Nvidia’s ( NVDA.US ) results were Wall Street’s most important news in weeks. The results for the 4th quarter exceeded market expectations both at the level of sales and at the level of earnings per share. Nvidia shares gained nearly 5% following the US market closed.

- Revenue (Q4 2023): $22.1 billion vs. $20.41 billion forecast

- Earnings per share (Non-GAAP): $5.16 vs. forecasts of $4.63

- Data center revenue: $18.48 billion vs. $17.21 billion forecast

- Gaming revenue: $2.98 billion vs. estimates of $2.72 billion

- Auto revenue: $281 million vs. estimates of $272.1 million

- Gross margin: 76.7% vs. 75.4% of the prediction

- The company estimates Q1 revenue at $24.8 billion (with a 2% margin of error), versus Wall Street’s forecast of $21.9 billion.

Facts from the report

-

Fourth quarter data center revenue was a record, up 409% year-over-year (27% sequentially).

-

Game revenue grew by 56% year-on-year, signaling a significant improvement (unchanged year-on-year).

-

Automotive sales were down 4% year-over-year and (8% sequentially).

-

Revenue from professional visualization grew by 105% year-on-year (11% sequentially).

Outlook for Q1 2024

- Gross margins are expected at 76.3%, or 77.0%, plus or minus 50 basis points.

- The costs are expected to be approximately 3.5 billion.

- USD, excluding gains and losses from unrelated investments. other revenues and costs are expected in the amount of approximately 250 mil.

- Tax rates are expected to be 17.0%, plus or minus 1%, excluding any discrete items.

The report delivered very strong results that signal huge momentum in AI investment and demand for AI chips (data centers). Investor attention now shifts to the conference call. The most important thing now will be what communication the company will adopt for the next quarter of the year, when much of the “low base” effect will evaporate. It’s also worth noting that the company has a huge market cap (over $1.6 trillion), and it’s hard to expect the stock to grow 100% every year.

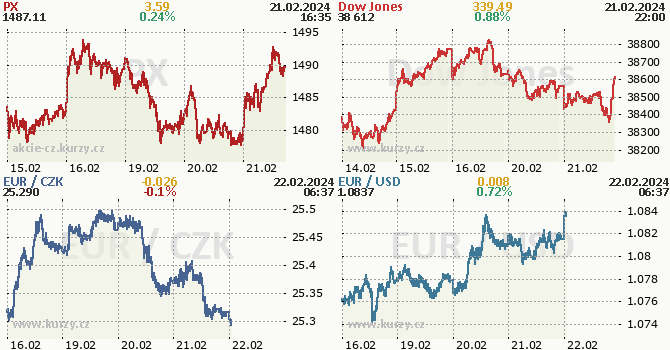

Source: xStation5

X-Trade Brokers (XTB) is an international brokerage house that provides professional conditions for trading CFDs on forex, indices, commodities, cryptocurrencies and for investing in stocks and ETFs. It is constantly improving its services, which is evidenced by a number of international awards and confirmed by the domestic awards Broker of the Year and Forex Broker of the Year, won repeatedly at the MoneyExpo Investment Summit. For its clients, XTB offers professional trading platforms MetaTrader 4 and xStation 5 with an integrated calculator, free training, 24-hour customer support, free training and daily financial market news.

CFDs are complex instruments and, due to the use of financial leverage, are associated with a high risk of rapid financial loss. 72% of retail investor accounts experienced a loss when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford the high risk of losing your funds.