Enter 2022.04.07 13:58

Edit 2022.04.07 14:28

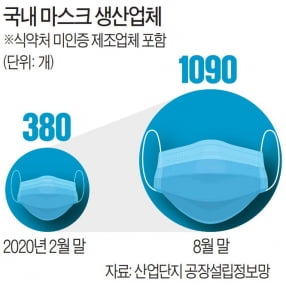

Mask production ‘dropped’ by one-fifth

“Price competition is not possible” in the volume of ‘dumping sales’ of closed companies

The utilization rate of downstream industries such as nonwovens is also lowered to 20%.

Simplified licensing due to shortage of supply “Industry is saturated”

5000 companies nationwide at the peak, now 40% of them are closed

Overseas market is dominated by Chinese products, domestic 1/3 price

Industry “The government’s ‘back book’ export restrictions are the root cause of the problem”

As the number of mask manufacturers surged in the early stages of the COVID-19 crisis, the domestic mask market reached saturation. As there is a possibility that the government will phase out the mandatory mask wearing clause, the closure of the mask industry is expected to be inevitable. Workers are working at a mask maker in the metropolitan area on the 7th. Reporter Min Kyung-jin

The mask manufacturing industry, which has reached saturation following the COVID-19 crisis, is in danger of going bankrupt. The possibility is raised that the government will gradually lift the current mandatory requirement to wear a mask, such as wearing an outdoor mask.

In the industry, which is ten times larger than it was before the corona virus, the quantity that has not already been found is being dumped and sold at a bargain price. Analysts say that large-scale restructuring of the domestic mask industry is inevitable in the future as the overseas market is dominated by Chinese products with price competitiveness.

Company A in Hwaseong, Gyeonggi-do has recently reduced its daily production of masks to 30,000 from 150,000 in March 2020. Because the mask stock is overflowing in the market, there are hardly any new orders. In the early days of the corona crisis, the factory ran 24 hours without weekends, and the number of employees increased to 30, but now only 5 are guarding the production line.

The president of this company said, “There is no price competition itself because companies that go out of business release masks below cost.”

The downstream industry was also hit hard. The average factory utilization rate of meltblown (MB) filter manufacturers, a major subsidiary material for masks, has sank to the level of 10-20%. This is due to the fact that mask makers, which took 90% of MB filter production from around March of last year, stopped visiting.

An official from the Korea Non-woven Fabric Industry Cooperative said, “Except for some distribution industries, the domestic mask supply chain has almost stopped working since the first half of last year.”

According to the Ministry of Food and Drug Safety, the number of mask makers from 137 in January 2020 increased more than tenfold to 1,600 in the second half of last year.

However, this is only the official number of certified companies. If you include companies that produce products that are not certified by the Ministry of Food and Drug Safety, such as ‘square masks’, industry insiders explain that the number of mask manufacturers reached 5,000 at one time in 2020.

MB filter producers, which had a ‘shortage situation’ in the early stages of the corona crisis, also surged from regarding 10 places to regarding 100 over the past two years.

In the early stages of the Corona crisis, when the supply of masks was running, the process for permitting new companies was greatly simplified, which is the background to the emergence of mask companies.

The number of companies entering the mask business with poor market analysis is rapidly increasing due to the fact that the approval process, which normally took more than 8 months, has been drastically reduced to one to two weeks, and the price per mask manufacturing facility is between 100 million and 150 million won, which is relatively low. analysis was done.

As these companies pour out two to three times more than the actual demand, the market has accumulated several years’ worth of mask stock.

The mask production of Company B in South Chungcheong Province is barely maintaining the level of 30% compared to April 2020. An official from this company said, “Out of regarding 5,000 companies, 40% have already closed their business or have given up on mask production.” “The price of used mask manufacturing equipment, which once soared to 200 to 300 million won, has also fallen below 50 million won,” he added.

The industry is concerned that the mask stock will further increase if the mandatory mask wearing clause is phased out.

With the possibility that the government will phase out the mandatory mask wearing clause, it is expected that the closure of the mask industry, which has reached saturation, is inevitable. Workers are working at a mask maker in the metropolitan area on the 7th. Reporter Min Kyung-jin

Some mask makers, who are in a position to lose the domestic market, are trying to enter the overseas market, but even this is not easy. This is because Chinese-made products, which are one-third cheaper than domestic equivalent products, have already dominated the global market.

Exports of domestic masks (HS code 630790) fell sharply from $71.66 million (regarding 851.8 billion won) in 2020 to $295.42 million last year.

It is also pointed out that the domestic mask industry has been driven to a moribund state due to the government’s export restrictions on ‘back book’.

Overinvestment spread due to the ‘mask crisis’, which occurred in January and February 2020, when domestic mask supplies flowed out to China and Hong Kong, right following the outbreak of Corona. It has given the mask industry time to grow rapidly.

An industry official said, “Among small and medium-sized companies, companies that have participated in the market following the coronavirus will inevitably go out of business or give up their business due to deterioration in profitability. predicted that

Reporter Min Kyung-jin [email protected]