MetaPlanet‘s Bold Bitcoin Bet: A Strategic Reserve or Risky Gamble?

Table of Contents

- 1. MetaPlanet’s Bold Bitcoin Bet: A Strategic Reserve or Risky Gamble?

- 2. MetaPlanet’s Bitcoin Buying Spree

- 3. The MicroStrategy Model: high risk, high Reward

- 4. BTC Bull Token: A New Breed of Bitcoin Investment?

- 5. The Bottom Line: A Cautious Approach to Crypto

- 6. What is MetaPlanet’s primary reason for holding Bitcoin, and how does this compare to MicroStrategy’s strategy?

- 7. MetaPlanet’s Bitcoin Strategy: An Interview with Crypto Analyst, Anya Sharma

- 8. Introduction

- 9. MetaPlanet’s Bitcoin Holdings: A Deep Dive

- 10. Risks and Rewards

- 11. The Japanese Yen and Bitcoin: A Strategic Alliance?

- 12. The Future of Crypto Investment

- 13. Regulatory Landscape

- 14. Concluding Thoughts

October 26, 2025

By a News Journalist

Japanese firm MetaPlanet is aggressively accumulating Bitcoin, mirroring MicroStrategy‘s strategy. But is this a sound financial move or a dangerous over-reliance on cryptocurrency?

MetaPlanet’s Bitcoin Buying Spree

Amidst market turbulence and fluctuating cryptocurrency values, one japanese company is doubling down on Bitcoin. MetaPlanet, following in the footsteps of MicroStrategy, GameStop, and even perhaps the U.S. government, is amassing a important Bitcoin reserve. The company views Bitcoin as a “store of value, such as gold,” according to their public statements.

This strategy involves treating Bitcoin as a strategic asset, similar to how the U.S. might hold gold reserves, to hedge against economic uncertainty and currency devaluation. Specifically, MetaPlanet seems to be using Bitcoin to counteract the weakening Japanese yen, which is suffering due to Japan’s continued low-interest rate policy. This mirrors concerns many Americans have about the strength of the dollar and the potential for inflation, prompting some to consider option assets like Bitcoin.

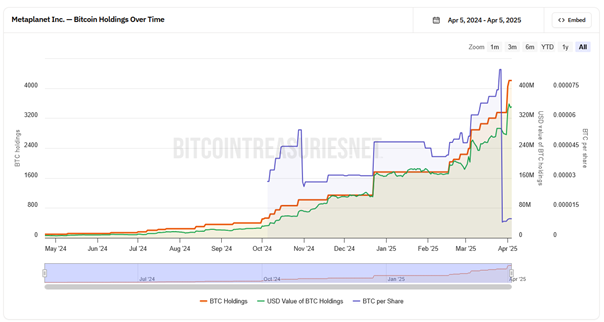

In early April 2024, MetaPlanet made a ample investment, acquiring 696 BTC. This surpassed their previous record of 619.7 BTC in December, signaling a strong commitment to their Bitcoin strategy. As of October 2025, MetaPlanet holds 4,206 BTC, valued at approximately $348.69 million. This represents a significant 33.5% of the company’s $1 billion market capitalization.

For U.S. investors, this strategy raises some captivating questions about corporate treasury management. could we see more American companies adding Bitcoin to their balance sheets as a hedge against inflation or dollar instability? The potential benefits are clear, but so are the risks.

The MicroStrategy Model: high risk, high Reward

MicroStrategy’s early adoption of Bitcoin as a treasury reserve has yielded notable results.Since their initial Bitcoin investment on August 11, 2020, their stock price has reportedly increased by 1,933%. This significantly outperforms Bitcoin’s own growth of 701% during the same period, as well as conventional assets like gold (57%) and the NASDAQ 100 (49.69%).

Though, this impressive growth comes with significant risk. MicroStrategy’s strategy involves leveraging their Bitcoin holdings through bonds, convertible notes, and equity sales. This creates a “particularly high dependence on the cryptocurrency,” with their 528,185 BTC representing 57.3% of the company’s market capitalization,valued at $43.82 billion.

This reliance on Bitcoin makes MicroStrategy’s stock price highly susceptible to cryptocurrency price swings. A sharp Bitcoin correction could have a devastating impact on the company’s value. This is amplified by the leverage they employ, creating a potentially volatile situation for investors.As one analyst put it, It’s a double-edged sword. The upside is enormous if Bitcoin continues to appreciate, but the downside is equally significant if it doesn’t.

The Securities and Exchange Commission (SEC) has also scrutinized companies with significant crypto holdings, raising concerns about valuation, disclosure, and risk management. Companies must carefully consider these regulatory implications before adopting a similar strategy.

BTC Bull Token: A New Breed of Bitcoin Investment?

the article highlights a new type of investment called BTC Bull Token. The article suggests that these tokens are designed to provide leveraged exposure to Bitcoin’s price movements, potentially offering higher returns than simply holding Bitcoin.

One of the key features of the BTC Bull Token is the Bitcoin-AirDrop mechanism. According to the article, when Bitcoin exceeds $150,000 they receive bitcoins sent to their wallets. This is repeated every time BTC rises by a further $50,000 and trained a new record.

It’s crucial to remember that these are highly speculative assets.Memecoins are known for their volatility and lack of basic value. While the potential for high returns exists, so does the risk of significant losses.

the article mentions that the presale investors may be able to get most of the advantages, which is why the project has already secured over $4.44 million. It states that the $ Btcbull will still be available for the current price of $ 0.002445 for less than 12 hours, unless the next financing goal has been reached beforehand.

The Bottom Line: A Cautious Approach to Crypto

MetaPlanet’s aggressive Bitcoin accumulation represents a bold bet on the future of cryptocurrency. While the potential for significant returns exists, it’s crucial to acknowledge the inherent risks. For U.S. investors and companies considering similar strategies, a cautious and well-informed approach is essential.

before investing in Bitcoin or related assets, carefully consider your risk tolerance, conduct thorough research, and consult with a qualified financial advisor. Diversification is key, and it’s crucial to avoid putting all your eggs in one basket, especially when that basket is as volatile as cryptocurrency.

What is MetaPlanet’s primary reason for holding Bitcoin, and how does this compare to MicroStrategy’s strategy?

MetaPlanet’s Bitcoin Strategy: An Interview with Crypto Analyst, Anya Sharma

October 27, 2025

Archyde News Editor

Introduction

Welcome to Archyde. Today, we have Anya Sharma, a leading crypto analyst, to discuss MetaPlanet’s ambitious Bitcoin strategy. Anya, thanks for joining us.

Anya Sharma: thanks for having me.

MetaPlanet’s Bitcoin Holdings: A Deep Dive

Archyde: MetaPlanet, a Japanese firm, has been aggressively accumulating Bitcoin. They currently hold over 4,200 BTC.What are your initial thoughts on this move, and how does it compare to strategies like MicroStrategy’s?

Anya Sharma: MetaPlanet’s strategy is certainly bold. Mirroring MicroStrategy, they see Bitcoin as a store of value, a hedge against economic uncertainty and specifically, the weakening Japanese Yen. The key difference is the scale and the context. MicroStrategy was an earlier adopter. MetaPlanet is joining a trend, and their actions reflect a broader shift in how companies are viewing Bitcoin, especially in regions facing currency devaluation.

Risks and Rewards

Archyde: The article highlights the impressive returns MicroStrategy has seen, yet also notes the significant risks. What are the most critical risks MetaPlanet faces, and what potential rewards do they stand to gain?

Anya Sharma: The primary risk is Bitcoin’s volatility. A sharp downturn in bitcoin’s price could significantly impact MetaPlanet’s balance sheet and, by extension, their stock price. They are using a smaller percentage of their market capitalization compared to MicroStrategy, but the risk remains considerable. The rewards? If Bitcoin appreciates, they stand to gain significantly, outperforming conventional investments, just like MicroStrategy has done. They could also gain a reputation as a forward-thinking company embracing new technologies.

The Japanese Yen and Bitcoin: A Strategic Alliance?

Archyde: The article mentions that MetaPlanet is using Bitcoin as a hedge against the weakening Japanese Yen. Can you elaborate on this strategy and its potential implications for Japan?

Anya Sharma: The weakening Yen,due to Japan’s persistent low-interest-rate policy,is a real concern. By holding Bitcoin, MetaPlanet effectively diversifies its assets. Bitcoin’s perceived value as a store of value allows the company to protect its purchasing power. If the Yen continues to decline against other currencies,MetaPlanet will have a financial advantage. It’s a strategic move, suggesting a lack of belief in the strength of the Yen, or the willingness to invest in alternative assets like Bitcoin over traditional ones.

The Future of Crypto Investment

Archyde: The article also touches on BTC Bull Tokens and other crypto-related assets. What’s your take on these types of investments, and what should investors understand before putting their money in?

Anya sharma: It’s a highly speculative area. BTC Bull Tokens, as described, involve leveraged exposure, which amplifies both potential gains and losses.Before investing in these, or any new crypto asset, thorough research is paramount, understanding the white paper, tokenomics, and the associated risks. Investors need to be aware of the incredibly high volatility. The presale advantage, while offering a head start in returns, is just another example of highly speculative activity that may lead to considerable losses.

Regulatory Landscape

Archyde: The SEC has scrutinized companies with significant crypto holdings. What regulatory hurdles should MetaPlanet and other companies be aware of?

Anya sharma: The SEC is very concerned with valuation, disclosure, and risk management. Companies must be clear about their Bitcoin holdings, how they’re valued, and the impact of price fluctuations on their financial statements. They also need to demonstrate robust risk management practices to protect investors. Non-compliance can lead to investigations and penalties.

Concluding Thoughts

Archyde: To wrap up, what advice would you give to both companies considering a similar strategy and to individual investors?

Anya Sharma: For companies, proceed cautiously. Conduct thorough due diligence, understand the risks, assess the long-term implications and consider diversification. For individual investors, never invest more than you can afford to lose. Consult with a financial advisor. Approach Bitcoin and related assets with a well-informed, cautious viewpoint as the volatility is not for the faint of heart.

Archyde: Anya, thank you for your insightful analysis.

Anya Sharma: My pleasure.