Primerica, Inc. (NYSE: PRI) got here out with its third-quarter outcomes final week, and we wished to see how the enterprise is performing and what trade forecasters consider the corporate following this report. Primerica reported US$711m in income, roughly in keeping with analyst forecasts, though statutory earnings per share (EPS) of US$4.23 beat expectations, being 4.8% greater than what the analysts anticipated. Earnings are an essential time for traders, as they will observe an organization’s efficiency, have a look at what the analysts are forecasting for subsequent yr, and see if there’s been a change in sentiment in the direction of the corporate. So we collected the newest post-earnings statutory consensus estimates to see what might be in retailer for subsequent yr.

Take a look at our newest evaluation for Primerica

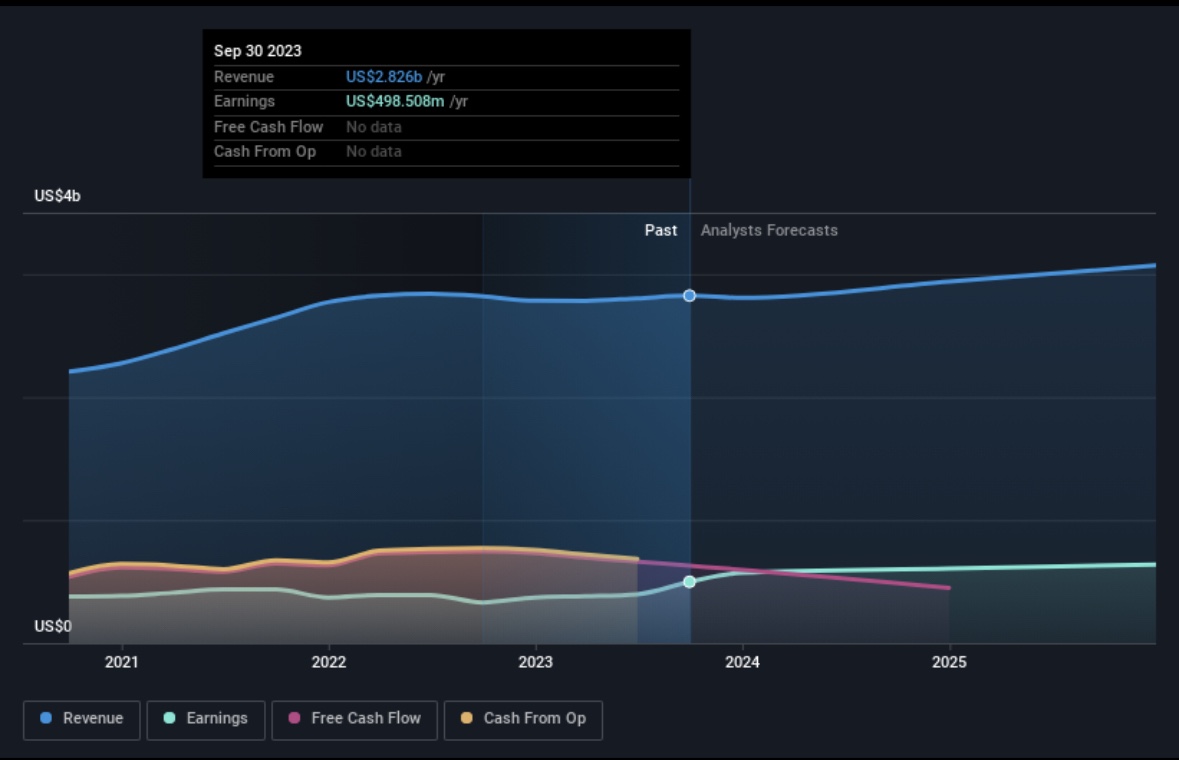

Following the newest outcomes, Primerica’s six analysts are actually forecasting revenues of US$2.94b in 2024. This might be an okay 4.0% enchancment in income in comparison with the final 12 months. Statutory earnings per share are predicted to leap 23% to US$17.54. Earlier than this earnings report, the analysts had been forecasting revenues of US$2.94b and earnings per share (EPS) of US$17.42 in 2024. So it’s fairly clear that, though the analysts have up to date their estimates, there’s been no main change in expectations for the enterprise following the newest outcomes.

There have been no modifications to income or earnings estimates or the value goal of US$222, suggesting that the corporate has met expectations in its current end result. That’s not the one conclusion we will draw from this information nonetheless, as some traders additionally like to contemplate the unfold in estimates when evaluating analyst worth targets. Probably the most optimistic Primerica analyst has a worth goal of US$260 per share, whereas essentially the most pessimistic values it at US$190. Analysts positively have various views on the enterprise, however the unfold of estimates will not be broad sufficient in our view to recommend that excessive outcomes may await Primerica shareholders.

After all, one other method to take a look at these forecasts is to put them into context in opposition to the trade itself. It’s fairly clear that there’s an expectation that Primerica’s income progress will decelerate considerably, with revenues to the top of 2024 anticipated to show 3.2% progress on an annualised foundation. That is in comparison with a historic progress price of 9.3% over the previous 5 years. Evaluate this in opposition to different corporations (with analyst forecasts) within the trade, that are in mixture anticipated to see income progress of 6.4% yearly. Factoring within the forecast slowdown in progress, it appears apparent that Primerica can be anticipated to develop slower than different trade individuals.

The Backside Line

An important factor to remove is that there’s been no main change in sentiment, with the analysts reconfirming that the enterprise is performing in keeping with their earlier earnings per share estimates. On the plus aspect, there have been no main modifications to income estimates; though forecasts indicate they’ll carry out worse than the broader trade. The consensus worth goal held regular at US$222, with the newest estimates not sufficient to have an effect on their worth targets.

Following on from that line of thought, we expect that the long-term prospects of the enterprise are way more related than subsequent yr’s earnings. We now have estimates – from a number of Primerica analysts – going out to 2025, and you’ll see them free on our platform right here.

Earlier than you are taking the following step it’s best to know concerning the 2 warning indicators for Primerica that we’ve got uncovered.

Have suggestions on this text? Involved concerning the content material? Get in contact with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We purpose to convey you long-term targeted evaluation pushed by elementary information. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked regarding.

Be a part of A Paid Consumer Analysis Session

You’ll obtain a US$30 Amazon Present card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Enroll right here

Primerica, Inc. (NYSE:PRI) Third-Quarter Outcomes Simply Got here Out: Right here’s What Analysts Are Forecasting For Subsequent 12 months

Primerica, Inc. (NYSE: PRI) got here out with its third-quarter outcomes final week, and we wished to see how the enterprise is performing and what trade forecasters consider the corporate following this report. Primerica reported US$711m in income, roughly in keeping with analyst forecasts, though statutory earnings per share (EPS) of US$4.23 beat expectations, being 4.8% greater than what the analysts anticipated. Earnings are an essential time for traders, as they will observe an organization’s efficiency, have a look at what the analysts are forecasting for subsequent yr, and see if there’s been a change in sentiment in the direction of the corporate. So we collected the newest post-earnings statutory consensus estimates to see what might be in retailer for subsequent yr.

Take a look at our newest evaluation for Primerica

Following the newest outcomes, Primerica’s six analysts are actually forecasting revenues of US$2.94b in 2024. This might be an okay 4.0% enchancment in income in comparison with the final 12 months. Statutory earnings per share are predicted to leap 23% to US$17.54. Earlier than this earnings report, the analysts had been forecasting revenues of US$2.94b and earnings per share (EPS) of US$17.42 in 2024. So it’s fairly clear that, though the analysts have up to date their estimates, there’s been no main change in expectations for the enterprise following the newest outcomes.

There have been no modifications to income or earnings estimates or the value goal of US$222, suggesting that the corporate has met expectations in its current end result. That’s not the one conclusion we will draw from this information nonetheless, as some traders additionally like to contemplate the unfold in estimates when evaluating analyst worth targets. Probably the most optimistic Primerica analyst has a worth goal of US$260 per share, whereas essentially the most pessimistic values it at US$190. Analysts positively have various views on the enterprise, however the unfold of estimates will not be broad sufficient in our view to recommend that excessive outcomes may await Primerica shareholders.

After all, one other method to take a look at these forecasts is to put them into context in opposition to the trade itself. It’s fairly clear that there’s an expectation that Primerica’s income progress will decelerate considerably, with revenues to the top of 2024 anticipated to show 3.2% progress on an annualised foundation. That is in comparison with a historic progress price of 9.3% over the previous 5 years. Evaluate this in opposition to different corporations (with analyst forecasts) within the trade, that are in mixture anticipated to see income progress of 6.4% yearly. Factoring within the forecast slowdown in progress, it appears apparent that Primerica can be anticipated to develop slower than different trade individuals.

The Backside Line

An important factor to remove is that there’s been no main change in sentiment, with the analysts reconfirming that the enterprise is performing in keeping with their earlier earnings per share estimates. On the plus aspect, there have been no main modifications to income estimates; though forecasts indicate they’ll carry out worse than the broader trade. The consensus worth goal held regular at US$222, with the newest estimates not sufficient to have an effect on their worth targets.

Following on from that line of thought, we expect that the long-term prospects of the enterprise are way more related than subsequent yr’s earnings. We now have estimates – from a number of Primerica analysts – going out to 2025, and you’ll see them free on our platform right here.

Earlier than you are taking the following step it’s best to know concerning the 2 warning indicators for Primerica that we’ve got uncovered.

Have suggestions on this text? Involved concerning the content material? Get in contact with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We purpose to convey you long-term targeted evaluation pushed by elementary information. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked regarding.

Hernán Porras Molina (Primerica)

#Primerica #NYSEPRI #ThirdQuarter #Outcomes #Heres #Analysts #Forecasting #12 months

2024-06-18 00:29:29