Enter 2022.05.28 07:37

Edited 2022.05.28 07:40

On the 27th (local time), the major indices of the New York Stock Exchange surged all at once. This is because the US consumer price index has soared in the meantime, but there is a signal that the central bank (Fed) is watching inflation has reached a peak.

The leading index, the S&P 500, finished trading at 4,158.24, up 2.47% from the previous day, the Nasdaq Composite, up 3.33%, at 12,131.13, and the Dow, up 1.76%, at 33,212.96, respectively.

photo = AFP

The S&P 500 and Nasdaq Composites rebounded for the first time in eight weeks. The Nasdaq is up 6.45% this week alone. The Dow ended its long-term decline and rose 5.79% this week alone.

In the New York Stock Exchange this week, consumer discretionary and energy sectors showed remarkable gains.

The uptrend was fueled by the US Department of Commerce’s announcement that the core price of personal consumption expenditure (PCE) fell for the second straight month in April. Core inflation in April rose 4.9% compared to the same period last year. It slowed from 5.3% in February and 5.2% in March.

Compared to the previous month, it rose 0.3% and maintained the same level for three consecutive months. This is the first time since November 2020 that this figure has slowed from the previous month (6.6%).

However, the Consumer Sentiment Index released by the University of Michigan today was sluggish. It came in at 58.4 on a firm basis, beating the market consensus of 59.1.

The consumer attitude index for May released by the University of Michigan fell to 58.4, the lowest in ten years.

Yields on U.S. Treasury bonds were slightly mixed by long-term and short-term. The 10-year maturity rate was 2.74% per annum, 1bp (0.01 percentage points) lower than the previous day. The two-year bond yield stood at 2.47% per annum, up 1bp.

International oil prices also rose sharply today.

On the New York Mercantile Exchange, the price of West Texas Intermediate (WTI) for July futures ended at $115.07 a barrel, up 0.9% from the previous day. On the London ICE Futures Exchange, the price of North Sea Brent crude rose 1.7% to $119.43 per barrel.

The price of WTI rose 4.34% over the past week, marking the fifth straight week of gains.

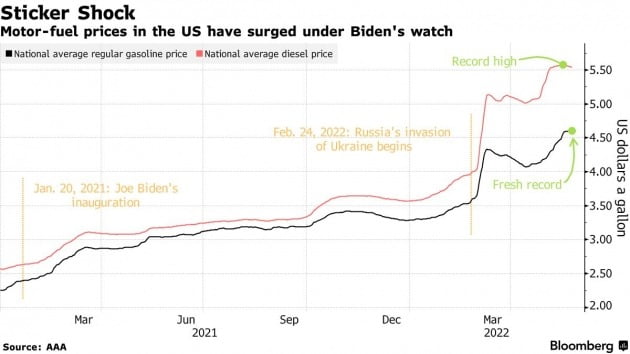

Retail prices for gasoline and diesel in the US are near all-time highs. Courtesy of Bloomberg

The major reason for the further rise in international oil prices is the prospect of short-term demand growth. In the United States, the world’s largest oil producer and consumer, the ‘driving season’ begins this weekend. The American Automobile Association (AAA) estimates that a total of 39.2 million people will travel 50+ miles this weekend alone. It is expected to increase by 8.3% compared to last year, although it will be 7.2% less than in 2019, before the pandemic.

The observation that it will be difficult to increase production at the Organization of Petroleum Exporting Countries (OPEC) plus (+) oil producing countries regular meeting scheduled for next week is also a factor that increases oil price pressure. OPEC+ oil producing countries have maintained an average capacity increase of 432,000 barrels per day.

In the US, personal income increased by 0.4% in April and consumer spending increased by 0.9%, respectively, compared to the previous month. The US Commerce Department explained that spending power is still good.

Today’s ‘Global Market Now’ issues are as follows.

① Signs of slowing inflation for the first time in a year and five months ② Sales of corporate PCs and cosmetics increased? ③ University of Michigan consumer sentiment lowest in 10 years ④ Citi saying “don’t buy US stocks” ⑤ “Oil price of 150 dollars” forecast ⑥ British prime minister “Putin is a crocodile” ⑦ Next week’s Beige Book, employment indicators, etc.

More details can be found on Hankyung Global Market YouTube and Hankyung.com broadcasts.

New York = Correspondent Jo Jae-gil [email protected]