2024-03-11 23:51:57

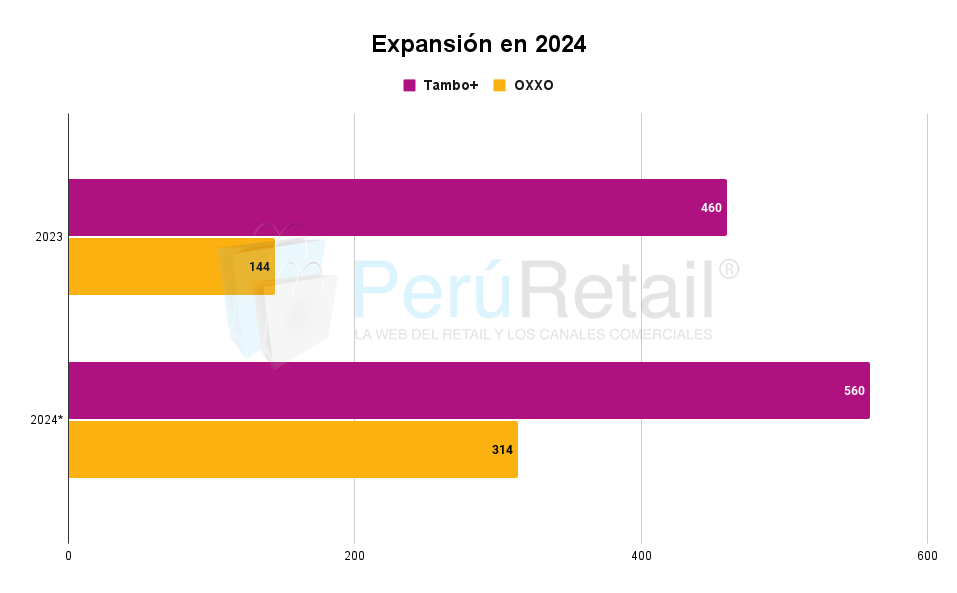

In the dynamic Peruvian commercial landscape, convenience stores have emerged as undisputed protagonists, transforming the shopping experience and redefining the relationship between consumers and retail commerce. Amid a resurgence of investments in 2024, the main chains will continue with their expansion plans, projecting a growth of 34% through the opening of new stores nationwide.

The Peruvian chain Tambo seeks to recover its opening rate that it maintained before the pandemic. Since its founding in 2015, the chain has achieved an average rate of 100 locations per year, reaching 406 by the end of 2019. However, the pandemic affected its plans, forcing it to close locations and culminating with 358 stores in June 2022. It was at this moment when they decided to resume their growth. In 2023 alone, they opened 75 new establishments, including their expansion in the provinces, closing the year with 460 stores. At the beginning of this year, there are already 469 stores.

On the other hand, the Mexican chain OXXO maintains the projection of doubling its openings annually. In 2023, they also closed with 75 new openings, reaching a total of 144 stores today, including their first location in Ica, thus marking the beginning of their expansion to the provinces. Along with the above, the Primax and Repsol service chains also have a notable market share. Primax, through LiSTO!, has 181 stores, of which regarding 27 are stand-alone format. Meanwhile, Repsol, through its Repshop and Sprint brands, has nearly 80 stores.

Preparation: Peru Retail.

What characterizes a convenience store?

A convenience store, also known as a proximity store, is a retail establishment specialized in providing a wide range of daily consumer products, all in a smaller space compared to supermarkets or hypermarkets. These stores are designed with the primary goal of offering convenience to consumers, providing them with quick and easy access to essential products, often 24/7.

Strategically located in urban and suburban areas, close to residential areas, offices, service stations or high traffic places, convenience stores ensure optimal accessibility. Among the products they usually have include prepared foods, drinks, personal care items, cleaning products, newspapers, confectionery, among others. Additionally, many of these stores have expanded their offerings to include additional services such as bill payments, phone top-ups and basic financial services.

The Peruvian convenience market in figures

According to RE Propiedades, a real estate consultancy specialized in commercial premises, in Lima there are around 1,000 convenience stores, involving various participants that include main chains and entrepreneurs.

However, when applying a comparison with the Mexican market, where OXXO alone has approximately 20,000 stores, representing one store for every 5,600 inhabitants in a population of 127 million, in Peru the existence of around 6,000 stores is estimated, considering both the ventures such as the conversions of traditional warehouses to minimarkets.

In Lima, with a population of more than 10 million inhabitants, the presence of around 1,800 convenience stores would be expected to satisfy demand. However, competition once morest the traditional channel is considerable, with around 200,000 wineries in the capital alone and around 535 thousand nationwide.

READ ALSO: The rise of convenience stores in Peru: Challenges and opportunities in an expanding market

“There are several factors that accompany the growth of convenience stores. The first of them is that they are replacing traditional warehouses, although the supply of perishables still represents a great differential. On the other hand, there is the expansion of the goods and services offered within the store, such as recharges and payments.”comments Adolfo Vega, Retail Director at RE Propiedades.

Data collected by Perú Retail through February 2024 provides a detailed view of the current landscape of the proximity market in Peru:

- Tambo+ (owned by Lindcorp): 469 stores; regarding 9% located outside Metropolitan Lima.

- OXXO (FEMSA): 148 stores.

- Ready! (Primax): 181 stores.

- Repshop and Sprint (Repsol brands): 77 stores.

- Vega Market (Vega Corporation): 39 stores.

- VAO (Petroperú): 21 stores.

- Mimarket (Mifarma): 44 stores (last registration in 2017).

- TaDá (Backus): 5 stores.

- SPID (Cencosud): 1 store.

Together, these brands add up to 941 stores in Peru (985 considering the outdated Mimarket figure).

Preparation: Peru Retail.

Expansion of convenience stores in 2024

As we have previously highlighted, Tambo aims to recover its opening rate prior to the pandemic. In 2023, it managed to open 75 stores, and it is highly probable that in 2024 it will open a hundred new stores. With this boost, it is projected that the chain will close the year with a total of 560 establishments.

Furthermore, Tambo’s ambition focuses on the conquest of new regions and cities in the country. To date, the chain has established around 41 locations in cities outside Metropolitan Lima, extending its presence to places such as Barranca, Cañete, as well as the regions of Piura, La Libertad, Áncash and Ica.

On the other hand, the FEMSA Group has plans to open 1,400 stores per year in Latin America until 2028. Specifically, it is estimated that it will open one thousand stores in Mexico, reserving approximately 400 stores per year for Brazil, Chile, Colombia and Peru.

READ ALSO: Retail sees a resurgence in 2024: What areas will lead this growth?

According to Adolfo Vega of RE Properties, OXXO has set an even more ambitious goal for 2024, planning to add 170 stores to its portfolio. This figure represents more than double what was achieved in its first 6 years in Peru, demonstrating the strength and significant opportunities present in the convenience market.

Together, both brands will contribute to a 33.83% increase in the size of the proximity segment in the Peruvian market.

Source: RE Propiedades, Perú Retail.

Will Oxxo surpass Tambo?

To answer this question, let’s first look at the current data. Tambo+ was born in 2015, marking the beginning of the segment in the country as it is known today. During these years, it has positioned itself in the top of mind of Lima consumers. Likewise, it achieved its long-awaited expansion to the provinces in December 2022, following resuming its growth plans.

Oxxo, on the other hand, landed in the Peruvian market in 2018, which although it had a very complex start due to the established competition from Tambo, in the post-pandemic era it has managed to boost its presence as we have shown above. Now, it began its expansion to the provinces also in December 2023, with its first location in Ica.

“A first factor to consider is financial support. Oxxo has a corporation like FEMSA behind it, and has made its long-term growth projection clear. Tambo along with his sister Aruma are the drivers of Lindcorp, that is, what they sell themselves is reinvested in their expansion. Now, precisely both Peruvian brands have a synergy that allows them to take advantage of the same lot to settle and share the rent, generating greater profitability.”notes Vega.

Taking into account that it took Tambo 8 years to expand outside the capital, and Oxxo only 6, we have a first indicator of this competition and how the horizon is being drawn. “I think there is still room for these convenience stores to continue growing. The ‘war’ will be more focused on who takes positions faster. In that sense, I think there will be healthy competition and both brands will be on par in the future.“estimates the representative of RE Properties.

Preparation: Peru Retail.READ ALSO: Nestlé bets on the convenience market with the opening of its first store in Lima

1710210297

#Tambo #accelerates #Oxxo #Listo #advance #firmly