The prototype of the hero of the movie “The Big Short” urged investors to get rid of assets in the market. Michael Burry has repeatedly warned regarding a future stock market crash.

Head of Scion Asset Management Michael Burry

(Photo: Astrid Trzeciarz / Getty Images)

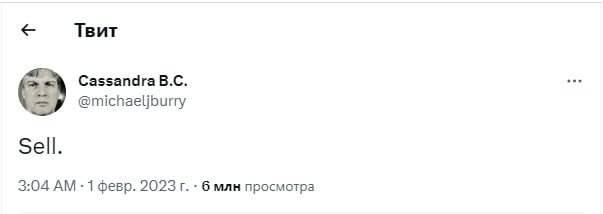

The head of the Scion Asset Management fund, Michael Burry, the prototype of one of the main characters in the movie “The Big Short”, advised investors to get rid of assets in the market. In a one-word tweet, he simply urged investors to sell. “Sell,” Burry wrote on Twitter (the social network is blocked in Russia).

Message from the head of the Scion Asset Management fund, Michael Burry, on Twitter (the social network is blocked in Russia)

Throughout 2022, Burry, who predicted the 2008 mortgage crisis, repeatedly warned that the stock market was regarding to crash. Last year, the financier compared the current market situation with the events of 2008, expressed concern regarding the large-scale reduction in corporate profits, and also pointed to the habit of the population to spend money once morest the backdrop of soaring inflation.

He is also known for his cryptic tweets, which he then deleted. So, in mid-November, the financier hinted that he had a big bet on the fall of the market. “You have no idea how much

short positions

», — wrote he then. According to the results survey Bloombrg, Michael Burry’s Twitter account has become the most followed among professional investors in 2022.

Burry was one of the first to predict the collapse of the US real estate market, which was followed by the global financial crisis of 2008-2009. He managed to make $100 million for himself and $700 million for investors in the Scion Capital fund, which he then managed, on a bet once morest the market. Two years later, Burry became the subject of a book by Michael Lewis, which was made into the film Big Short.

A method of trading on the stock exchange, when an investor borrows from a broker shares that he does not own in order to sell them at the current market price in order to buy the same shares at a lower price and reap the benefits. In this case, the investor is limited by the terms of settlements, and opening a short position is associated with a high risk.

Author

Marina Mazina