Kyiv Attack: 9 Dead, 63 Injured

Ukraine War Update: Drone Strikes in Russia, Negotiation Stances, and Weapon Shortages By Archyde News Staff | April 26, 2025 Ukrainian Drones Strike Deep Inside

Ukraine War Update: Drone Strikes in Russia, Negotiation Stances, and Weapon Shortages By Archyde News Staff | April 26, 2025 Ukrainian Drones Strike Deep Inside

MagicianS Decades-Long Journey: From Disguise to Acceptance in the Magic circle A tale of deception, discrimination, and eventual reconciliation in the prestigious world of magic.

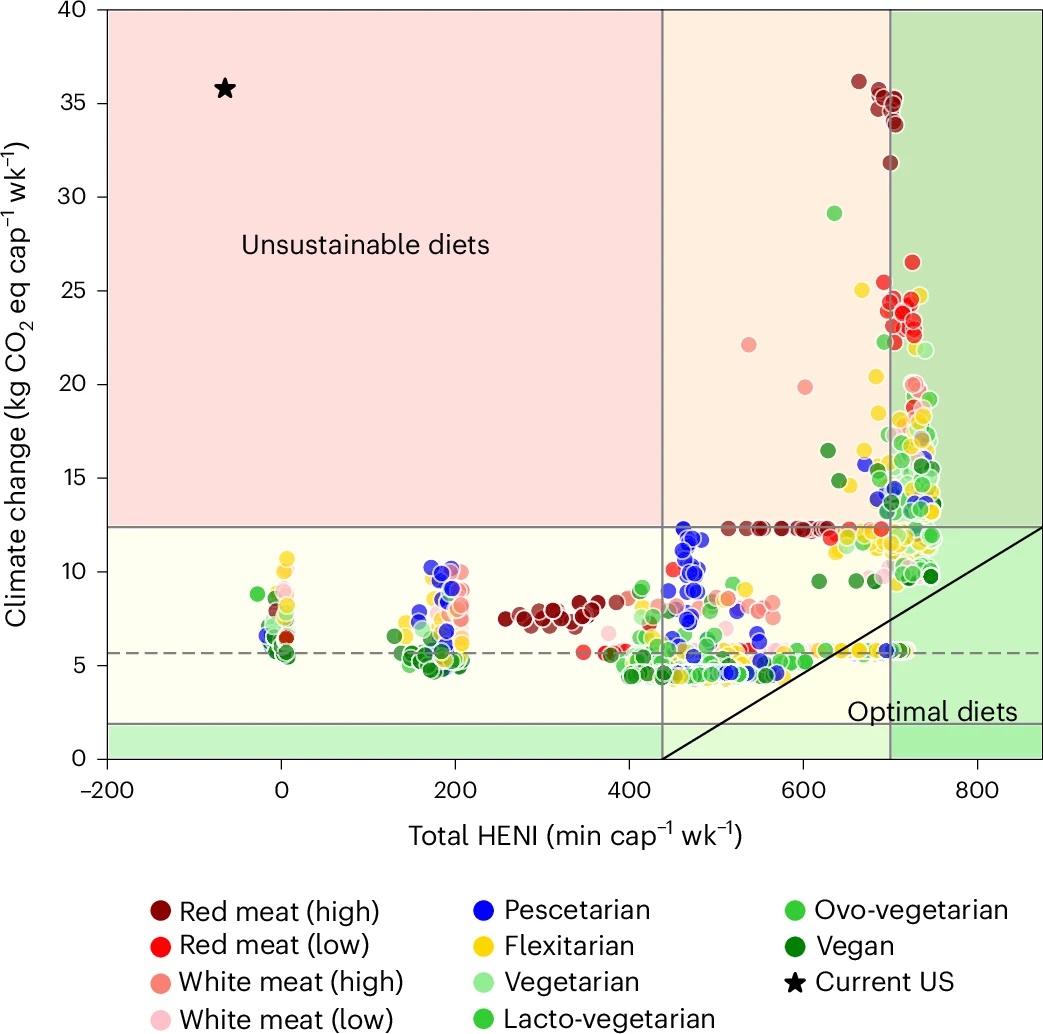

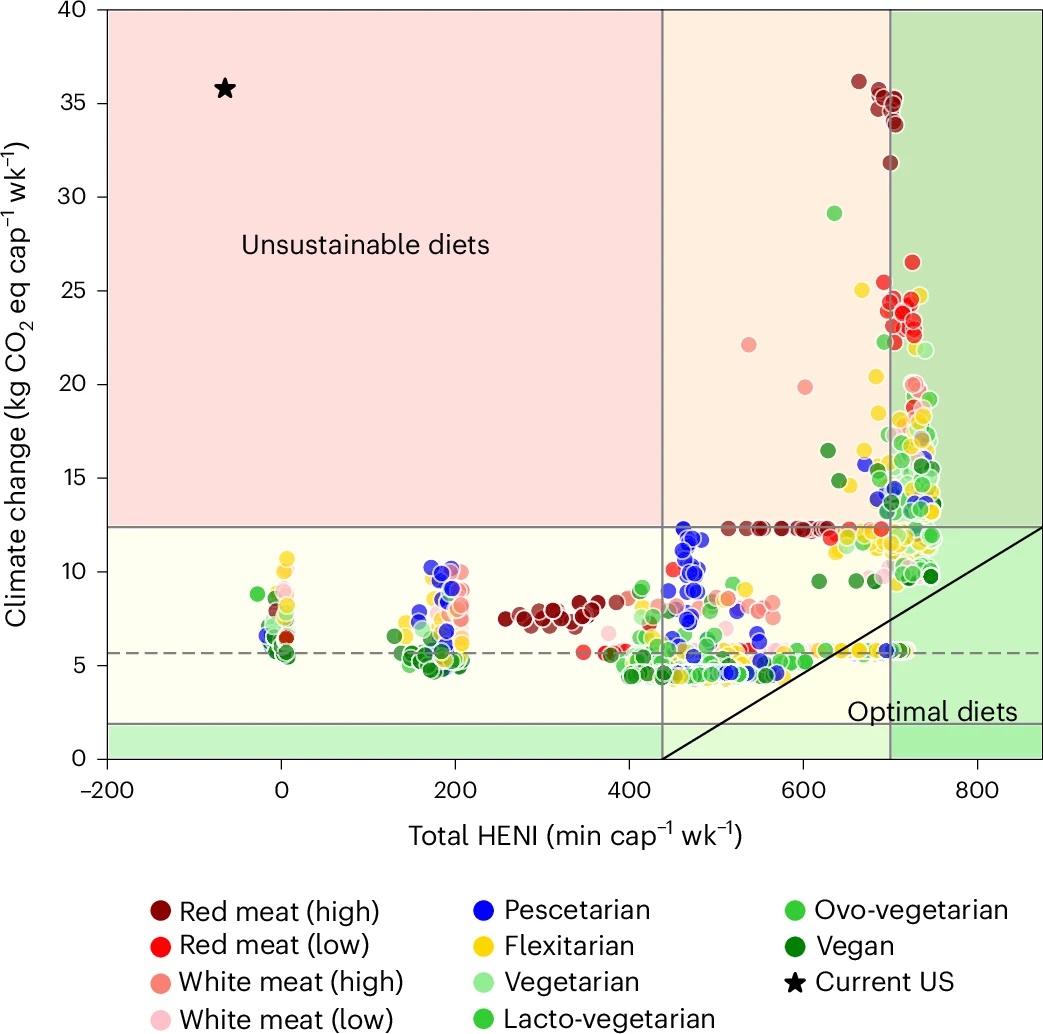

Sustainable Eating: How Much Meat Can You Eat? By Archyde News Staff May 3, 2024 Reconciling personal dietary needs with environmental duty can feel like

JD Vance Reflects on Meeting with Pope Francis Before Pontiff’s Death By Archyde News Staff Published: [Date] | Updated: [Date] Pope Francis greets U.S. Sen.

Ukraine War Update: Drone Strikes in Russia, Negotiation Stances, and Weapon Shortages By Archyde News Staff | April 26, 2025 Ukrainian Drones Strike Deep Inside

MagicianS Decades-Long Journey: From Disguise to Acceptance in the Magic circle A tale of deception, discrimination, and eventual reconciliation in the prestigious world of magic.

Sustainable Eating: How Much Meat Can You Eat? By Archyde News Staff May 3, 2024 Reconciling personal dietary needs with environmental duty can feel like

JD Vance Reflects on Meeting with Pope Francis Before Pontiff’s Death By Archyde News Staff Published: [Date] | Updated: [Date] Pope Francis greets U.S. Sen.

© 2025 All rights reserved