Pi Network Price Analysis: Is the Recent Surge a Bull Trap? (April 5, 2025)

By Archyde news Team

Published: april 6, 2025

Pi Network’s token experienced a meaningful price bounce on April 5th, 2025, but key indicators suggest this might be a temporary rally before further decline. Concerns about centralization and persistent selling pressure continue to weigh on the token’s long-term prospects. Is this surge a genuine recovery or a carefully laid bull trap?

Brief Overview of Pi network

Pi Network, a cryptocurrency project allowing users to mine PI tokens on their smartphones, has faced scrutiny regarding its decentralization and overall value proposition. While the project boasts a large user base, the actual utility and tradability of the PI token remain limited, leading to price volatility and skepticism among seasoned crypto investors.

Price Action and Key Resistance Levels

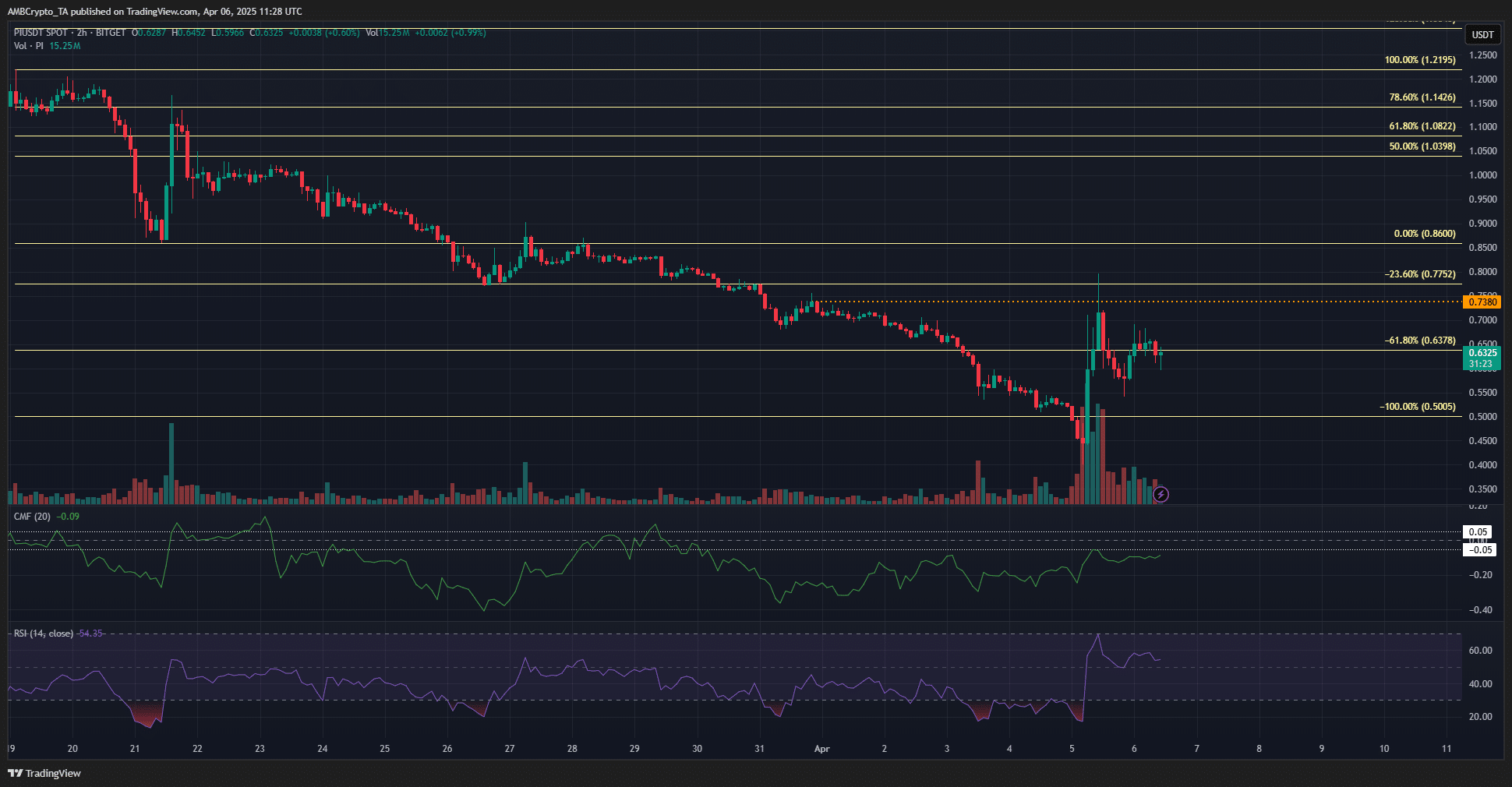

Pi Network [PI] experienced a bearish trend throughout March 2025, dipping as low as $0.4 over the weekend. On April 5th, the token saw a dramatic 99% price bounce within a six-hour timeframe. However, this surge faces significant resistance.

The $0.75 level is identified as a critical short-term resistance. A sustained break above this point would signal renewed bullish momentum. “The $0.75 was a critical resistance level in the short term,” analysts note. However, the inability to hold gains above $0.8 indicates persistent selling pressure. Long-term concerns about centralization contribute to this pressure.

For U.S. investors accustomed to the openness and regulatory oversight of customary financial markets, the opacity surrounding Pi Network’s development and token distribution raises red flags. this lack of clarity can deter institutional investment and further contribute to price volatility.

| Key Levels | Description |

|---|---|

| Critical Resistance | $0.75 (Short-term) |

| Lower High | $0.738 (From March) |

| Potential Range Extremes | $0.55 and $0.75 |

Technical Indicators: A mixed Bag

Several technical indicators offer conflicting signals regarding Pi Network’s immediate future.

- relative Strength Index (RSI): The RSI climbed above 50, suggesting bullish momentum. though, analysts caution that this could be a false alarm.

- Chaikin Money Flow (CMF): The CMF has remained below -0.05 for the past week, indicating significant capital outflow from the PI market. “Without a pause in selling pressure, it would be exceedingly difficult for the bulls to drive a rally,” experts warn.

- open Interest: Open Interest has increased alongside the price bounce, suggesting speculative interest and short-term bullish conviction. This increase suggests more investors are opening positions in the market.

- Funding Rate: The funding rate remains bearish, indicating that short positions are paying longs, further reinforcing the potential for a short squeeze.

Bearish Sentiment persists

Despite the recent price surge, the overall sentiment surrounding Pi Network remains bearish. Strong selling pressure and concerns about the project’s fundamentals continue to weigh on the token. “The capital outflow and the funding rate suggested that bears were dominant,” analysts affirm.

Potential Scenarios and Trading Strategies

Given the conflicting signals, several scenarios are possible:

- Short Squeeze: The bearish funding rate combined with increased open interest could trigger a short squeeze, potentially driving the price higher in the short term.

- Range-Bound Trading: If selling pressure eases, PI could enter a short-term consolidation phase, with the price fluctuating between $0.55 and $0.75.

- Continued Downtrend: the most likely scenario, according to analysts, is a continuation of the downtrend due to persistent selling pressure and essential concerns.

The trend has not shifted bullishly yet.

For U.S.traders, it’s crucial to approach Pi Network with caution. Given the high volatility and speculative nature of the token, risk management is paramount. Strategies such as setting stop-loss orders and diversifying portfolios are essential to mitigate potential losses.

Decentralization debate

The decentralization of Pi Network has been a recurring point of debate. The concentration of a significant portion of PI coins raises concerns about the network’s true decentralization,which goes against the ethos of most cryptocurrencies. centralization persisted and helped explain the consistent selling pressure.

Conclusion: Proceed with Caution

While Pi Network’s recent price surge might potentially be enticing, the underlying indicators suggest that it might very well be a temporary bull trap. Concerns about centralization, persistent selling pressure, and conflicting technical signals warrant caution. Investors shoudl conduct thorough research and exercise prudent risk management before considering any investment in PI.

Disclaimer: The data presented does not constitute financial,investment,trading,or other types of advice and is solely the writer’s opinion