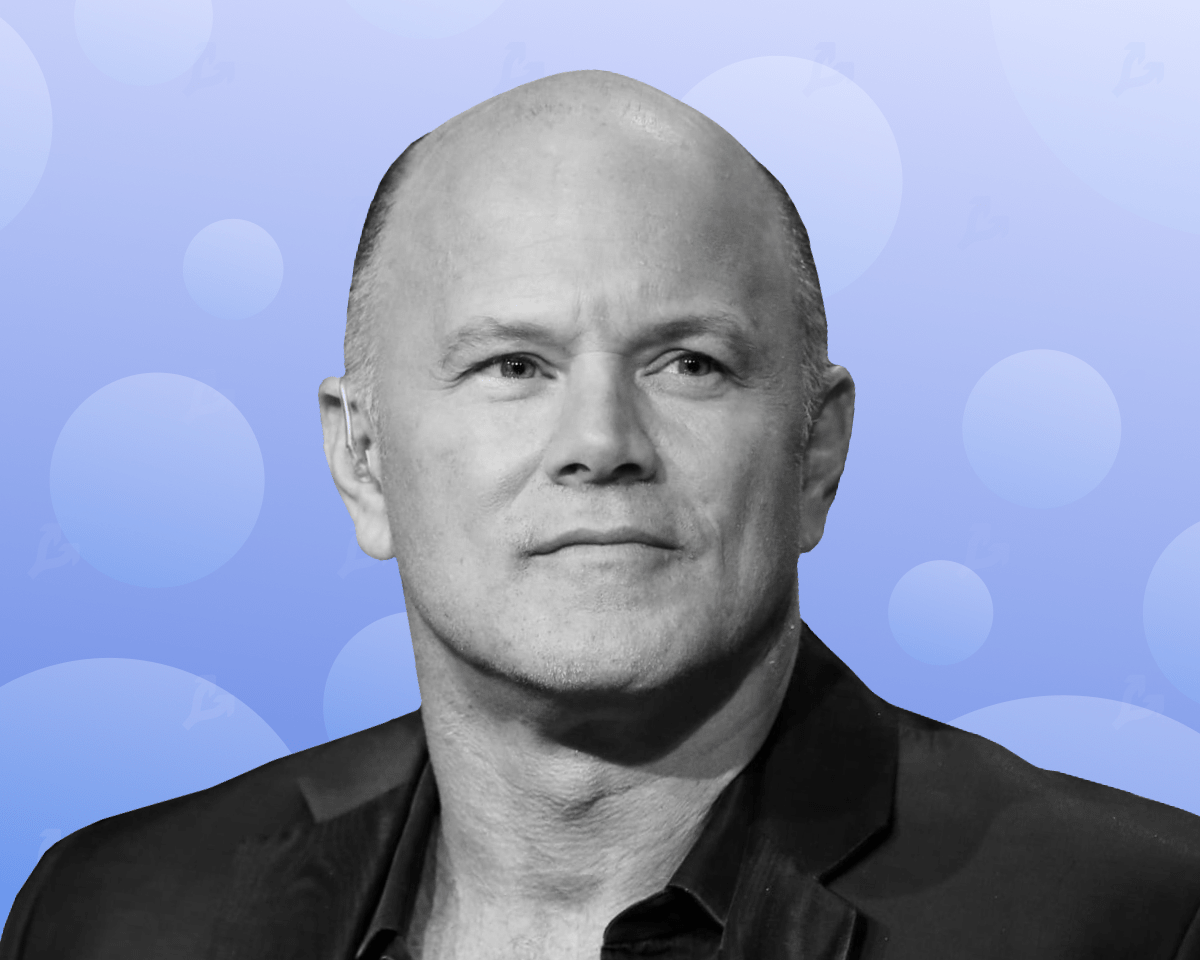

Founder of Galaxy Digital Mike Novogratz criticized Sam Bankman-Fried (SBF) following his recent media comments regarding the collapse of FTX.

“It was delusional. Let’s be really clear. Sam was delusional regarding what happened and his culpability in it,” says @novogratz. “He needs to be prosecuted. He will spend time in jail. And it wasn’t just Sam. You don’t pull this off with one person.” pic.twitter.com/0SSh1r8XIL

— Squawk Box (@SquawkCNBC) December 1, 2022

“It was nonsense. Let’s be clear. Sam raved regarding what had happened and his own fault for it. He needs to be held accountable,” Novogratz told Squawk Box host Andrew Sorkin.

The founder of Galaxy Digital was surprised that lawyers “allow [Бэнкману-Фриду] talk”. In his opinion, the former head of FTX and his associates “perpetuated fraud” and should be in jail.

Previously SBF interviewed by Tiffany Fong declaredthat the exchange’s utility token (FTT) “had real value” and its collapse was caused by the actions of investors. He also denied the information that he allegedly used a backdoor in the FTX system, which allowed him to transfer assets to Alameda Research accounts.

On December 1, the founder of the platform ruled out the misuse of customer funds.

In an interview with IBC Group founder Mario Naufal, SBF said he did not know regarding what was happening in his companies. Community members expressed dissatisfaction with his answers and behavior during the interview.

@SBF_FTX why’s your voice continually straying form the mic while no other speaker’s are?

Who’re you with, who’s quietly coaching you as to what you’re responses are? What’s your distraction that you keep moving away from the mic?

How regarding we hook you up to a lie detector?

— CryptoB513 (@CryptoB513) December 1, 2022

“SBF, why are you constantly talking past the microphone, unlike other speakers? […] How regarding hooking you up to a lie detector?” one user wrote.

Kraken co-founder Jess Powell suggested that Bankman-Fried doesn’t understand how margin trading works.

SBF is completely full of shit regarding how margin trading works. He’s saying that the whole exchange operated on a net account equity model and anybody might borrow anything (in any amount?) from client funds or from nowhere. That’s not how it should work.https://t.co/3k7PkbAHVM

— Jesse Powell (@jespow) December 1, 2022

“He says the exchange operated on a net account balance model and anyone might borrow anything (any amount?) from client funds or out of nowhere. This is not how it should work,” Powell wrote.

11th of November FTX Group files for insolvency in accordance with Chapter 11 of the United States Bankruptcy Code. Bankman-Fried stepped down as CEO.

Later he expressed regret because of this decision and stated that he should have continued his efforts to find funding. John Ray, who took over as head of FTX and director of restructuring, urged not to focus on the speeches of the SBF.

Recall that on November 16 it became known that a group of American investors filed a lawsuit once morest Bankman-Fried.

A few days later, a resident of Canada applied to the court, accusing ex-CEO of the exchange, former head of Alameda Research Caroline Ellison and the NBA club Golden State Warriors in false .

According to the media, the American authorities started investigations regarding the bitcoin exchange. Texas Securities Board sent a notice to Bankman-Fried on participation in the hearing on February 2, 2023.

Read ForkLog bitcoin news in our Telegram – Cryptocurrency news, courses and analytics.

Found a mistake in the text? Select it and press CTRL+ENTER