The specialization of the economic measures announced by Kyriakos Mitsotakis at the 87th Executive Exhibition of Thessaloniki is the subject of the interview of the Ministry of Finance. Present at it are the Minister of National Economy and Finance Kostis Hatzidakis and the Deputy Ministers Haris Theocharis and Thanos Petralias.

We are trying to work seriously and systematically both before and after the elections and we are getting results, Kostis Hatzidakis stressed, announcing the four axes in which the Ministry of Finance will move in the next period.

1. Banking system

A robust banking system that will provide liquidity to households with intense competition

2. Tackling tax evasion

Armed with new technologies and limiting the use of cash

3. Income support

We give what we have and not what we don’t have by staying true to the target of a primary surplus of 0.7%

4. Initiatives on a more permanent basis of the consequences of climate disasters

For the banks, the Minister of Finance said that the effort in the next two months and three months will move along 5 axes:

Talking about competition for us is importance the extension of loans also from non-banking institutions as provided on a limited scale. We will expand it and this feature will also cover other categories such as mortgages. It is happening internationally, it is not our patent, there is interest and I believe it will affect the whole scene to some extent

The second is the implementation of the Hercules program for issues that are on the table and also concern the systemic banks and the 5th Pillar that we want to support. Respecting principles and rules of course

Third, in a bill that will soon come to the cabinet, rules of transparency and obligations for servicers will be established in compliance with a relevant European directive. They have an obligation to operate with transparency and rules that will respect the borrowers’ need for information. They need to know what the balance is, what the state of affairs in their relationships is. In this context, penalties will be imposed on servicers if they do not obey the rules

Fourth, we embrace the IRIS service for cashless transactions up to 500 euros without commission. We will extend their use to freelancers as well

Fifth, the process of reducing the HFSF in the banking system began and we think it will strengthen it as well as the image of the country from an investment point of view.

Haris Theocharis

Table of Contents

The Deputy Minister of National Economy Haris Theocharis presented 10 measures to combat tax evasion explaining that the primary reason is not revenue but social justice because anyone who evades taxes puts the burden on the rest of his fellow citizens.

1. Completion of the interface of cash registers with POS in the first months of 2024

2. Mandatory use of electronic invoicing in 2024

3. The completion of the MyData process.

4. Mandatory possession of an electronic payment system (POS and IRIS) also by the rest of the retail sectors

5. Obligation to buy and sell real estate only through a bank transaction and not with third parties

6. Activation of the digital shipping slip, piloting in the first months

7. The increase in the fine for the use of cash over 500 euros. The penalty will be double the transaction that is not allowed

8. The payment of welfare allowances through debit cards so that these funds are utilized by recorded transactions

9. Ban on smuggling offenses with all fuel trading companies.

10. Interventions for short-term leases

For interfacing POS with cash registers the goal is to not even have the possibility to make the payment without cutting the receipt and finally even the pre-filling of the declarations is done with reduced paperwork. It concerns 450,000 businesses that are required by law to have a cash register.

For electronic invoices Mr. Theoharis said that AADE has started discussions with the European Commission to get the approvals – a process that takes about 6 months – and in any case we will proceed with the establishment of mandatory ones because now we have simple incentives. This practically sends all the data to MyData as well.

First from the VAT declarations and then from the income declarations, one cannot declare income or expenses that are not in Mydata. In practice, he will be able to declare more income or less expenses, data that lead to a higher tax.

For buying and selling real estate without cash we had 42,613 cash-only transfers at a price of €462 million and we have as many cases where the price was partially paid in cash totaling €3 billion. The aim is to make it more difficult to use “black money”. We must also make it difficult for the one who will use this money.

To activate the digital consignment note, we want to enable it without the red tape it used to have. Here is a project in progress by AADE that will allow real-time control without any extensive red tape.

For short-term leases the interventions are the inclusion of VAT and the tax of vagrants. A special CAD will be made. There will be a resident tax on all rentals. The goal of the measures we are taking is to direct someone to these leases and to increase the stock of this type of lease or to make the industry more professional because we recognize that it is part of the tourism product.

The goal of the measures we are taking is to direct someone to these leases and to increase the stock of this type of lease or to make the industry more professional because we recognize that it is part of the tourism product.

Thanos Petralias

Pensions are increasing again from January 1, 2024. At the moment they are estimated at just over 3% at a cost of 400 million euros per year

For 750,000 pensioners with a pension of up to 1,600 euros and a personal difference of more than 10 euros, 100 to 200 euros will be given at the end of December. Cost 107 million euros. This covers 750,000 of the 850,000

From December, the Minimum Guaranteed Income increases by 8% for 225,000 beneficiaries at a cost of 41 million euros

The refund of the excise duty on agricultural oil is progressing

For the heating allowance it will fluctuate at the same levels as 350 euros multiplied by degree days. The limit for families with children is increased to 5,000 euros for each child, a double subsidy does not apply for those who consume oil or LPG for the first time instead of natural gas, for natural persons practicing with a business activity, a turnover limit of up to 80,000 euros per year is set in addition to the income . 237 million euros this year, of which 189 million for 2023 and 48 million euros for 2024

An air rescue program is established with 6 helicopter bases at a cost of 25 million euros

As it was in the pre-election program, the maternity allowance for freelancers and farmers is being increased to 9 months to the level of the minimum wage of 150-200 euros they received

From 1/1/2024 the capital accumulation tax is reduced to 0.2%

For 300 pilots and crews of firefighting aircraft, the flying allowance increases by 2,000

The market pass is extended to Thessaly, Evros, Boeotia and Fthiotida for areas affected by natural disasters and is doubled. 280,000 households with 740,000 members benefit at a cost of 35 million euros

The three-year period is unfrozen from January 1, 2024

The 30% reduction in pensions of those pensioners who work is abolished in exchange for a contribution of 10% on additional remuneration for work

The total costs of the new interventions amount to 411 million in 2023 and 623 million euros for 2024 and are beyond natural disasters

For natural disasters

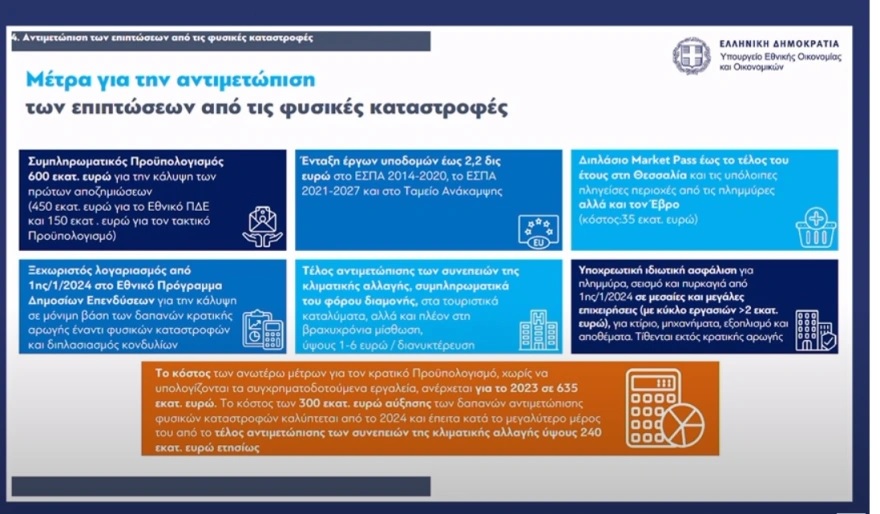

An additional budget of EUR 600 million is submitted to cover the first compensations (EUR 450 for the national public investment program and EUR 150 million for the regular budget)

Inclusion of infrastructure projects up to 2.2 billion euros in the NSRF 2014-2020, the NSRF 2021-2027 and the Recovery Fund

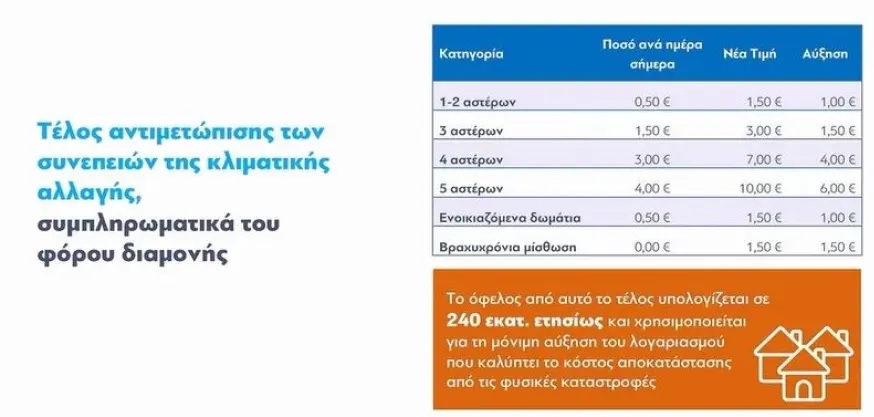

An environmental protection fee is imposed in addition to the accommodation tax in tourist accommodation as well as in short-term rentals. 1 euro per night in 2 stars and rooms for rent and up to 6 euros for five stars

Mandatory private insurance for flood, earthquake and fire from 1/1/2024 for medium and large enterprises with a turnover of more than 2 million euros for building machinery, equipment and stocks. They are excluded from state aid.

#Ministry #Finance #measures #boost #income #moves #tax #evasion

Tax evasion, boosting income support, and addressing climate disasters.

Greek Economy: Kyriakos Mitsotakis Announces Specialization of Economic Measures at 87th Thessaloniki Executive Exhibition

The Greek Ministry of Finance has unveiled its plans to tackle the country’s economic challenges, with a focus on four key areas: banking system, tax evasion, income support, and initiatives to address the consequences of climate disasters. Minister of National Economy and Finance, Kostis Hatzidakis, presented the comprehensive strategy alongside Deputy Ministers Haris Theocharis and Thanos Petralias.

Strengthening the Banking System

The government aims to create a robust banking system that provides liquidity to households with intense competition. To achieve this, the Ministry of Finance will focus on five key axes:

- Extension of Loans from Non-Banking Institutions: The government will expand the provision of loans from non-banking institutions, including mortgages, to increase competition in the banking sector.

- Implementation of the Hercules Program: The Hercules program will address bad debt and support systemic banks, while also implementing the 5th Pillar.

- Transparency and Obligations for Servicers: A new bill will establish rules of transparency and obligations for servicers, ensuring they operate with transparency and respect borrowers’ need for information.

- Expansion of IRIS Service: The IRIS service for cashless transactions up to 500 euros without commission will be extended to freelancers as well.

- Reducing HFSF in the Banking System: The process of reducing the Hellenic Financial Stability Fund (HFSF) in the banking system has begun, aiming to strengthen the banking system and improve the country’s investment image.

Combatting Tax Evasion

Deputy Minister of National Economy, Haris Theocharis, presented 10 measures to combat tax evasion, emphasizing that the primary goal is social justice, as those who evade taxes put an unfair burden on fellow citizens. The measures include:

- Completion of the Interface of Cash Registers with POS: The interface will be completed in the first months of 2024, ensuring that all transactions are recorded and tracked.

- Mandatory Use of Electronic Invoicing: Electronic invoicing will become mandatory in 2024, reducing the opportunities for tax evasion.

- MyData Process Completion: The MyData process will be completed, allowing for the integration of all taxpayer data and ensuring that all transactions are recorded and tracked.

- Mandatory Possession of POS: All retail sectors will be required to have an electronic payment system, including POS and IRIS.

- Ban on Cash Transactions for Real Estate: All real estate transactions must be conducted through banks, eliminating the use of cash and reducing the risk of tax evasion.

- Digital Shipping Slip: A digital shipping slip will be activated, piloting in the first months, to track and monitor goods transportation.

- Increased Fines for Cash Transactions: Fines for using cash for transactions over 500 euros will be doubled, discouraging the use of cash for large transactions.

- Payment of Welfare Allowances through Debit Cards: Welfare allowances will be paid through debit cards, ensuring that the funds are utilized through recorded transactions.

- Ban on Smuggling Offenses: Fuel trading companies will be banned from smuggling offenses, reducing tax evasion in the fuel sector.

- Interventions for Short-Term Leases: Measures will be introduced to combat tax evasion in short-term leases.

Boosting Income Support

The government aims to provide income support while maintaining a primary surplus of 0.7%. The Minister of Finance emphasized that the government will provide what it has, rather than what it doesn’t have, ensuring a sustainable and responsible approach to income support.

Addressing Climate Disasters

The government will introduce initiatives to address the consequences of climate disasters, aiming to mitigate the impact of natural disasters on the economy and the environment.

the Greek Ministry of Finance has outlined a comprehensive strategy to address the country’s economic challenges, focusing on strengthening the banking system, combatting