocked by the operator and file a police report in case of theft. Find your device’s IMEI code and keep it in a place where you’re sure you won’t lose it. To find this number from your cell phone, open the screen that allows you to make calls and enter the code *#06#.

3. Back up your data and photos

When we lose our cell phone, one of the most difficult things to accept is the loss of important files, documents and photos. So, before you even leave the house, back up your cell phone files and photos in advance, saving them in the cloud or in some secure application. So, if your device is stolen, you don’t lose your most important data and can even recover it to use it on another device.

4. Enable geolocation

Activate geolocation so that you can locate your device in real time in case of theft or theft, and block it easily using services such as Find iPhone (if your phone is an iPhone) and Find My Device (if you use Android). Sharing your real-time location with your friends can also help protect you and make it easier if you get lost in the group.

5. Don’t use your cell phone in the middle of the block

Avoid picking up your cell phone in a crowd, as this is when thieves tend to act. Generally, when someone is caught giving soup with their cell phone, thieves usually shake some “push push” to distract you and take your cell phone without you even noticing. So, if you really need to use your cell phone while on the street, look for a safe place to use your cell phone, such as a restaurant, pharmacy or near a police station. Pay attention and don’t be silly.

6. Don’t put your cell phone in your back pocket

Another very important tip is not to carry your cell phone in your back pocket. Give preference to fanny packs or moneybags to store your belongings and keep them close to you at all times. We do not recommend using backpacks unless you keep them on the front of your body at all times.

7. Disable or limit contactless payments

Maintaining the approximation payment can also lead to a much bigger headache during the revelry. Scammers can swipe your card without you even noticing, or thieves who steal your device simply try to use your cell phone as payment in some technology-compatible machine.

Another tip is to limit the amount for payment. If you don’t have or don’t want to use a physical card, it might be best to keep contactless payment enabled, but limit the amount of credit. In addition to avoiding damage during a robbery, you will also avoid falling into scams from machines with a broken display, where the criminal puts a higher value than you expect.

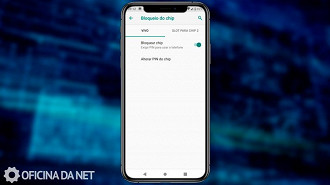

8. Block your cell phone SIM card

Blocking your cell phone’s SIM card is an additional form of security in case of robbery or theft. This is important because virtually all banks use SMS and phone calls as password recovery mechanisms and, unfortunately, thieves know this. When they can’t access your account on your mobile phone, they can take your SIM card, insert it in another device and try to regain access to their bank accounts by triggering the feature “I forgot my passworda”. To prevent this, you can add a pinwhich is nothing more than a password to use the chip.

Chips from operators Claro, TIM, Vivo and Oi already have a default PIN configured, so you just need to change it to keep it protected — just like we already taught you here at Oficina da Net.

9. Uninstall banking apps

During Carnival revelry, it is better to uninstall banking applications from your cell phone to avoid possible fraud or scams. If you have a lot of banking apps, uninstall them all. If you really need to use a street banking app for Pix payments, for example, concentrate everything in one app, and follow the security tips mentioned in the previous step, by disabling payment by approximation.

Oficina da Net published a video a while ago, showing what to do before and following a cell phone theft with access to banks. Check it out below:

10. If possible, use a less expensive cell phone

As a last tip, try to leave your main cell phone at home, especially if it’s a device with all your banking passwords, social media passwords and so on. If you need a cell phone just to communicate with your friends and family, choose a simple model, without internet or that only works for WhatsApp, for example.

Some groups of friends agreed to stay together during the festivities and it was agreed that everyone in the group would only use a cell phone, which would be taken by one of them. These tips are very good, as this prevents further financial losses in case of theft or theft.

Shii, I lost my cell phone. And now?

It may seem difficult, but it’s important to stay calm. In short, if you realize that your cell phone has been stolen or simply lost, try blocking the device with the carrier first. As a public utility, see below the telephone numbers of each of the main operators:

- Clear: 1052

- TIM: 1056

- Hey: 1057

- Vivo: 1058

After, locate the nearest police station to file a police report. At this time, you can enter the number of IMEI, which is like the “RG” of the cell phone. With that information, the police will be able to track the device and hopefully find it.

If you have important personal data on your cell phone, such as bank passwords, it is important to contact financial institutions as soon as possible so that security measures are taken, such as blocking the account or changing the password. To avoid an even bigger headache, Oficina da Net has already listed some palliative ways to protect your account.

If you have a tracking app installed on your phone, try to locate it. Some of these apps even allow you to remotely erase all data from the device, which is useful if you have sensitive information on it. Here in the web workshop we have already taught you how to block and track a cell phone remotely. See the links below: