Recently, an influential figure in the finance world, Larry Fink, has been making headlines for his insights into the looming retirement crisis facing average Americans. Fink, the CEO of BlackRock, one of the largest asset management firms in the world, has been calling attention to the fact that many individuals are not saving enough money for their retirement.

While Fink has been criticized for his focus on environmental and social issues within the realm of investing, it is important to acknowledge his extensive knowledge and experience in the financial industry. Fink’s background and expertise lend credibility to his concerns regarding the retirement crisis.

One of the key points made by Fink is that relying solely on Social Security is no longer sufficient for a comfortable retirement. With advancements in medical technology and increased life expectancy, individuals are likely to live well into their 80s or even 90s. This means that retirement savings need to stretch much further than before.

Fink suggests that tapping into the US capital markets is an effective way to secure investment returns that can sustain a comfortable retirement. Despite concerns regarding market volatility and the possibility of a bubble, Fink remains bullish on US stocks. He believes that advances in technology, including artificial intelligence, combined with strong corporate balance sheets, have made the US economy and markets hyper-efficient.

While it is important to consider Fink’s position as the head of a major asset management firm, his insights into the retirement crisis should not be dismissed. Instead, they should serve as a wake-up call for individuals to take proactive steps towards securing their financial future.

So, what can average Americans do to navigate this retirement crisis?

First and foremost, it is crucial to expand financial literacy. Many individuals lack the necessary knowledge and understanding of markets and investing. By educating themselves regarding different investment options and strategies, individuals can make informed decisions and actively grow their wealth.

Additionally, it may be necessary for individuals to retire later than the traditional age of 65 in order to build up their nest egg. With increased life expectancy, working a few extra years can provide additional time to save and invest for retirement.

Fink also emphasizes the importance of not trying to outsmart professionals in the investment world. Instead, individuals should focus on investing in high-quality companies that are at the forefront of new economic trends. This can be achieved through purchasing shares or funds holding shares of these companies.

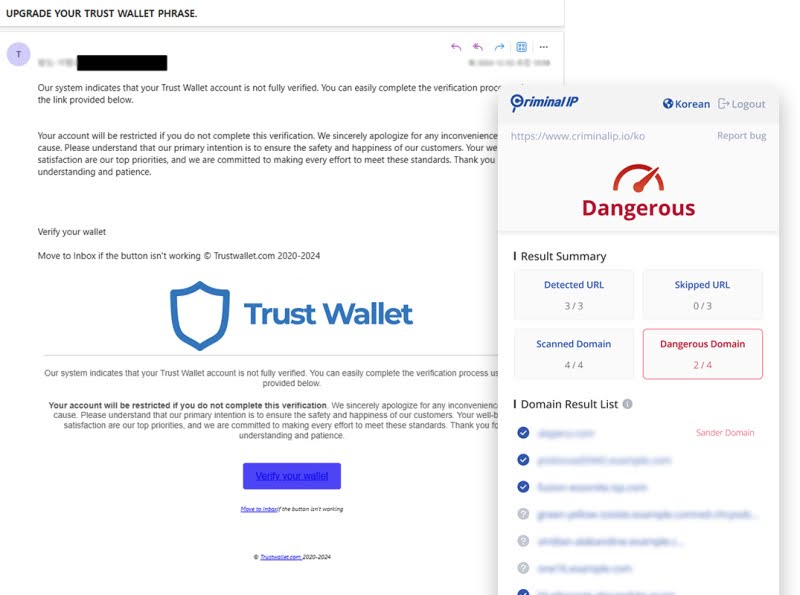

Lastly, it is crucial to seek reliable sources of information when it comes to investing. Social media platforms are filled with dubious sources and get-rich-quick schemes that can lead to significant losses. Trustworthy financial advisers, reputable news sources, and credible research can help individuals make sound investment decisions.

As we face the reality of a retirement crisis, it is important for individuals to take action and plan for their financial future. By expanding financial literacy, investing wisely, and seeking reliable information, average Americans can work towards a comfortable retirement. It is essential for individuals to start taking steps now to avoid the potential consequences of inadequate retirement savings. With careful planning and informed decision-making, a secure financial future is within reach.