- Cristina J. Orgaz @cjorgaz

- BBC News World

6 hours

image source, Getty Images

Russia announced that it will cut gas shipments to two countries of the European Union and the accusations of “blackmail” and “militarization” of energy have not been long in coming.

Caught up in this new escalation of tensions since Vladimir Putin ordered the invasion of Ukraine two months ago will be millions of homes in Poland and Bulgaria, whose gas supply is in danger following Moscow’s decision.

Russia thus loses two important clients for its gas and the income generated by these contracts, but sends a strong message to the world: it will defend itself with all the weapons it has in its hand once morest the sanctions imposed by the West.

Hydrocarbon exports are Russia’s most powerful tool in this regard.

“Gazprom’s announcement that it will unilaterally suspend gas delivery to customers in Europe is yet another attempt by Russia to use gas as an instrument of blackmail“European Commission President Ursula von der Leyen said in a statement.

Here we tell you in 3 questions what is happening:

image source, Getty Images

The ruble, the Russian currency, has lost regarding 40% of its value once morest the dollar since the beginning of the year.

1.- Why those countries?

The refusal of both nations to pay the Russian state company Gazprom in rubles instead of dollars or euros it has put them in the crosshairs of the Kremlin, which will close the tap on the gas pipelines that transport their fuel.

Russia changed the payment method for its customers in the wake of economic sanctions imposed by Europe.

Since April 1, European companies are required to open an account in local currency and Gazprom Bank.

Ruble payments would benefit the Russian economy and prop up its currency.

Experts believe that with this measure, Moscow tries to stop the depreciation of the Russian currencywhich has lost around 40% of its value once morest the dollar since the beginning of the year.

image source, Getty Images

More than a million people have arrived in Poland from Ukraine since the Russian invasion on February 24.

“Why does Russia want to be paid rubles, when it can print as many rubles as it wants?” asks Paul Donovan, chief economist at Swiss bank UBS Global Wealth Management.

“Avoiding financial penalties is easier with the ruble, making the ruble the Bitcoin of the currency world (although obviously the ruble is less volatile and has a fundamental value),” he replies.

But EU member states argue that this change means a “serious breach of contract”.

On Tuesday Poland, which during the war has welcomed thousands of Ukrainians fleeing the war, announced sanctions once morest major Russian companies and once morest 50 oligarchs whose assets in the country will be frozen.

image source, Getty Images

According to Bloomberg, some European companies have already paid under the system claimed by Russia, although the name of the companies was not disclosed.

Nathan Piper, head of oil and gas research at Investec, told the BBC that the disruption of supplies to Poland and Bulgaria was the “start of Russia puts economic pressure on Europe. and a measure that might “escalate” with other EU nations.

2. Is the European plan to reduce dependence on Russian gas viable?

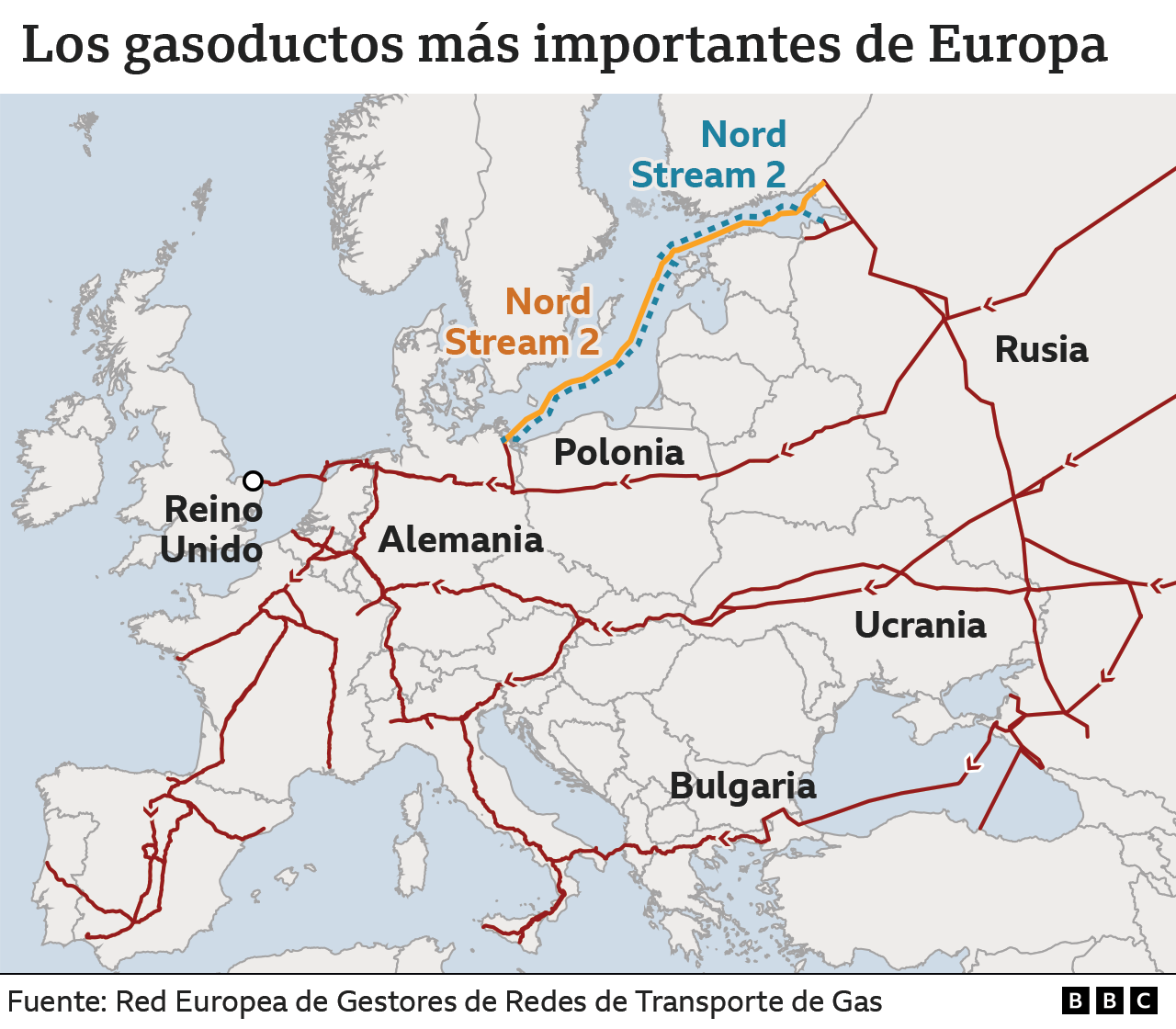

Russia currently supplies Europe between 35% and 40% of its gas needs.

Long before it invaded neighboring Ukraine, several European countries began to consider how to reduce your energy dependency from Moscow.

The first country to achieve full independence was Lithuania.

And that in 2015, almost 100% of the gas supply came from Russian imports.

But the situation has changed dramatically in recent years following the country built an offshore liquefied natural gas (LNG) import terminal in the port city of Klaipeda.

Now the search for viable alternatives to Russian gas it has become a priority for Europe, which has launched the joint “REPowerEU” plan.

The goal is to reduce European imports of Russian gas in two thirds during the next year.

“The war in Ukraine has highlighted the urgent need for Europe to diversify your gas sourcesas well as the long-term goal of transitioning to clean energy sources,” explain Mark Lacey, Alexander Monk and Felix Odey, global analysts at Schroders.

“The European plan REPowerEU is extraordinarily ambitious“, they add.

image source, Getty Images

Energy prices have skyrocketed following the pandemic and the war in Ukraine.

At the end of March, the EU signed an important agreement with the United States on liquefied natural gas (LNG) by which it will supply Europe, by the end of the year, with a volume of natural gas equivalent to approximately 10% of what it receives Currently from Russia.

“The problem is that The US cannot offer such a large supplyand Europe is competing with other countries for imported LNG shipments,” Schroders experts say of the increased needs by India and China.

“Another obstacle is that LNG, as its name suggests, is liquid and in order to use it you have to turn it back into gas. This is a process called regasification, and Europe has very little regasification capacity of LNG “.

For John Kemp, senior market analyst at Archyde.com, “cutting off gas supplies might shake energy markets and further increase gas prices and household and business bills, when the cost of living is already through the roof“.

image source, Archyde.com

3. What global consequences will Russia’s decision have?

“Having off gas supplies has less of an impact on Europe during its spring, and Poland said it has sufficient reserves. However, markets will likely see this as the start of a general militarization of energyDonovan explained in a market commentary.

However, if the Russian gas supply were to end,Europe might turn to existing gas exporters such as Qatar, Algeria or Nigeria.

A new gas pipeline from Norway is also expected to start up next October.

In any case, gas prices in Europe following the Moscow announcement have shot up regarding 20%.

Higher energy prices stemming from the war between Russia and Ukraine mean that the probability of a slowdown or recession significant is greater, especially in Europe.

“In low-income countries of Asia, Africa and Latin America Higher food and fuel costs will further affect spending on “durables” that are more expensive, such as cars, furniture, refrigerators, stoves, televisions or computers, believes Kemp, a senior market analyst.

“With consumers under pressure in all major economies, the likelihood of a recession or at least a significant slowdown in one or more regions is very high and has started to affect industrial commodity and energy prices,” it added.

Now you can receive notifications from BBC World. Download the new version of our app and activate it so you don’t miss out on our best content.