Colombia has not been oblivious to the need to develop the housing sector, promoting access to it as an instrument for social equity. For this reason, initiatives such as Mi Casa Ya (MCY) and Frech No VIS have been launched from public policy.

But, in recent weeks, these programs have been slowed down, which has set off alerts due to the effects on the most vulnerable homes and in the building sector.

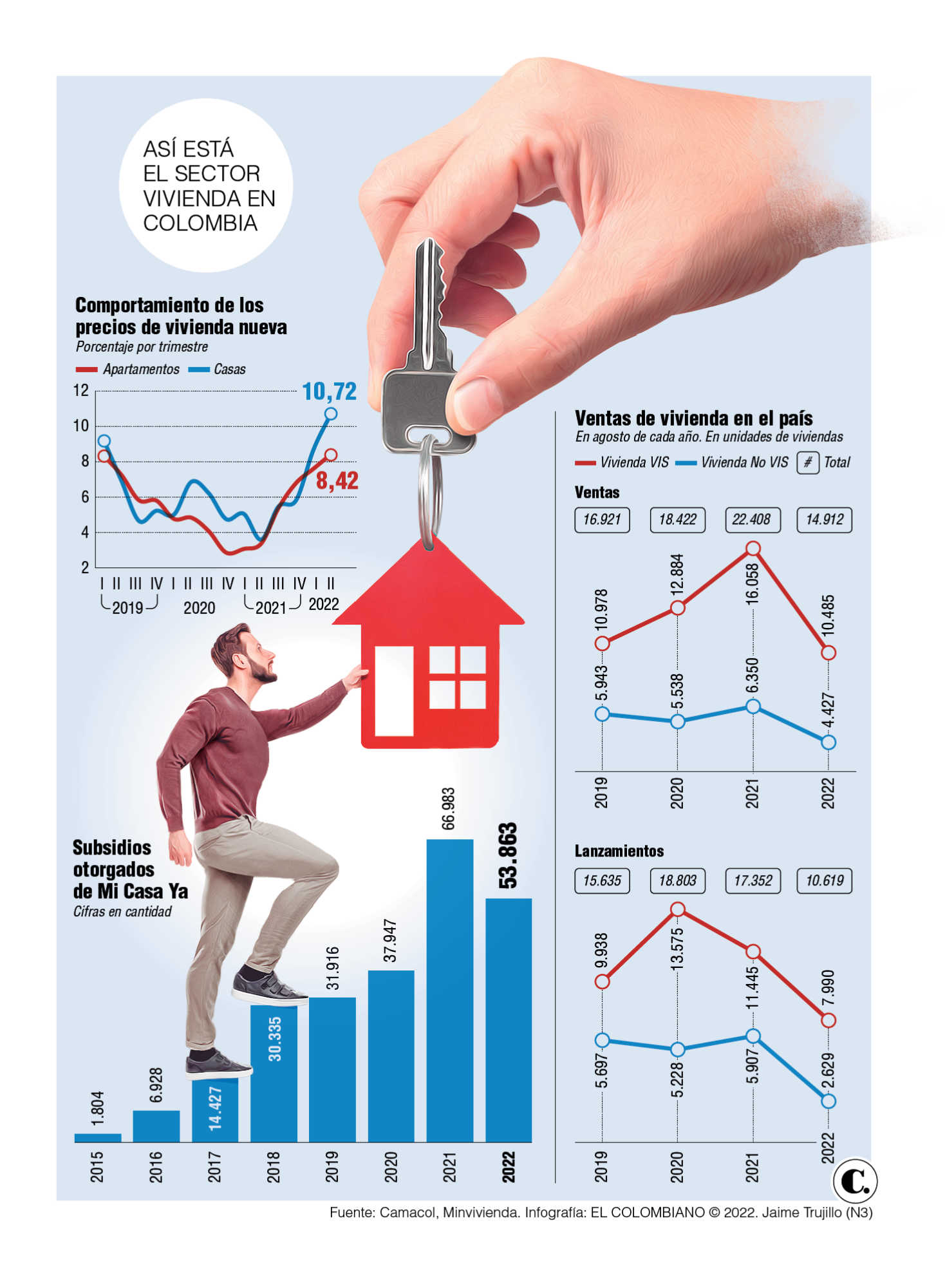

In fact, Bancolombia’s economic team anticipates that a stronger slowdown in housing sales will be observed in this fourth quarter, due to the end of housing subsidies, especially in the VIS segment, and the increase in the interest rate to 10 %.

No VIS, no more

The No VIS housing subsidies, which are those that cost more than $150 million, were created during the government of former President Iván Duque, in order to face the negative impacts of covid-19 and accelerate economic reactivation.

In this way, the Frech No VIS subsidy began to operate, as an extension of the housing policy of the then government. In 2020, 100,000 quotas were created that might be taken until December 31 of this year. The benefit provides a monthly economic aid of $500,000 for those who buy Non-VIS homes of up to $500 million in urban areas, regardless of income level or properties already acquired.

For this reason, one of the bad news that Colombians received is that this subsidy will be eliminated as of 2023.

The announcement was made by Catalina Velasco, Minister of Housing, in an interview with La W, in which she stated that what the government of President Gustavo Petro is seeking is to reach the poorest families, “taking into account that those homes of up to $400 millions are for those with high incomes… We want to direct our efforts to people who have between 0 and 1.5 minimum wages, those who live in the rural sector”. And she stressed that these subsidies had a reactivation purpose, so it is time to redirect those resources.

However, families that already have the subsidy will continue to benefit from it.

“In addition to the rise in interest rates, the high value of real estate, inflation and the strengthening of the dollar, the elimination of this subsidy is now added. The perfect storm is brewing for the No VIS segment. Properties of more than $150 million are largely acquired by the middle strata, so these families would be the most affected,” explained Juan Álvarez, a lawyer specializing in urban law.

And he added that to all this is added the decrease in supply, as this would further slow down Non-VIS housing sales for 2023: in August of this year they decreased 43% compared to the same month in 2021.

The resources of Mi Casa Ya

According to the economic studies center Anif, in recent years VIS housing subsidies have leveraged 1 out of 3 home sales in this segment, which is the market with the highest volume.

And it is that the Minister of Housing announced in recent days that the resources of the MCY program were fully committed for this term. “65,000 subsidies were granted, meeting the 2022 goal in advance. 41,800 had financing corresponding to this year and the rest were supported with future validity of the year 2023. The will is to maintain that allocation scheme,” she said.

Therefore, that portfolio and Camacol called on the construction companies that have VIS housing projects to maintain the business conditions for the beneficiaries of the subsidy.

And Asobancaria highlighted that thanks to this, 60% of Colombians can access credit and with it the possibility of acquiring their own home. In addition to the fact that, currently, 79.6% of VIS housing disbursements use this support. “Efforts must be redoubled to expand coverage to the informal, to the rural sector and promote housing improvements,” said Hernando José Gómez, president of the guild.

There are many families who invested in projects that are regarding to be delivered and for whom there seems to be no way out