FRANKFURT, Germany.— This Tuesday, the day within the principal European inventory exchanges ended with earnings, highlighting the closing of the Milan Inventory Change which rose 1.90%, whereas the euro rose to 1.0697 {dollars}.

The euro rises to 1.0697 {dollars}

The euro rose to $1.0697 following eurozone enterprise exercise rose in April for the second consecutive month following 9 months of “fixed decline.”

The one foreign money was exchanged at $1.0697 round 3:00 p.m. GMT this Tuesday, in comparison with $1.0645 on the final buying and selling hours on Monday.

For his half, the European Central Financial institution (ECB) set the change charge at 1.0674 {dollars}.

In the course of the day it was realized that enterprise exercise within the euro zone elevated for the second consecutive month in April following 9 months of “fixed decline”, though the enlargement was “modest” and was “nicely beneath” the tempo noticed for these dates a 12 months in the past.

That is mirrored within the advance of the PMI exercise index within the HCOB eurozone, ready by S&P World, which stood at 51.4 factors in April, its highest in eleven months, 1.1 factors larger than March and above the 50 that separate the contraction development.

The one foreign money was exchanged right this moment in a fluctuation band between 1.0640 and 1.0709 {dollars}.

Milan rises 1.90%

The Milan Inventory Change closed right this moment larger and its selective index FTSE MIB It superior 1.90%, to 34,363 factors, following the relative cooling of tensions within the Center East and following this Monday’s dividend distribution negatively affected the market.

For its half, the overall index FTSE Italia All-Share It grew by 0.54%, as much as 36,496.29 integers.

In the course of the session, 1,130 million shares modified fingers for a price of three,245 million euros.

After the distribution of dividends penalized the Milan market yesterday, Monday, the principle selective indices closed positively following the progressive calm within the geopolitical tensions that has been occurring since this weekend, particularly within the Center East, following a extra tense state of affairs .

Banking recorded the largest will increase of the day, with Banco Popolare of Milano (3.80%), Unicredit (3.52%) and Banca Popolare of Emilia Romagna as the principle beneficiaries, in addition to the renewables firm A2A (3.74%) and the car large Ferrari (3.14%), amongst others.

On the unfavorable facet, solely the multinational metallurgical firm Tenaris noticed the worth of its shares diminished, with a drop of 0.74%.

The Spanish inventory market rises 1.7%

The Spanish inventory market rose 1.7% this Tuesday to recuperate the 11,000 factors, which it had misplaced firstly of April.

He IBEX 35the principle selective of the Spanish inventory market, rose 185.2 factors, that’s 1.7%, the biggest improve since November 14, 2023, to 11,075.4 factors and within the 12 months it accumulates an increase of 9.63%.

The Spanish sq. started the session with progress, which accelerated round an hour following the beginning, which led it to exceed 11,000 factors, which it had misplaced firstly of April.

All the large shares closed in inexperienced. Inditex rose 3.09% (third highest improve on the IBEX); BBVA, 2.21%; Santander, 1.72%; Telefónica, 1.1%; Repsol, 1.07% and Iberdrola, 0.79%.

The DAX 40 rises 1.55%

The primary selective of the Frankfurt Inventory Change, the DAX 40rose 1.55% this Tuesday and has recovered 18,000 factors.

The DAX 40 closed the session at 18,137.65 factors, whereas the TecDAX expertise index superior 2.17%, to three,286.91 factors.

The German public sale flooring started with advances, which have accelerated following the constructive opening of Wall Road, in a day that has been marked by the presentation of the monetary outcomes for the primary quarter of 2024.

On this sense, the German software program firm SAP confirmed yesterday on the shut of the market that between January and March it misplaced 824 million euros, in comparison with the constructive results of 509 million a 12 months earlier than, whereas its revenue elevated by 8%. year-on-year, as much as 8,041 million.

These knowledge have led the corporate to guide the day, following rising 5.27%, solely behind the pharmaceutical provider Sartorius, which has superior 6.77%, whereas the pharmaceutical firm Merck has elevated its worth by 4.47%.

Within the case of those two listed corporations, they’ve benefited from the figures of the American group of the identical department Danaher, which have positively dragged down the remainder of the businesses within the sector.

Then once more, the manufacturing firm Henkel has led the falls, following shedding 2.54%, whereas the chemical firm Symrise has misplaced 0.62% and the power firm RWE has misplaced 0.44%.

Along with the enterprise knowledge, in the course of the session it was identified that the HCOB PMI exercise index within the eurozone, ready by S&P World, stood at 51.4 factors in April, its highest in eleven months, 1.1 factors larger than March and above the 50 that separate development from contraction.

Due to this fact, enterprise exercise within the euro zone elevated for the second consecutive month in April, following 9 months of “fixed decline,” whereas, in the USA, this similar index fell 1.2 factors in comparison with March, reaching 50.9 factors. .

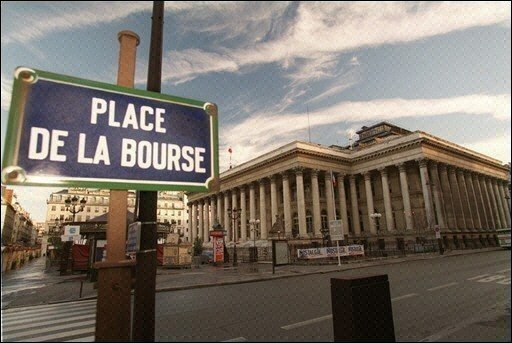

CAC-40 improves 0.81%

He CAC-40the principle index of the Paris Inventory Changeclosed with an increase of 0.81%, pushed by the development of Wall Road and the optimism of buyers within the face of some good indicators within the euro zone.

The Parisian buying and selling flooring closed at 8,105.78 factors, with 35 values in inexperienced and 5 in purple.

Non-public sector exercise within the euro zone and the index that measures providers and business, additionally within the euro zone, have produced higher than anticipated outcomes.

The resort firm Accor and the promoting firm Publicis led the enhancements with 2.76% and a pair of.50%, respectively, adopted by the power supervisor Schneider Electrical (+2.22%).

Among the many few values in purple, the metal firm ArcelorMittal stood out, which contracted 2.74%.

The London Inventory Change rose 0.26%

The London Inventory Change marked a brand new closing report by rising 0.26% or 20.94 factors to eight,044.81 factors, pushed by the power of the greenback, which advantages corporations that invoice in that foreign money, and the discount of tensions within the Center East.

The closing determine of the principle London index FTSE-100 It surpassed the utmost reached on Monday, of 8,023.87 items, which in flip broke the earlier mark registered in February 2023.

Throughout this Tuesday’s session, the one referred to as ‘footsie’ -which brings collectively the primary hundred corporations within the United Kingdom- additionally registered an intraday report, momentarily standing at 8,074.69 integers.

Traders within the London market are betting that the Financial institution of England will minimize rates of interest at its assembly on Could 9, from the present 5.25%, given the downward pattern in British inflation, at present at 3.2%.

Additionally driving up the Metropolis’s selective is the notion that tensions between Israel and Iran have been comparatively diminished following a number of mutual assaults in current days.

Among the many winners in London have been a number of corporations within the retail sector, similar to Related British Meals, which added 8.98%, the net grocery store group Ocado, which superior 5.41%, and JD Sports activities Style, which rose 3.76%.

Nevertheless, a number of mining corporations misplaced floor because of the fall within the worth of uncooked supplies, together with Anglo American, which fell 2.27%, Antofagasta, which fell 2.09%, and Fresnillo, which ended up 1.45% decrease.

You may also have an interest: “Claims to banks in Mexico are on the rise”

Associated information

#Most important #European #inventory #markets #shut #beneficial properties #euro #advances #greenback

2024-05-22 17:37:43