2024-11-20 23:00:00

Revenues have recovered in recent months to be even higher than inflationheld by the government There is still no correlation with consumption levelsa decrease of 10% from November 2023 to September 2024.

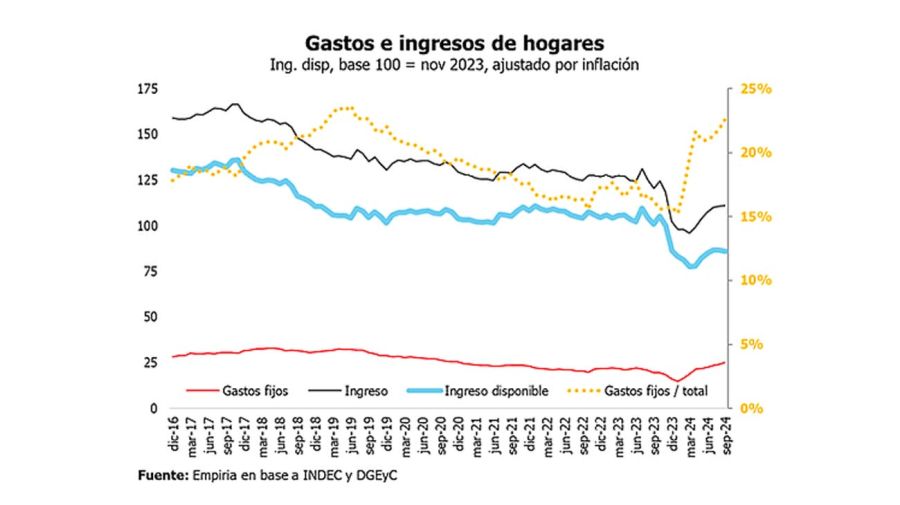

Consultancy firm Empiria explains this situation as the available income (income minus fixed expenses) of the average household in AMBA It actually fell 13.9% during the same period.

During the same period, Adjusted for inflation, average household income (recorded, unrecorded and unearned income) fell 6.3%. Fixed expenses such as transportation, electricity, gas, electricity, water, miscellaneous expenses, rent, etc. Growth 35.2% In real terms, it is difficult to “adjust” even if prices rise.

Dictators don’t like this

The practice of professional and critical journalism is a fundamental pillar of democracy. That’s why it bothers those who think they have the truth.

reductions in public service subsidies and corresponding increases in public transport fares, Household energy and water (between 60% and 92%), And increases in spending (+15% since November) and rents (+24%) “absorbed the recovery in household incomes that started in April”.

Hernan LacunzaThe person in charge of Empiria said, “Indeed, the economy was very sluggish in the first quarter, entered a plateau period in the second quarter, and began to rebound in an idiosyncratic and frugal manner in the third quarter.”

“Similarly, disposable income is the money a family has left after paying fixed expenses such as electricity, miscellaneous bills, transportation, etc. on the 5th of next month. In November 2023 it was 100 pesos, now it is 86 pesos. “These costs have been in place since last year,” the economist said in a statement. Radio is with you.

According to the consultancy’s report, the average household in the Buenos Aires Metropolitan Area (AMBA) is allocated 22.6% of revenue was spent on fixed expenses, compared with 15.6% in November 2023.

Among owner households (78% of the total), fixed expenses account for 20% of income, while among renters this rises to 31.5%, with rent being the main component (15%).

In mid-2019, the proportion of fixed spending was similar to the current high recorded (23.7%). “However, the policy of setting basic service rates in 2020 and 2023 has resulted in Spending as a share of revenue decreased by 8 percentage pointswhich artificially increases disposable income and consumption: 1.5 percentage points due to public transport, 3 percentage points due to the lower weight of energy expenditures, 0.3 percentage points due to water expenditures, 3.1 percentage points due to fees and rents (update lag) formula with rising inflation, which limits supply).

From November 2023 to September 2024, this trend reverses, Fixed expenses accounted for 22.6%, That is, 7.1 percentage points more: 1.3 percentage points for mass transport, 2.2 percentage points for energy and fuel, 0.7 percentage points for water, and 2.7 percentage points for housing costs.

Consumption decline and recovery prospects

in it Consumption fell 4.1% in the second quarter of this year This represents a new contraction compared to the first quarter of 2024 (-3.1%) and the last quarter of 2023 (-2.4%). As a result, consumption has fallen by 10% cumulatively since the third quarter of 2023, and against the backdrop of declining inflation, wage expenditures were able to recover by 5.6% in the second quarter.

Lacunza expects to reach 2024 “GDP will fall by 3.5% and consumption will fall by twice that, or 7%. Salaries are recovering due to the desynchronization between salary changes, but the recovery is smaller relative to the increase in fixed expenses.

He added: “Consumption is recovering, This apartment was occupied between March and May. “We can expect that by the end of 2025, we can reach the consumption level of the end of 2023.”

LM

1732144708

#wages #rising #consumption

**Interview with Hernan Lacunza from Empiria**

**Interviewer:** Hernan, thank you for joining us today. Your recent report indicates a significant decline in disposable income for households in the Buenos Aires Metropolitan Area. Can you explain the main reasons behind this drop?

**Hernan Lacunza:** Thank you for having me. Yes, our analysis shows that available income for the average household in the AMBA has fallen by 13.9% from November 2023 to September 2024. This is mainly due to rising fixed expenses—transportation, utilities like electricity and water, and rent—which have increased dramatically. For instance, household spending on energy and water has surged between 60% and 92%. The recovery in household incomes we saw earlier this year has effectively been absorbed by these escalating costs.

**Interviewer:** That’s quite alarming. You’ve mentioned that fixed expenses have seen a real growth of 35.2%. How are households coping with this situation?

**Hernan Lacunza:** It’s indeed challenging. With fixed expenses consuming a larger portion of household income—22.6% compared to just 15.6% last November—families are left with very little disposable income. For example, disposable income per household has dropped from 100 pesos in November 2023 to just 86 pesos now. This drastic change makes it difficult for households to maintain their previous spending levels, thereby impacting overall consumption.

**Interviewer:** So, while income levels have technically increased, the purchasing power has not kept pace due to inflation and rising costs. How do you see the economic outlook for these households moving forward?

**Hernan Lacunza:** The outlook is cautious. Although we have observed some recovery in income levels recently, this has not translated into a corresponding increase in consumption, which decreased by about 10% from November 2023 to September 2024. The economic environment remains sluggish, and with ongoing inflationary pressures, I believe many households will continue to struggle as they navigate these high fixed costs.

**Interviewer:** What policy measures do you think could alleviate some of this burden on households?

**Hernan Lacunza:** There needs to be a reconsideration of how public service rates are set. Reducing the burden of fixed expenses, particularly in utilities, can help free up more disposable income for families. Additionally, policies that focus on stabilizing prices for essential goods and services will be crucial in helping households regain some financial footing.

**Interviewer:** Thank you, Hernan, for your insights. It seems like the situation demands urgent attention from both policymakers and the economy as a whole.

**Hernan Lacunza:** Absolutely. I appreciate the opportunity to discuss these critical issues. It’s imperative that we keep the conversation going to find viable solutions for households facing these challenges. Thank you.