Microsoft Stock: Looking for Upside Breakout After October Correction

Technical Analysis

- S1

- 400

- S2

- 385

- R1

- 441,85

- R2

- 468,35

Short term

Medium term

Long term

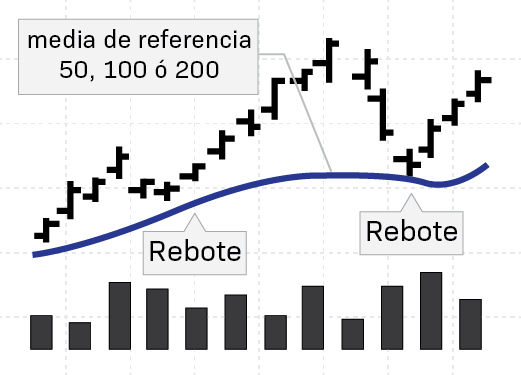

Microsoft has been consolidating around its 200-day moving average for the past few months, leaving investors wondering about its next move. While the tech giant’s main trend remains bullish, the recent correction that started in July has left some uncertainty.

A late October bearish gap has been erased in recent sessions, a promising sign for bullish investors. This effectively cancels out the negative signal from the gap, suggesting a potential shift in sentiment.

The real confirmation that the corrective phase is over will come when Microsoft overcomes the critical resistance level of $441.85.

Market watchers are laser-focused on this level.

A decisive close above $441.85 would likely signal a continuation of Microsoft’s upward trajectory. This could lead to a further push towards the previous all-time highs of $468.35 set earlier this year.

On the downside, the key support level to watch is $400.

As long as Microsoft trades above this level, there are no immediate signs of weakness. Traders will be keeping a close eye on price action, anticipating a potential breakout above resistance.

https://bolsamania.com/module/5561" width="600" height="125

What factors are contributing to a potential upside breakout for Microsoft’s stock?

## Microsoft Stock: Looking for Upside Breakout – A Short Interview

**Host:** Welcome back to the show. Today we’re taking a look at Microsoft’s stock performance following a correction in October. Joining us to discuss the technical analysis is [Guest Name], a senior market analyst at [Guest Affiliation]. [Guest Name], thanks for being here.

**Guest:** Thanks for having me.

**Host:** Let’s dive right in. As we can see from the chart [[1](https://www.zacks.com/stock/quote/MSFT)], Microsoft has been showing signs of recovery since the October dip. What are your thoughts on Microsoft’s short-term outlook?

**Guest:** Right, we see a clear rebound in the reference mean, indicating a potential upside breakout. The stock is currently testing the key resistance levels of R1 at 441.85. If it manages to break above this level, we could see continued upward momentum, possibly targeting R2 at 468.35.

**Host:** Very interesting. What are some of the factors supporting this potential breakout?

**Guest:** Several factors contribute. Microsoft’s strong fundamentals, robust cloud business performance, and continued investments in AI are all positive signals for investors. Additionally, the broader market sentiment is also improving, further supporting a bullish outlook for tech stocks like Microsoft.

**Host:** Are there any potential downside risks investors should be aware of?

**Guest:** Of course, no investment is without risk. The stock could face resistance at the R1 level, and failure to break through could lead to a pullback towards support levels like S1 at 400. Additionally, unforeseen macroeconomic events or a broader market correction could also impact Microsoft’s stock price.

**Host:** Important points to keep in mind. what’s your overall advice for investors interested in Microsoft?

**Guest:** For investors with a long-term horizon and confidence in Microsoft’s growth potential, the current price levels could present a buying opportunity. However, it’s crucial to carefully monitor the stock’s performance, understand the associated risks, and make informed investment decisions based on individual circumstances and risk tolerance.

**Host:** Thank you, [Guest Name], for sharing your valuable insights. We appreciate your time.

**Guest:** My pleasure. Thank you for having me.