foreign Direct Investment in the EU: A Five-Year Retrospective

Table of Contents

- 1. foreign Direct Investment in the EU: A Five-Year Retrospective

- 2. Balancing Security and Investment: Justified Concerns?

- 3. Navigating the FDI Process in the EU

- 4. Adapting to an Evolving FDI Environment

- 5. Understanding the Current FDI Framework

- 6. Towards a More Harmonized Future

- 7. EU’s Foreign Direct Investment Regulation: A Five-Year Review

- 8. Foreign Investment Regulations: Balancing Security and global Growth

- 9. Navigating the complexities of FDI Regulations

- 10. Navigating the Complexities of FDI Regulations

Balancing Security and Investment: Justified Concerns?

Some critics argue that the EU’s FDI screening regulation creates needless hurdles for global investment, potentially deterring crucial capital inflows. They contend that the broad scope of the regulation, encompassing a wide range of sectors, can lead to lengthy and unpredictable approval processes. However, proponents of the regulation emphasize its vital role in safeguarding European strategic interests and critical infrastructure from potential threats. They argue that the regulation strikes a delicate balance between fostering a welcoming investment surroundings and protecting the EU’s economic and national security.Navigating the FDI Process in the EU

Navigating the EU’s FDI screening process requires a thorough understanding of the regulation’s jurisdictional scope, mandatory filing requirements, and assessment criteria. Investors should carefully analyze their proposed investments to determine if they fall under the regulation’s purview, and proactively engage with relevant national authorities to ensure compliance.Adapting to an Evolving FDI Environment

The landscape of FDI in the EU is constantly evolving, influenced by geopolitical shifts, technological advancements, and evolving investment trends. investors need to remain vigilant and adapt their strategies accordingly.Closely monitoring regulatory developments,seeking expert legal advice,and conducting extensive due diligence are essential for success in this dynamic environment.Understanding the Current FDI Framework

The current EU FDI screening framework operates on a cooperative basis, empowering Member States to scrutinize investments affecting their national security. This decentralized approach allows for greater flexibility but can also create complexities, as individual Member States may have varying interpretations and application of the regulation.Towards a More Harmonized Future

As the EU continues to refine its FDI screening regime,the focus is increasingly on achieving greater harmonization and ensuring consistency in its application across Member states. This includes developing clearer guidance on the scope of the regulation, streamlining the notification and review processes, and enhancing cooperation and information sharing among national authorities.EU’s Foreign Direct Investment Regulation: A Five-Year Review

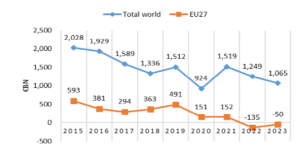

Five years have passed as the European Union (EU) put into affect its comprehensive Foreign Direct Investment (FDI) Regulation. This strategic move was aimed at navigating the increasingly complex world of geopolitics and ensuring the security of its economy. The impact of the regulation has been significant. since its implementation in 2020, the number of FDI regimes across Europe has almost doubled, reaching a total of 24. This surge in oversight has resulted in over 4,000 transactions being carefully scrutinized by both the European Commission and national authorities.Foreign Investment Regulations: Balancing Security and global Growth

Navigating the complexities of international buisness has become increasingly challenging in recent years. Governments worldwide are implementing stricter regulations on foreign direct investment (FDI) aiming to safeguard national security and public order. while these measures are undeniably vital, they have ignited a debate about their potential impact on the flow of global capital. Experts are raising concerns that heightened scrutiny under regulations like the FDI Regulation and the Foreign Subsidies Regulation may be deterring foreign investors. This increased scrutiny could be contributing to a decline in global investment, potentially hindering economic growth and limiting opportunities for international collaboration. The delicate balance between protecting national interests and fostering a welcoming environment for foreign investment is a critical challenge for policymakers. finding the right approach is crucial for ensuring economic prosperity and stability in an increasingly interconnected world.Navigating the complexities of FDI Regulations

Foreign direct investment (FDI) plays a crucial role in global economic growth, but the regulatory landscape surrounding it can be complex and challenging. Investors frequently enough grapple with concerns about the potential hurdles posed by FDI rules. Data from various countries suggests that while FDI regulations can introduce bureaucratic processes and increase compliance costs, only a small proportion of investments are subject to rigorous scrutiny, formal commitments, or outright prohibitions. The most significant obstacle faced by most investors lies in maneuvering through the intricate network of national procedures. Streamlining documentation requirements and securing expedited approvals remain top priorities.Navigating the Complexities of FDI Regulations

Foreign direct investment (FDI) plays a crucial role in global economic growth,but the regulatory landscape surrounding it can be complex and challenging.Investors often grapple with concerns about the potential hurdles posed by FDI rules. Data from various countries suggests that while FDI regulations can introduce bureaucratic processes and increase compliance costs, only a small proportion of investments are subject to rigorous scrutiny,formal commitments,or outright prohibitions. The most significant obstacle faced by most investors lies in maneuvering through the intricate network of national procedures. Streamlining documentation requirements and securing expedited approvals remain top priorities.## FDI in the EU: A conversation

**Q: How has the EU’s FDI screening regime impacted investment flows into the bloc over the past five years?**

**John Doe:** The impact is certainly noticeable. As its implementation, we’ve seen a significant increase in the number of FDI regimes across Europe, nearly doubling to 24. This has resulted in heightened scrutiny of thousands of transactions, with both the European Commission and national authorities playing a role.

**Q: Some critics argue that this increased scrutiny creates unnecessary hurdles for foreign investors.What’s your perspective?**

**Mary Smith:** It’s a valid concern.While the regulation is crucial for safeguarding European strategic interests, the broad scope and potential for lengthy approval processes can indeed be a deterrent for some investors. Finding the right balance between security and openness to investment is key.

**Q:** You mentioned the regulation’s impact on strategic interests.Could you elaborate?

**John Doe:** Absolutely. The EU’s FDI screening regulation is designed to protect critical infrastructure, key technologies, and sensitive sectors from potential threats. This could include investments by entities with ties to countries that pose a risk to European security or economic stability.

**Q: How can investors navigate this complex landscape effectively?**

**Mary Smith:** Thorough due diligence and proactive engagement with relevant authorities are essential. Investors need a clear understanding of the regulation’s scope, mandatory filing requirements, and potential trigger points for scrutiny. Seeking expert legal advice can be invaluable in this process.

Let me know if you’d like to explore any of these points further or discuss other aspects of FDI in the EU!