At what price do foreign currencies appear in Cuba today, November 7, on the black market? Also the official rates of the US dollar, euro, pound sterling, Mexican peso, etc.

After Hurricane Rafael passed through western Cuba, the news will not be encouraging for ordinary Cubans, and the instability in the informal currency market is one of them. Nor do the official rates of the Central Bank (BCC) move much.

According to the online newspaper El Toque, the value of the US dollar (USD) remains at 327 CUP, the euro (EUR) at 345 CUP, and the Freely Convertible Currency (MLC) at 265 CUP. This momentary stability in exchange rates reflects the continued high demand for currencies, although prices remain unchanged for the moment for buyers.

The constant need for foreign currency in the country responds to the limited supply in the formal market, which forces citizens and businessmen to resort to the informal market to acquire dollars, euros and MLC.

For micro, small and medium-sized enterprises (MSMEs), which require foreign currency to purchase inputs and maintain their operations, this situation implies higher costs that, ultimately, are transferred to consumers, increasing the prices of goods and services. services.

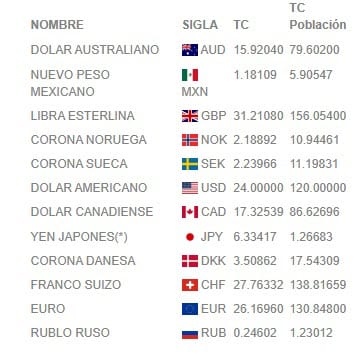

Price of currencies in Cuba today, November 7

As is known, Cubans allocate a significant part of their income in Cuban pesos to basic products and services, also impacted by inflation.

Essential goods, both from the private sector and from businesses that operate in MLC, continue to become more expensive in a context of economic instability that continues to erode the purchasing power of the population on the island.

The current stability in the informal market could offer temporary respite, but the overall picture remains complex.

How does the price of currencies move in Cuba today, according to the BCC?

#Price #currencies #Cuba #today #euro #dollar #MLC #dawn

**Interview with Economic Analyst Maria Gomez on Cuba’s Currency Challenges**

**Interviewer:** Today, we’re joining by Maria Gomez, an expert in Caribbean economics. Maria, thank you for being here. Can you provide an overview of the current state of foreign currency rates in Cuba, especially in light of the recent economic instability?

**Maria Gomez:** Thank you for having me. The situation in Cuba regarding foreign currency is quite complex at the moment. As of November 7, the US dollar (USD) is trading at around 327 Cuban pesos (CUP) on the black market, while the euro (EUR) is priced at 345 CUP. The Freely Convertible Currency (MLC) stands at 265 CUP. This temporary stability in exchange rates is somewhat misleading, as it reflects the continued high demand for foreign currencies rather than a healthy economic environment.

**Interviewer:** What factors are driving this demand for foreign currency among Cubans?

**Maria Gomez:** The primary reason is the severe shortage of essential goods in the formal market, which compels individuals and businesses to seek foreign currencies in the informal market. Many micro, small, and medium-sized enterprises (MSMEs) require foreign currency to procure necessary inputs and maintain operations. As they face higher costs in acquiring these currencies, those expenses get transferred to consumers, leading to increased prices for goods and services—a critical issue as inflation remains high.

**Interviewer:** In light of the recent Hurricane Rafael, how have the economic conditions been impacted further?

**Maria Gomez:** The aftermath of Hurricane Rafael is daunting for ordinary Cubans, aggravating an already unstable economy. The additional strain on resources and infrastructure will likely worsen the existing shortages of food, medicine, and fuel. The overall economic instability diminishes the purchasing power of the population, which was already struggling due to inflation and rising costs.

**Interviewer:** How do you see the future for citizens trying to navigate this currency landscape in Cuba?

**Maria Gomez:** The immediate future appears challenging. While the relative stability in currency prices could offer a slight relief, the underlying economic factors, such as inflation and resource shortages, continue to pose significant hurdles. Long-term solutions will require systemic changes in Cuba’s economic policies to stabilize both the formal and informal markets, ensuring that citizens can access basic necessities without being heavily burdened by inflated prices.

**Interviewer:** Thank you, Maria, for shedding light on these important issues facing Cuba today.

**Maria Gomez:** It’s my pleasure. Thank you for addressing such critical topics affecting the lives of many.