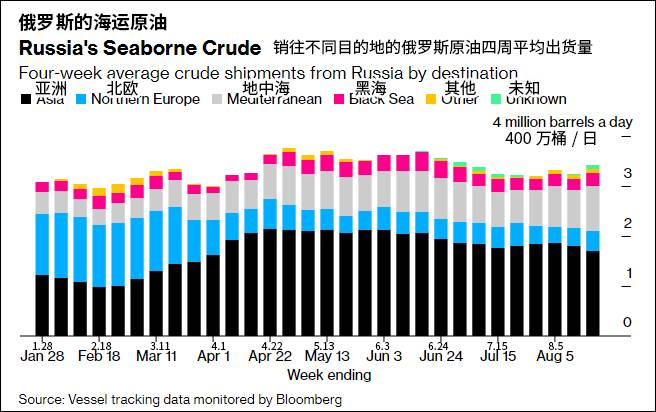

The United States and its allies are planning to limit the price of Russian oil, but it is reported that Russia has taken the lead in turning its attention to Asia, not to mention selling it at a discount of as low as 30%.

The conflict between Russia and Ukraine has pushed up global oil prices, and the sanctions imposed by Western countries have not affected Russia’s oil exports, which are expected to increase significantly this year.

As a result, the United States and its allies plan to cap the price of Russian oil, reducing Russia’s profit from its all-important oil exports and depriving the Kremlin of the ability to finance its war in Ukraine.

Profits from Russian oil exports are expected to surge this year. The picture shows the oil storage tank of Rosneft.

On August 24, Bloomberg quoted a Western official as saying that Russia has contacted several Asian countries to discuss the possibility of signing long-term oil contracts at deep discounts.

He said on condition of anonymity that in these initial meetings, Russia offered discounts of up to 30 percent to some Asian buyers, possibly related to recent discussions by the G7 of EU sanctions on Russian oil to limit Russian oil prices. They may allow third parties to more easily buy Russian crude when it matches low prices set by Western countries.

Russia may also be trying to find alternative buyers for the oil it currently sells to Europe.

Indonesia’s tourism minister, Sandiaga Uno, said on social media over the weekend that Russia had offered to sell oil to the country “at a price 30 percent below international market prices.” He added that President Joko Widodo was considering the proposal “but there are differences. There are concerns that we will be hit by the US ban”.

The EU’s sixth round of sanctions includes a ban on Russian oil and a ban on third countries from using EU companies’ insurance and financial services for this purpose. The ban will go into effect on Dec. 5, but U.S. officials worry that the current framework will send oil prices sharply higher, giving Russia a windfall instead.

During this period, some European countries supported an exception to the insurance ban when oil trades below an internationally set cap. Officials pushing for the plan hope it will be in place before EU sanctions on Russia’s oil take effect in early December. U.S. Treasury Secretary Yellen hopes the price cap will deprive Russia of much-needed revenue and drive down global oil prices as EU sanctions take effect.

But other countries said such a sanctions waiver system would only work if key Asian buyers of Russian oil, especially India, agreed to participate.

German Chancellor Scholz said the proposal was being seriously discussed in the G7, but it was a complex issue. “If only the G7 countries agree, it will not work. We also need the cooperation of other countries.”

This week, U.S. Treasury Undersecretary Wally Adeyemo is in India once more. He told an event in Mumbai on Wednesday that the coalition to set price caps on Russian oil had expanded, with many countries joining.

It is unclear where most Asian countries stand on the plan, but few have publicly expressed support. India is reluctant to join the price cap mechanism because Indian industry players fear that it will lose out to other buyers when it comes to buying Russian crude at a discount, according to people familiar with the attitude of Indian companies.

Proponents of the plan, on the other hand, argue that even if major buyers of Russian oil do not formally join the price-cap coalition, it might help reduce Russia’s revenue, as the countries will gain extra leverage in negotiating oil contracts with Moscow .

U.S. officials have signaled they intend to cap oil prices slightly above Russia’s marginal cost of production, although the final level will depend in part on global oil prices when the ban takes effect, the report quoted people familiar with the matter as saying.

On the EU side, the Hungarian government has said it will oppose any oil price cap, sources said. US media believes that this indicates that the plan may face another difficult political battle.