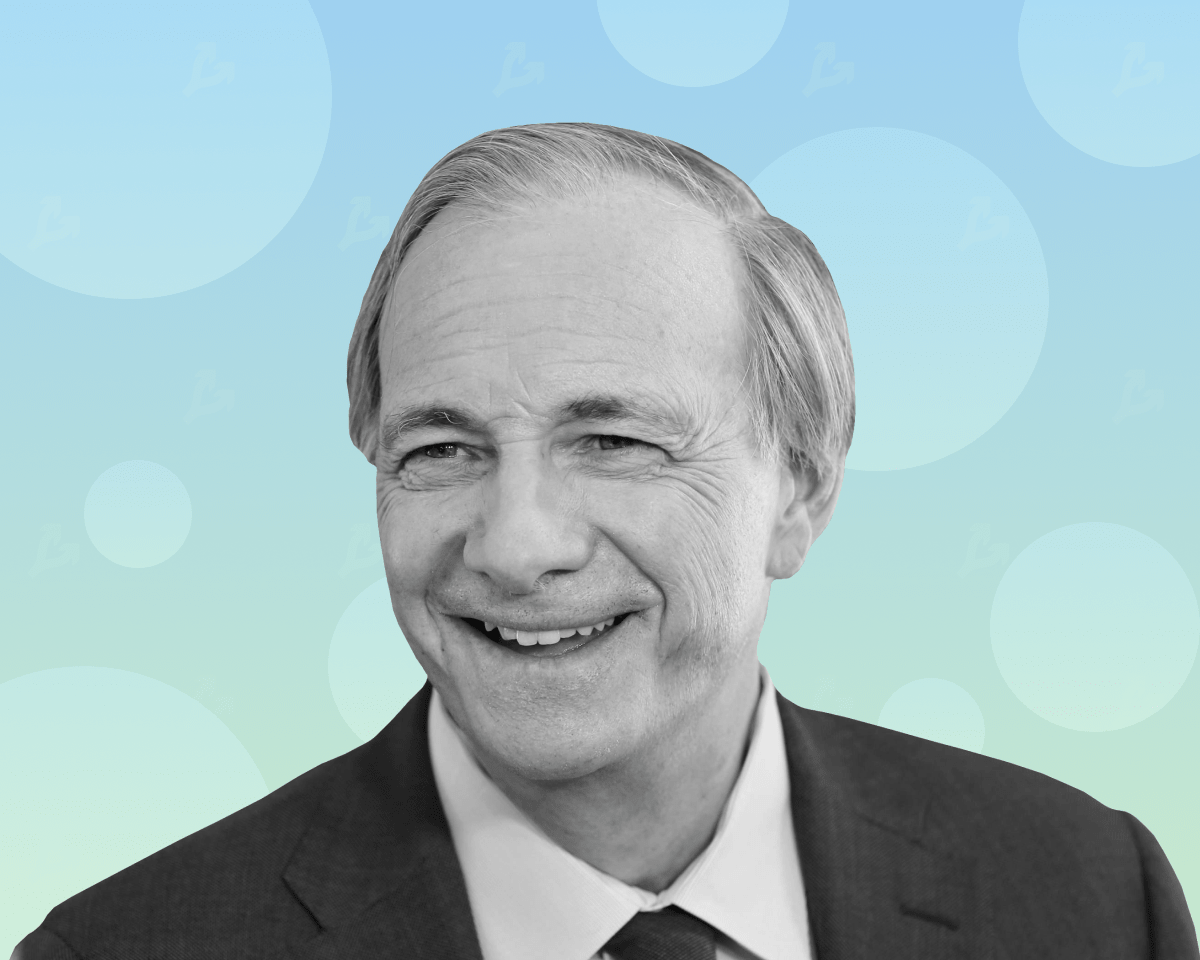

Cryptocurrencies are too vulnerable, easy to track and likely to be banned by a number of governments. Billionaire Ray Dalio, founder of Bridgewater Associates, stated this in an interview with David Rubenstein.

According to Dalio, given the size of the cryptocurrency market, it is “getting too much attention.” He confirmed that digital assets make up “a tiny percentage” of his personal investment portfolio.

In December 2021, the billionaire said that in order to diversify invested in Ethereum. He did not disclose the exact amount of the investment, but said that “not very much.”

In a conversation with Rubenstein, he noted that the use of cryptocurrencies is fraught with risks, which are not least related to the transparency of the blockchain. The billionaire also said that digital assets “will be outlawed by possibly a number of governments.”

According to the head of Bridgewater Associates, people are increasingly wondering what to use as a medium of exchange and store of value. He emphasized that fiat will experience increasing competition from digital currencies.

He also advised creating an investment portfolio that is diversified across asset classes and markets. The billionaire also noted that “cash is garbage.”

Recall that Dalio has already warned regarding a potential ban on cryptocurrencies by the authorities. In September, he stated that regulators will kill bitcoin in case of its massive success.

Subscribe to ForkLog news in Telegram: ForkLog Feed – the entire news feed, ForkLog — the most important news, infographics and opinions.

Found a mistake in the text? Select it and press CTRL+ENTER