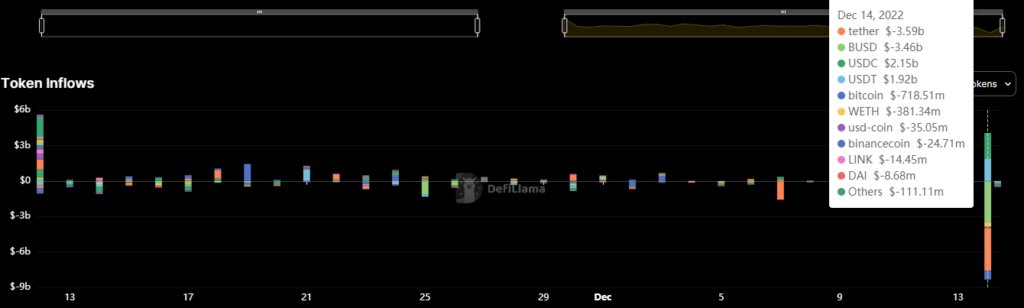

More than $7 billion worth of stablecoins were withdrawn from the largest crypto exchange Binance in 24 hours. The influx of “stable coins” during the same time amounted to regarding $4 billion.

USDT, BUSD and USDC are in the highest demand.

This is the largest outflow of coins since June, Nansen analysts emphasized.

Binance has had the highest daily withdrawals since June, with over $2B* in net outflows since Dec 12

*ETH & ERC20 tokens only pic.twitter.com/xZNdZxRCVy

— Nansen ???? (@nansen_ai) December 13, 2022

The head of the exchange, Changpeng Zhao, stressed that once morest the backdrop of the May the Terra collapse the volume of outgoing funds was even greater, and now “deposits are returning.”

Things seem to have stabilized. Yesterday was not the highest withdrawals we processed, not even top 5. We processed more during LUNA or FTX crashes. Now deposits are coming back in. ????♂️???? https://t.co/WLK2KyCym0

— CZ ???? Binance (@cz_binance) December 14, 2022

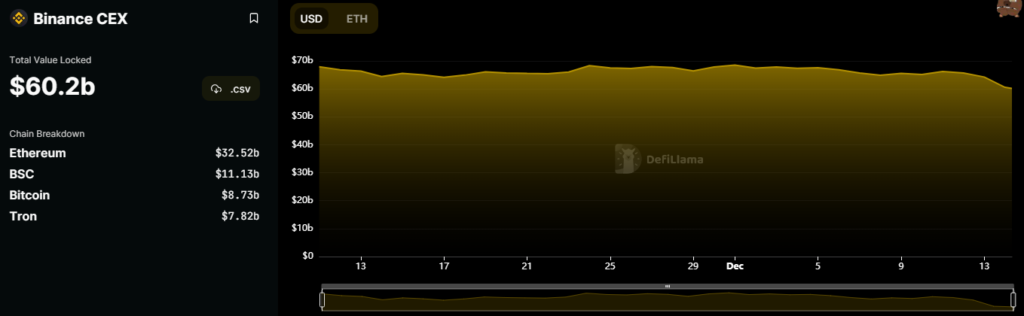

According to DeFi Llama, the total value of coins at Binance’s disposal exceeds $60 billion. Ethereum dominates the asset structure with $32.5 billion (54%).

“The withdrawal of funds from the exchange is increasing due to the growing uncertainty regarding its reserve report,” — shared their opinion Nansen researchers speaking to Archyde.com.

Recall, on December 13, Binance will not be for long closed the possibility of withdrawing funds in the stablecoin USD Coin (USDC).

December 11 stock exchange suspended withdrawals for a number of assets and restricted the accounts of some users due to “anomalous price movements in certain trading pairs.”

Experts previously interviewed by the WSJ raised warning signs in the Mazars report on Binance bitcoin reserves.

Read ForkLog bitcoin news in our Telegram – Cryptocurrency news, courses and analytics.

Found a mistake in the text? Select it and press CTRL+ENTER