Geopolitical risks drive market hedging demand,DollarIt rose strongly once morest a basket of major currencies on Friday (11th). U.S. national security adviser Jake Sullivan has warned that Russia might invade Ukraine at any time, including during the Winter Olympics. U.S. citizens still in Ukraine should leave within the next 24 to 48 hours.

trackDollarICE once morest six major currencies DollarThe index (DXY) rose 0.219%, back above 96, closing the week higher for the week.

EUR once morestDollarDepreciated 0.71% to 1.1346 Dollar.European Central Bank (ECB) President Christine Lagarde said in an earlier interview that raising interest rates cannot be suppressed nowEURRecord inflation in the region will only hurt the economy.

Bipan Rai, head of foreign exchange strategy at CIBC Capital Markets, said that Sullivan’s speech directly led to theDollarappreciation, coupled with U.S. Treasuries andJapanese YenWaiting for safe-haven assets to rise, indicating that the market is increasingly worried regarding the possibility of a Russian invasion, “This is definitely a safe-haven trend.”

Before Sullivan’s speech, U.S. President Joe Biden held a secret video conference with leaders across the Atlantic in the White House Situation Room, hoping that allies would unite as the situation worsened.

Sullivan said it was unclear whether Russian President Vladimir Putin actually gave the order to launch the invasion, and Biden was expected to speak to Putin regarding the crisis soon.

Investors are also digesting the latest consumer confidence data. The University of Michigan’s consumer confidence index unexpectedly fell to an 11-year low in February, as consumers expect inflation to continue to rise in the short term.

Erik Nelson, currency strategist at Wells Fargo Securities, said the market’s various speculations regarding the prospect of U.S. interest rate hikes have made theDollarThe trend this week is crazy, and the future trend of the foreign exchange market is difficult to judge.”I think it’s going to be a consolidation in the short term, maybeEURslide down,DollarGains once morest most currencies. “

GBPSupported by interest rate hike expectations, the uptrend continued,GBP once morestDollarIt rose 0.2% to 1.3577 on Friday Dollar, the weekly line closed in the red for the second consecutive week. Market expectations are that the Bank of England (BOE) will raise interest rates by another 150 basis points by the end of the year.

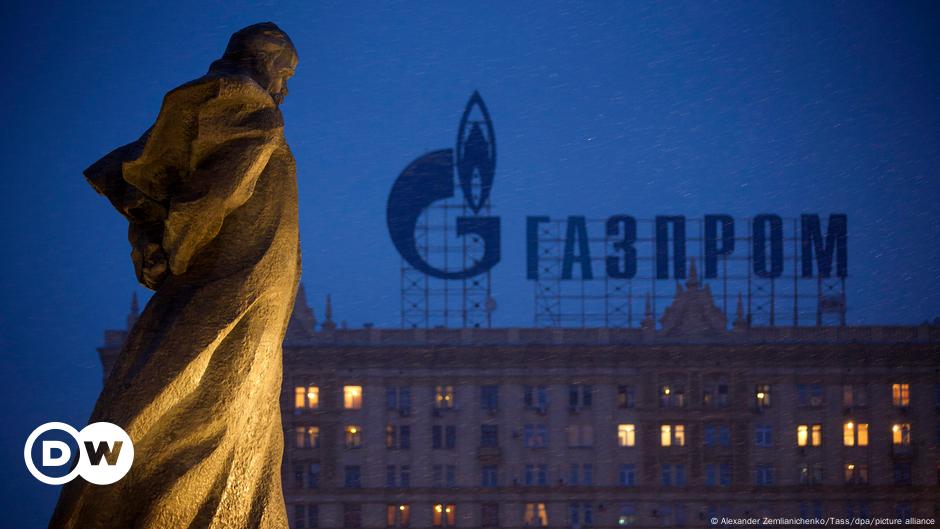

Russia’s ruble tumbled 2.9 percent to 77.2 rubles to 1 on Friday Dollaris expected to record the worst decline since the outbreak of the epidemic in March 2020.

As of Saturday (12th) around 6:00 Taiwan time Price: