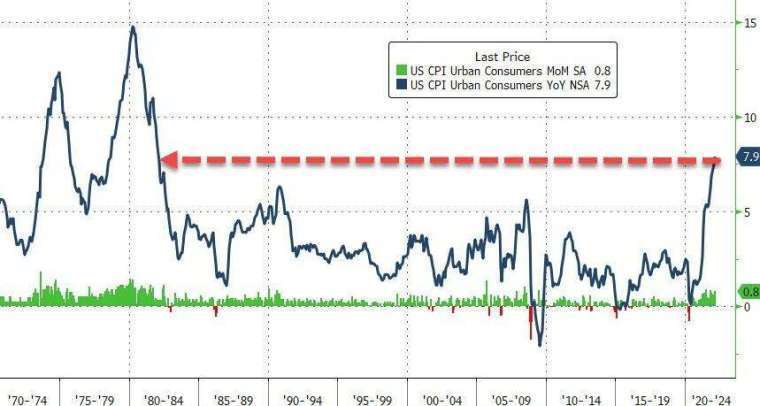

The latest US consumer price index (CPI) in February increased by 7.9% year-on-year, reaching a new high in nearly 40 years. In addition, there is still no progress in the negotiations between Russia and Ukraine in Turkey, and international oil prices are still higher. US stocks on Thursday (10 Japan) opened low and fell. At the time of writing, the Dow Jones Industrial Average fell more than 300 points or nearly 0.98%, the Nasdaq Composite fell 1.27%, the S&P 500 fell 0.94%, and the Philadelphia Semiconductor Index fell 2.48%.

The U.S. Labor Department announced that the CPI in February increased by 7.9% year-on-year, slightly higher than the 7.8% expected by economists , but also recorded the fastest growth since 1982.

Among them, the core CPI is the inflation data that the Federal Reserve (Fed) is most concerned regarding. Although this performance is not in line with expectations, no matter what the market predicts, the central bank will raise interest rates by 1 yard following the monetary policy meeting next week. Economists had expected the CPI to peak in March, but now they believe it will not peak until later in the spring, and the recent surge in oil prices will mainly be reflected in March and April data.

Another report from the Labor Department on the same day was that initial jobless claims rose by 11,000 to 227,000, beating market expectations of 217,000. Despite the increase, they remained near record lows.

In terms of the Russian-Ukrainian war, the two countries have made no progress in the ceasefire negotiations in Turkey. However, Ukrainian Foreign Minister Kuleba said at a press conference following the meeting that he would continue to promote ceasefire negotiations to prevent the war. Russian Foreign Minister Lavrov said that Russian President Vladimir Putin Ding has no objection to meeting with Ukrainian President Volodymyr Zelensky.

In terms of international oil prices, Yousef al-Otaiba, the UAE’s ambassador to Washington, once expressed support for the Organization of the Petroleum Exporting Countries and its partner countries (OPEC+) to accelerate the increase in oil production. After the news spread, oil prices crashed for a while, but then the UAE energy minister came forward. It was clarified that the current OPEC+ agreement to increase production was still supported, and oil prices rebounded.

Before the deadline, the settlement price of the May Brent crude oil contract rose 4.78% to 116.45 per barrel. DollarWest Texas Intermediate (WTI) April contract settlement price rose 3.94% to 112.99 per barrel Dollar。

In Europe, the European Central Bank (ECB) chose to keep interest rates unchanged on Thursday, continuing to be cautious in assessing the economic impact of Russia’s invasion of Ukraine. The ECB’s benchmark refinancing rate remains at 0%, the marginal lending rate remains at 0.25%, and the deposit rate remains at -0.5%.

As of 22:00 on Thursday (10th) Taipei time:

- The Dow Jones Industrial Average fell 327.13 points, or 0.98%, to 32,959.12

- The Nasdaq Composite fell 168.79 points, or 1.27%, to 13,086.75

- The S&P 500 fell 40.28 points, or 0.94%, to end at 4,237.06

- Feihan fell 81.43 points or 2.48% to temporarily report 3,200.75 points

- TSMC ADR fell 0.58% to 104.34 per share Dollar

- 10-year U.S. Treasury yield rose to 1.9780%

- New York Light crude oil rose 4.46% to 113.55 a barrel Dollar

- Brent crude rose 5.13% to 116.84 a barrel Dollar

- Gold rose 1.04% to 2,008.80 an ounce Dollar

- DollarIndex rose to 98.24

Stocks in focus:

Amazon (AMZN-US) rose 4.29% to 2,904.97 per share in early trade Dollar

Amazon recently announced a 1-for-20 stock split plan to make the stock more attractive to investors. The company said the split was designed to give the company greater flexibility in managing its equity and also allow retail investors to have more flexibility. Easy to invest. The market believes that Amazon’s stock split plan has the opportunity to become a Dow Jones stock.In addition, Amazon also announced that it will implement 10 billionDollartreasury stock plan.

Jingdong (JD-US) fell 15.74% to 52.58 per share in early trade Dollar

JD.com reported fourth-quarter earnings on Thursday, although revenue rose 23 percent toRMB 275.9 billion yuan (43.64 billion yuan in total)Dollar) was slightly higher than the consensus estimate of 274.45 billion yuan, but fourth-quarter adjusted earnings per share were reported at the weakest pace in six quarters due to soaring operating costs and slowing consumer spending.RMB 2.21 yuan, better than analysts’ estimate of 1.54 yuan.

Asana(ASAN-US) fell 4.29% to 38.95 per share in early trade Dollar

Application software company Asana reports strong fourth-quarter earnings, with revenue up 64% year-on-year to 111.9 millionDollarnot only better than previous company estimates of 104.5 million to 105.5 millionDollarrange, also higher than the market’s estimate of 105.2 millionDollara loss of 46.9 million in Q4Dollara loss per share of 0.25 Dollarslightly below analysts’ forecast for a loss per share of 0.28 Dollar.However, the company estimates that there may be a higher-than-expected loss in the 2023 fiscal year, leaving the excellent Q4 financial report in the dust. The company estimates a full-year loss of 162.9 millionDollaror a loss per share of 0.48 Dollar。

Today’s key economic data:

- U.S. CPI in February reported an annual rate of 7.9%, expected 7.8%, and the previous value of 7.5%

- The monthly rate of US CPI in February was 0.8%, expected 0.8%, the previous value was 0.6%

- U.S. core CPI in February reported an annual rate of 6.4%, expected 6.4%, and the previous value of 6%

- U.S. core CPI in February reported a monthly rate of 0.5%, expected 0.5%, and the previous value of 0.6%

- The United States last week (as of March 5) reported 227,000 initial claims of unemployment benefits, compared with an expected 217,000, and the previous value was raised to 216,000 from 215,000

- The United States last week (as of 2/26) reported 1.494 million continuing unemployment benefits, 1.45 million is expected, the previous value was lowered from 1.476 million to 1.469 million

Wall Street Analysis:

Erin Browne, multi-asset portfolio manager at Pacific Investment Management, expects inflation to continue higher for the rest of 2022, with a major hit to commodities and some supply chain woes that will intensify due to the Russian-Ukrainian conflict.

U.S. asset management firm Invesco analyst David Chao said that from the perspective of the central bank, the Russian-Ukrainian war may cause further upward pressure on the consumer price index, which will cause a shock to the supply side. Volatility has increased as investors assess the inflationary impact of the conflict between the two countries and the Fed’s possible actions.