Nippon Steel Defiant After Biden Blocks US Steel Acquisition

Table of Contents

- 1. Nippon Steel Defiant After Biden Blocks US Steel Acquisition

- 2. A Turbulent Path for a Steel Giant merger

- 3. Global Steel Market Dynamics Drive Merger Talks

- 4. Future Uncertain Despite Nippon Steel’s Resolve

- 5. Biden’s Block on Nippon Steel Acquisition: A Steel Industry Earthquake?

- 6. Behind the Block: National Security and Political Repercussions

- 7. Battleground Politics and option Bidders

- 8. Legal Battles Loom: a Fight for the Future of US Steel

- 9. Interview with dr. Emily Carter: unpacking the Fallout

- 10. nippon Steel’s Bid for U.S. Steel: A Battle Over Steel and Sovereignty

- 11. Nippon Steel’s Ambitions and the USW’s Concerns

- 12. Geopolitics at play: Steel, Sovereignty, and Reshoring

- 13. Legal Battle with Global Repercussions

- 14. The Future of Steel: Consolidation or Geopolitical Gridlock?

- 15. A Crossroads for the Industry

- 16. Navigating a Complex Landscape

- 17. What are teh potential economic ramifications ofPresident Biden’s decision to block Nippon SteelS bid for U.S.steel?

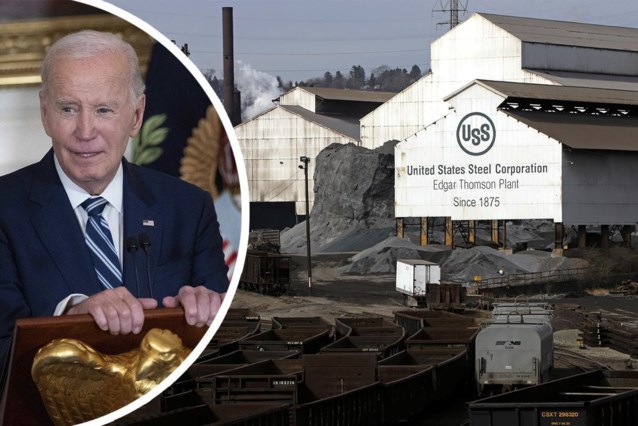

Despite President Biden’s decision to halt Nippon Steel’s $15 billion acquisition of US Steel, citing national security concerns, teh Japanese steel giant remains undeterred. Nippon steel CEO eiji Hashimoto stated, “There is no reason or need to give up,” signifying the company’s unwavering commitment to pursuing the merger.

A Turbulent Path for a Steel Giant merger

Since its inception in December 2023, the proposed merger between Nippon Steel, the world’s fourth-largest steel producer, and US Steel has navigated a challenging landscape. While US Steel management was receptive to the takeover, the powerful United Steelworkers (USW) union immediately voiced its opposition.This presented a formidable obstacle from the outset.

Nippon Steel, with its annual output of 44 million tons of steel, offered a considerable $14.9 billion for US Steel. A successful merger would have created the world’s third-largest steel company, surpassing China’s Ansteel Group and trailing only ArcelorMittal. The combined entity would have employed over 135,000 people, merging Nippon Steel’s 113,600 employees with US Steel’s 21,800.

Global Steel Market Dynamics Drive Merger Talks

Both Nippon Steel and US Steel face intense competition from Chinese steel manufacturers, who currently dominate the global market. The desire to leverage combined resources and operational strength likely played a significant role in their decision to pursue a merger.

Future Uncertain Despite Nippon Steel’s Resolve

The future of the Nippon Steel-US Steel deal remains murky. While Nippon Steel remains persistent to proceed, the USW union’s ongoing opposition and President Biden’s intervention raise serious doubts about the acquisition’s viability.

Biden’s Block on Nippon Steel Acquisition: A Steel Industry Earthquake?

president Biden’s decision to block the $15 billion acquisition of US Steel by Japanese giant Nippon Steel sent shockwaves through the global steel industry. Citing national security concerns, the White House moved to prevent the deal, sparking a flurry of legal challenges and international outcry.

Behind the Block: National Security and Political Repercussions

the Committee on Foreign investment in the United States (CFIUS) advised against the acquisition, arguing that placing a major steel producer under foreign control threatened critical supply chains. This move, however, has been met with strong resistance. US Steel and Nippon Steel jointly denounced the decision as politically motivated, while Japanese Prime Minister Shigeru Ishiba expressed disappointment, calling for a clear explanation from the US government.

Adding fuel to the fire, Japan’s Foreign Ministry, a top investor in the US, warned that the block sends a chilling message to Japanese businesses. They emphasized that investments from Japan, despite lacking security concerns, were not welcome in the USA.

Battleground Politics and option Bidders

Intriguingly, reports suggest Biden’s decision was made in September but delayed until after the presidential election. This strategic timing, given US Steel’s headquarters in the crucial battleground state of Pennsylvania, raises questions about the role of politics in this high-stakes deal.

US Steel CEO David Burritt maintains that the company lacks the resources for necessary investments in US facilities. Nippon Steel had offered concessions, including retaining US citizens in key management roles and granting the US government veto power over production cuts. In contrast, Cleveland-Cliffs, an American competitor, offered a lower bid of $7.3 billion.

Legal Battles Loom: a Fight for the Future of US Steel

In a last-ditch effort to salvage the deal, US Steel and Nippon Steel have launched three lawsuits.Notably, David McCall, president of the United Steelworkers union, has been personally summoned in the legal proceedings, highlighting the far-reaching consequences of this battle.

Interview with dr. Emily Carter: unpacking the Fallout

Archyde News Editor: Good afternoon, dr. Carter. Thank you for joining us today to discuss this complex situation surrounding Nippon Steel and US Steel. President Biden’s decision to block the $15 billion acquisition has undoubtedly ignited fierce debate.What are your thoughts on Nippon Steel’s determination to push forward despite this setback?

Dr. Emily Carter: Thank you for having me. This is indeed a compelling and intricate situation. Nippon Steel’s unwavering commitment reflects the immense strategic importance of this acquisition for them.

nippon Steel’s Bid for U.S. Steel: A Battle Over Steel and Sovereignty

The proposed merger of Nippon Steel and U.S.Steel has sent shockwaves through the global steel industry and ignited a fierce debate about national security, economic protectionism, and the future of American manufacturing.

Nippon Steel’s Ambitions and the USW’s Concerns

For Nippon Steel, this acquisition represents much more than just expanding its global footprint. CEO Eiji Hashimoto has made it clear: there’s “no reason or need to give up” on this deal. The acquisition would bolster Nippon Steel’s position in the crucial U.S. market, a hub for industrial production.

However, the United Steelworkers (USW) union has emerged as a staunch opponent, raising concerns about potential job losses, changes in labor practices, and the implications of foreign ownership in a historically American industry. “The USW’s opposition is a major factor,” explains Dr. emily Carter, an expert on the steel industry. “Unions play a crucial role in protecting workers’ rights and ensuring job security, especially in industries like steel, which have faced significant challenges over the years.”

While Nippon Steel has pledged to honor existing labor agreements, the union’s skepticism is understandable. Their opposition has undoubtedly influenced the political landscape, contributing to President Biden’s decision to block the deal.

Geopolitics at play: Steel, Sovereignty, and Reshoring

The US government has a long history of caution when it comes to foreign acquisitions of domestic companies, especially in strategic industries like steel.“this decision likely reflects concerns about maintaining control over a critical industry, especially in an era of heightened geopolitical tensions,” Dr. Carter says.

Steel is more than just a commodity; it’s basic to national infrastructure and defense.The US might potentially be wary of ceding control of such a vital sector to a foreign entity, even a trusted ally like Japan. This decision also aligns with the Biden management’s broader focus on reshoring critical industries and bolstering domestic manufacturing.

Legal Battle with Global Repercussions

Undeterred, Nippon Steel and U.S. Steel have filed a lawsuit against the US government, demonstrating their determination to see the deal through. The legal battle could have significant ramifications for the global steel industry.

“If the courts rule in favor of Nippon Steel, it could set a precedent for future foreign acquisitions in the US, possibly easing restrictions on international mergers and acquisitions,” Dr. Carter notes. “On the other hand, if the government’s decision is upheld, it could reinforce the current trend of protectionism and make it more difficult for foreign companies to acquire US assets in strategic industries. Either way,the outcome will have ripple effects across the global steel industry.”

The Future of Steel: Consolidation or Geopolitical Gridlock?

The recent collapse of a major cross-border steel merger has sent ripples through the global industry, raising questions about its future trajectory. Dr. Emily Carter, a leading expert in international trade and industry dynamics, sheds light on the complex forces at play.

A Crossroads for the Industry

“the global steel industry is at a crossroads,” explains Dr. Carter. “On the one hand, consolidation makes strong business sense. It allows companies to achieve economies of scale, reduce costs, and compete more effectively in a highly competitive market.”

However,she points out,geopolitical tensions and national security concerns are complicating the landscape.”These factors are making cross-border mergers increasingly challenging,” Dr. Carter says. “We’ll likely see a continued push for consolidation, but it will be tempered by regulatory scrutiny and political considerations.”

Navigating a Complex Landscape

Dr.Carter emphasizes that companies will need to carefully navigate these complexities. “They must balance their strategic goals with the realities of the current geopolitical environment,” she cautions.

“It’s a pivotal moment for the industry,” dr.Carter concludes. “I look forward to seeing how it unfolds in the coming months.”

Whether the steel industry will ultimately embrace further consolidation or remain fragmented due to geopolitical pressures remains to be seen. One thing is certain: the stakes are high, and the outcome will have far-reaching implications for the global economy.

What are teh potential economic ramifications ofPresident Biden’s decision to block Nippon SteelS bid for U.S.steel?

Interview with Dr. Emily Carter: Unpacking the Fallout of Nippon Steel’s Bid for U.S. Steel

Archyde News editor: Good afternoon, Dr. Carter. Thank you for joining us today to discuss this complex situation surrounding Nippon steel and U.S. Steel. President biden’s decision to block the $15 billion acquisition has undoubtedly ignited fierce debate. What are your thoughts on Nippon Steel’s determination to push forward despite this setback?

Dr. Emily Carter: Thank you for having me. This is indeed a compelling and intricate situation. Nippon Steel’s unwavering commitment reflects the immense strategic importance of this acquisition for them. The U.S. market is a critical hub for industrial production, and securing a strong foothold here would significantly enhance Nippon Steel’s global competitiveness. Despite the setback, their determination underscores their long-term vision and the high stakes involved in this deal.

Archyde News Editor: The United Steelworkers (USW) union has been a vocal opponent of this merger. How meaningful is their role in shaping the outcome of this deal?

Dr. Emily Carter: The USW’s opposition is a major factor in this saga.Unions play a crucial role in protecting workers’ rights and ensuring job security, especially in industries like steel, which have faced significant challenges over the years. While Nippon Steel has pledged to honor existing labor agreements, the union’s skepticism is understandable. Their concerns about potential job losses, changes in labor practices, and the implications of foreign ownership in a historically American industry have resonated deeply, influencing both public opinion and political decisions.

Archyde News Editor: President Biden cited national security concerns as the reason for blocking the deal. How valid are these concerns, and what role does geopolitics play in this decision?

Dr. Emily Carter: The U.S. government has a long history of caution when it comes to foreign acquisitions of domestic companies, especially in strategic industries like steel.The committee on Foreign Investment in the United States (CFIUS) advised against the acquisition, arguing that placing a major steel producer under foreign control could threaten critical supply chains. While Nippon Steel is a trusted ally, the broader geopolitical context—particularly the U.S.’s focus on reshoring critical industries and reducing reliance on foreign entities—likely influenced this decision.

Archyde News Editor: Nippon Steel has offered concessions, including retaining U.S. citizens in key management roles and granting the U.S. government veto power over production cuts. Do you think these measures could have swayed the decision?

Dr. Emily Carter: These concessions were significant and demonstrated Nippon Steel’s willingness to address U.S. concerns. however,the political and economic landscape is complex.The Biden administration’s decision appears to be influenced by a combination of national security considerations, union opposition, and the broader push for economic sovereignty. While the concessions were a step in the right direction, they may not have been enough to overcome these multifaceted challenges.

Archyde News Editor: What does this decision mean for the future of U.S. Steel and the global steel industry?

Dr. Emily Carter: This decision leaves U.S. Steel in a precarious position. The company has acknowledged that it lacks the resources for necessary investments in it’s facilities,and without a strong partner,its ability to compete globally could be compromised. For the global steel industry,this decision highlights the growing tensions between globalization and economic nationalism. It also underscores the challenges faced by companies trying to navigate an increasingly complex geopolitical surroundings.

Archyde News Editor: what are the potential legal and economic ramifications of this decision, especially given the lawsuits filed by nippon Steel and U.S. Steel?

Dr. Emily Carter: The legal battles are likely to be protracted and contentious. Nippon Steel and U.S. Steel are challenging the decision on multiple fronts, arguing that it is politically motivated and lacks a solid legal foundation. The outcome of these lawsuits could set a precedent for future foreign acquisitions in strategic industries. Economically, this decision could deter foreign investment in the U.S., particularly from allies like Japan, who may view this as a signal that their investments are not welcome.

Archyde News Editor: thank you, Dr. Carter, for your insightful analysis. This is undoubtedly a pivotal moment for the steel industry, and your expertise has shed light on the many layers of this complex issue.

Dr. Emily Carter: Thank you for having me. It’s a fascinating case study in the intersection of economics, politics, and global trade, and I look forward to seeing how it unfolds.

—

This interview provides a extensive analysis of the Nippon Steel-U.S. Steel saga, offering expert insights into the geopolitical, economic, and legal dimensions of this high-stakes deal.