2024-11-06 09:54:00

Did you know that your pay slip hides much more than just a simple amount? What if this count became much more than a simple number, to better control your income and anticipate unsuspected opportunities?

Understanding the intricacies of a salary statement can be complex. In order to provide clarity, we will dissect here 7 representative profiles, illustrating concrete cases. Step by step, immerse yourself in the world of monthly and hourly salary, discover the subtleties of additional remuneration, and precisely identify the elements which escape social security contributions.

Modeled example of a salary slip

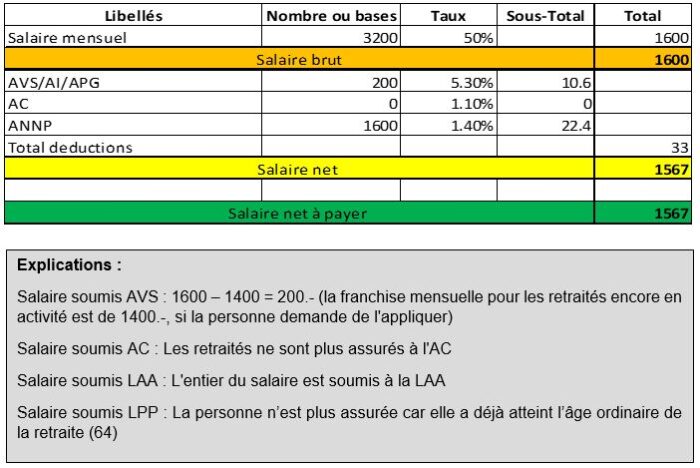

Retired working part time

Mrs Claire Moreau65, is a retiree who decided to work part-time to supplement her pension. Since September 1, 2024, she has been employed as an assistant in a municipal library. His gross monthly salary is CHF 3,200.- for 100% employment. Although she is retired, she continues to receive her retirement pension. She asks that the franchise be applied. Her retired status allows her to work without losing her pension rights. Make the salary for the month of October

- AVS/AI/APG: according to legal provisions

- AC: according to legal provisions

- LAA: the contribution rate for non-professional accidents is 1.40%

Period: October

Minor Apprentice

Monsieur Thomas Jollyaged 16, started his apprenticeship in automobile mechanics on August 1, 2024. His gross salary is CHF 700.- per month for his first year. According to his apprenticeship contract, he must follow theoretical courses at the same time, and he is entitled to 5 weeks of paid leave per year. Thomas is passionate about automobiles and hopes to obtain his CFC after his training. Countdown for the month of August

- AVS/AI/APG: according to legal provisions

- AC: according to legal provisions

- LAA: the contribution rate for non-professional accidents is 0.50%

No cantonal specificity in this count.

Period: August

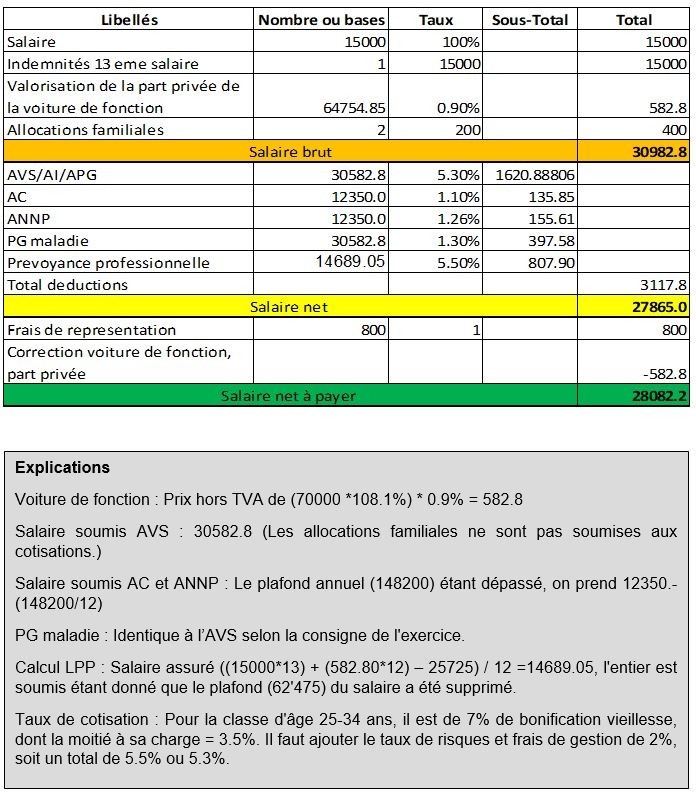

Executive with benefits

Mr. Vincent Lambert33, is a senior executive at a technology company. He receives a gross monthly salary of CHF 15,000 (x13). -. His contract includes a 13th salary paid in December 2024, as well as a company car worth CHF 70,000 (including tax). -, which he can use for private journeys. Vincent also benefits from an allowance of CHF 800.- per month for his representation expenses, validated by the tax administration. Being married and the father of two children, he also receives family allowances amounting to CHF 400.- for his children.

Its compensation fund removes the salary ceiling limit (62,475) compared to the LPP minimum, to better cover its senior executives. The risk rate and management fees are 2% payable by the employee, based on their insured salary. PG sickness insurance subscribed by the employer contribution rate is 1.3% payable by the employee, according to the salary subject to AVS.

- AVS/AI/APG: according to legal provisions

- AC: according to legal provisions

- LAA: the contribution rate for non-professional accidents is 1.26%

No cantonal specificity in this count.

Period: December

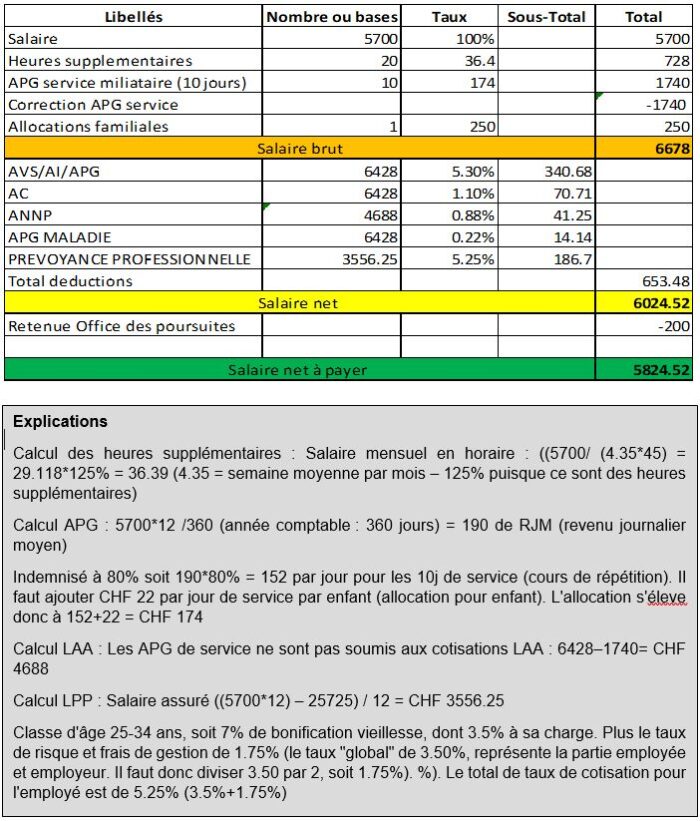

Employee with military service

Mr Julien Martin28 years old, is employed in a construction company with a gross salary of CHF 5,700.- (x12) per month. During the month of June 2024, he completed 10 days of military service, which impacted his salary. He works 45 hours a week, in addition, he worked 20 hours of overtime during the month of June, which we take into account for the count. In addition to his salary, he receives a family allowance of CHF 250 per month for his 5-year-old son. The employer maintains his salary at 100% during periods of military service. The prosecution office withholds 200CHF monthly.

- AVS/AI/APG: according to legal provisions

- AC: according to legal provisions

- LAA: the contribution rate for non-professional accidents is 0.88%

- LPP: the pension fund applies a plan linked to the minimum LPP standards. The risk rate and management fees amount to 3.50% overall, based on their insured salary.

- PG sickness: subscribed by the employer for a contribution rate of 0.22% payable by the employee, according to the salary submitted by AVS.

Period: June

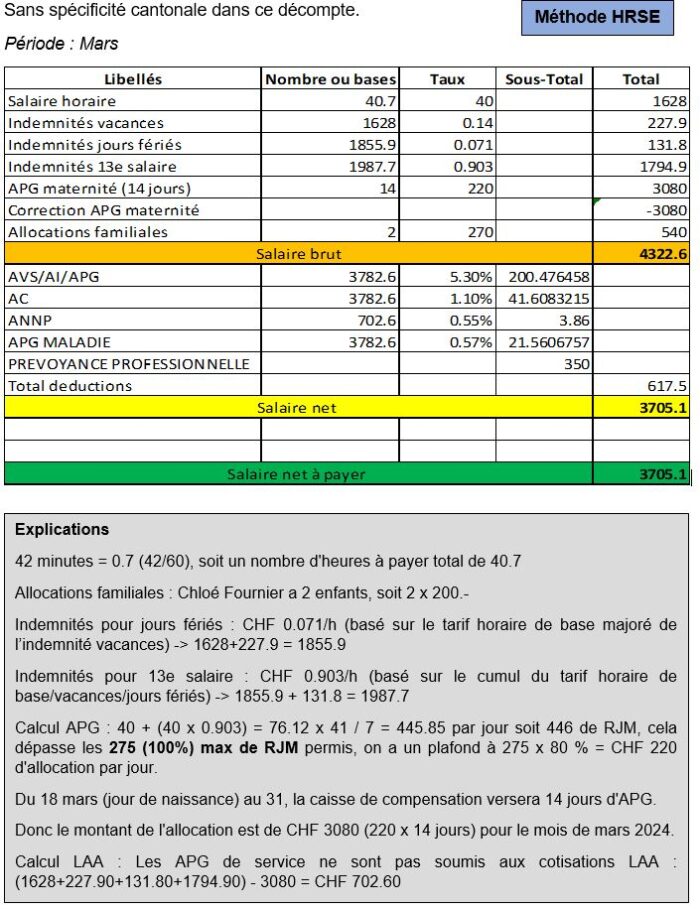

Maternity leave and hourly pay

Mrs Chloé Fournier22 years old, works as a web developer in a start-up. She is currently on maternity leave since March 18, 2024, after giving birth to her second child. According to her contract, she benefits from 14 weeks of maternity leave (16 in Geneva), her basic hourly salary is CHF 40, it is 100% maintained by her employer. She completed 40 hours and 42 minutes according to the last reading from Mars. Chloé is married and receives a family allowance per child of CHF 270.- per month. Weekly work in the company set at 41 hours.

- AVS/AI/APG: according to legal provisions

- AC: according to legal provisions

- LAA: the contribution rate for non-professional accidents is 0.55%

- LPP: the employee’s monthly contribution is set at CHF 350.-

- PG sickness: subscribed by the employer for a contribution rate of 0.57% payable by the employee, according to the salary submitted by AVS.

- Vacation compensation: CHF 0.14/h (based on the basic hourly rate).

- Pay for public holidays: CHF 0.071/h (based on the basic hourly rate plus holiday pay).

- Compensation for 13th salary: CHF 0.903/h (based on the accumulation of the basic hourly rate/vacation/public holidays).

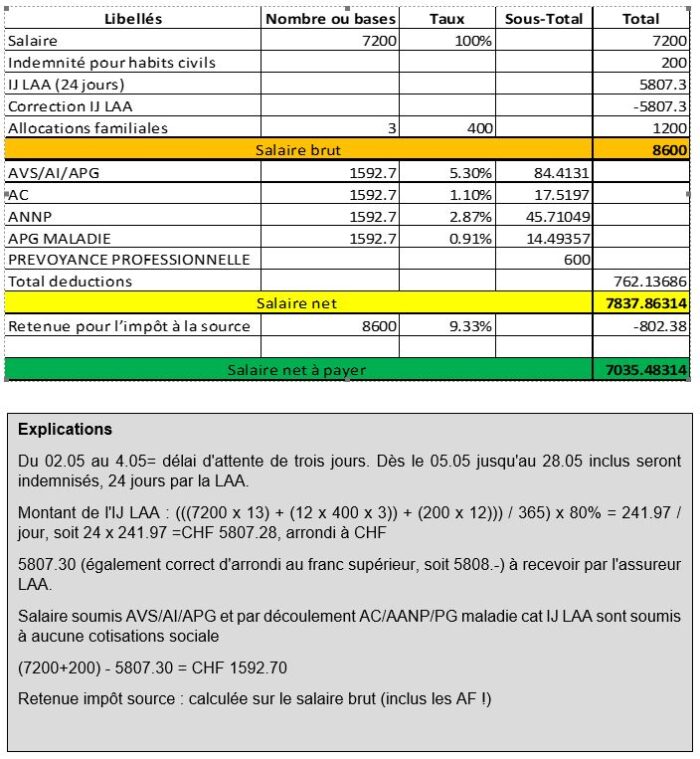

Employee injured at work

Mr Philippe Dufour37, is a maintenance technician in a production plant. He is married with 3 children, from whom he receives 400.-/per child in family allowances. On May 2, 2024, he suffered an accident at his workplace, which led to him being off work. His gross salary is CHF 7,200. (x13)- per month. The employer will receive his compensation from his LAA insurer and will also maintain his salary at 100%. Philippe returned to work on May 28, 2024 to resume his professional activities. Withholding tax at source of 9.33%. He benefits from allowances for civilian clothing up to 200CHf monthly.

- AVS/AI/APG: according to legal provisions

- AC: according to legal provisions

- LAA: the contribution rate for non-professional accidents is 2.87%

- LPP: the pension fund has been set at CHF 600 per month for this person

- PG sickness: subscribed by the employer is a contribution rate of 91% payable by the employee, according to the salary submitted AVS.

No cantonal specificity in this count.

Period: May

Employee on sick leave

Mr Nicolas Lemoine40 years old, works in a marketing company with a gross monthly salary of CHF 11,200.-. Due to illness, he is off work for three weeks, from 1is April to April 21, 2024. He will return to work as soon as he recovers. In addition, a first part of the 13th salary is paid in April and the other in August. He is given a flat rate for travel between home and work of 300.-/month. It also benefits from reimbursement of mileage costs of 150km at 88 cents/km.

His employer’s insurance contract guarantees him continued salary during sick leave of 720 days over a period of 900 days at 90%, the waiting period is 2 days without right to salary on a low of 360 days.

- AVS/AI/APG: according to legal provisions

- AC: according to legal provisions

- LAA: the contribution rate for non-professional accidents is 1.28%

- LPP: the pension fund applies a plan linked to the minimum LPP standards. The risk rate and management costs amount to 6.0% payable by the employee, based on their insured salary.

- PG sickness: subscribed by the employer is a contribution rate of 2.16% payable by the employee, according to the salary submitted AVS.

No cantonal specificity in this count.

Period: April

Whether you are retired, apprentice, executive, or faced with specific situations such as military service, maternity leave or sick leave, each profile illustrates unique specificities. This in-depth understanding allows you to transform your pay slip into a strategic tool to optimize your rights, anticipate opportunities and better manage your personal finances.

Articles by the same author:

Payroll statement 2: Your pay slip: a treasure to discover

The secrets of salary calculation

Photo credit: Stock Photo © IgorVetushko #353689398

1731043040

#Payroll #statement #pay #slip #treasure #discover

Text-align CSS

Period: June

### Maternity Leave and Hourly Pay

**Mrs. Chloé Fournier**, 22 years old, works as a web developer in a start-up. She is currently on maternity leave since March 18, 2024, after giving birth to her second child. According to her contract, she benefits from 14 weeks of maternity leave (16 in Geneva). Her basic hourly salary is CHF 40, which is 100% maintained by her employer. She completed 40 hours and 42 minutes according to the last reading from March. Chloé is married and receives a family allowance per child of CHF 270 per month. Weekly work in the company is set at 41 hours.

**Contributions**:

– AVS/AI/APG: according to legal provisions

– AC: according to legal provisions

– LAA: the contribution rate for non-professional accidents is 0.55%

– LPP: the employee’s monthly contribution is set at CHF 350

– PG sickness: subscribed by the employer, with a contribution rate of 0.57% payable by the employee based on the salary submitted by AVS.

– Vacation compensation: CHF 0.14/h (based on the basic hourly rate)

– Pay for public holidays: CHF 0.071/h (based on the basic hourly rate plus holiday pay)

– Compensation for 13th salary: CHF 0.903/h (based on the accumulation of the basic hourly rate/vacation/public holidays)

### Employee Injured at Work

**Mr. Philippe Dufour**, 37, is a maintenance technician in a production plant. He is married with 3 children, from whom he receives CHF 400 per child in family allowances. On May 2, 2024, he suffered an accident at work, which led to him being off work. His gross salary is CHF 7,200 per month (x13). The employer will receive his compensation from his LAA insurer and will also maintain his salary at 100%. Philippe returned to work on May 28, 2024, to resume his professional activities. The withholding tax at source is 9.33%. He benefits from allowances for civilian clothing up to CHF 200 monthly.

**Contributions**:

– AVS/AI/APG: according to legal provisions

– AC: according to legal provisions

– LAA: the contribution rate for non-professional accidents is 2.87%

– LPP: the pension fund has been set at CHF 600 per month for this person

- PG sickness: subscribed by the employer, with a contribution rate of 91% payable by the employee based on the salary submitted to AVS.

**Note**: No cantonal specificity is in this count.

Period: May

### Employee on Sick Leave

**Mr. Nicolas Lemoine**, 40 years old, works in a marketing company with a gross monthly salary of CHF 11,200. Due to illness, he is off work for three weeks, from April 1 to April 21, 2024. He will return to work as soon as he recovers. In April, a first part of the 13th salary is paid, and the other is paid in August. He receives a flat rate for travel between home and work of CHF 300 per month and benefits from reimbursement of mileage costs for 150 km at CHF 0.88/km.

**Insurance Details**: His employer’s insurance contract guarantees him continued salary during sick leave of 720 days over a period of 900 days at 90%; the waiting period is 2 days without salary during low periods of 360 days.

**Contributions**:

– AVS/AI/APG: according to legal provisions

– AC: according to legal provisions

– LAA: the contribution rate for non-professional accidents is 1.28%

– LPP: applies a plan linked to minimum LPP standards. The risk rate and management costs amount to 6.0% payable by the employee based on their insured salary.

– PG sickness: subscribed by the employer, with a contribution rate of 2.16% payable by the employee.