2023-05-28 17:41:43

Stratasys and Desktop Metal have been in talks for over a year to prepare for the announced merger – because that’s what it is. Stratasys CEO Yoav Zeif sees the merger as a necessary step to break through the stagnant breakthrough of 3D printing in the industry.

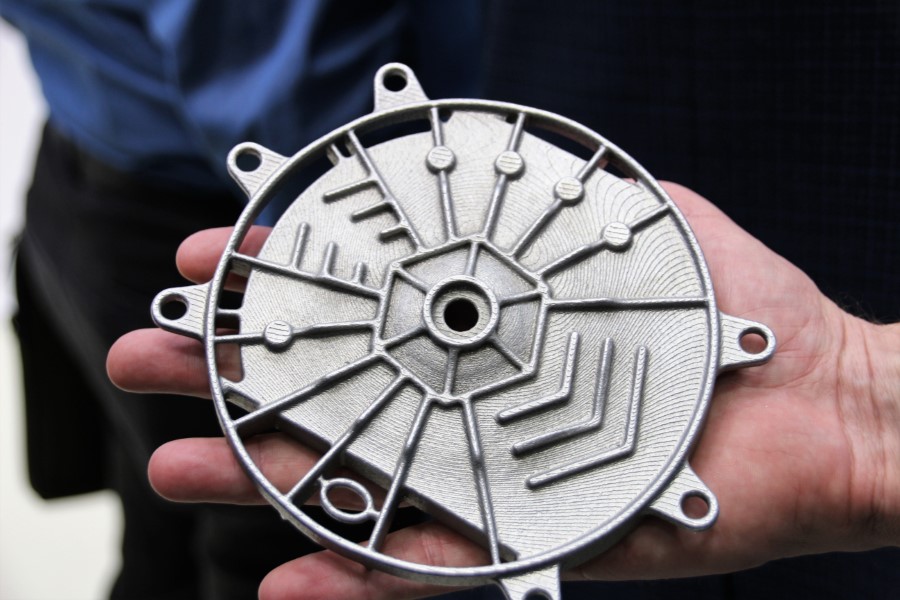

Potential customers are hesitant to switch their production lines to additive manufacturing because they doubt the strength of the counterpart. Striking detail in his explanation: Stratasys lacks 3D metal printing in the portfolio to really break open the market.

Merger group aims for $ 1.1 billion in revenue in 2025

Redesign AM landscape

No doubt the merger of Stratasys and Desktop Metal, announced a few days ago, has come as a surprise to many in the industry. This creates an AM giant with revenues of regarding $885 million this year and a wide range of AM technology, materials and software. Both Yoav Zeif and Ric Fulop emphasized several times in the analyst call that the two groups mainly complement each other and that there is minimal overlap of technologies. Not even in the DLP business, according to them, which Desktop Metal acquired with the acquisition of EnvisionTec; the application differs.

Belang in Desktop Metal

Both companies have therefore well prepared for this step, which comes at a time when Stratasys has been under attack from Nano Dimension for months. It is not a thoughtless step, believes Yoav Zeif. Incidentally, the contacts between Stratasys and Desktop Metal have been going on for a long time. At the first public appearance of Ric Fulop’s team six years ago at Rapid in Pitsburgh, Stratasys announced that it would open its distribution network to the startup that was then Desktop Metal. Precisely because of the distribution network. It can sometimes take a while…

“As an industry, we fail to deliver quality in a real workflow”

Something is not going well in the industry

Stratasys Yoav Zeif, who wants to start as CEO of the merger group, calls the merger of the two groups a milestone that will reshape the AM landscape. In his 3.5 years as CEO at Stratasys, he has seen the industry grapple with the position of additive manufacturing in the manufacturing technology landscape. 3D printing is a solution for the challenges of the manufacturing industry such as sustainability, mass customization, logistics and the need for decentralized production. “We have good solutions with AM but we all know that we are the only profitable company in the industry. So something is not working right. And that is that as an industry we fail to deliver quality in a real workflow.”

Stratasys lacks metal printing

A second revelation from the Stratasys CEO is that the company lacks metal printing. A few years ago, Stratasys was regarding to come out with a metal printing technology. In the end, it was decided to fully focus on polymer technology. The reasons, Yoav Zeif now says, were that the metal printing technology was not distinctive enough and that Stratasys wanted to stop the losses. Without focus, the company would have insufficient resources to scale up in polymers. “So we started to focus but knew all along that we needed metal.” That moment, he admits, has come sooner than expected. Stratasys believes it is necessary to have metal printing in its portfolio in order to effectively penetrate the manufacturing industry market at scale. The Desktop Metal technology and especially the holistic approach is distinctive, says Yoav Zeif. That approach is now being merged with that of Stratasys, for more or less the same customer group.

Desktop Metal: No financial necessity

There were also critical questions from equity analysts. Among other things, regarding the financial position of Desktop Metal, which has seen quite a bit of capital burn in recent years. With a 2022 loss of $233 million and $190 million still in cash, it still looks like Stratasys is buying a company that has thrown out a financial lifeline, one analyst said. Ric Fulop vehemently disputes this view. Quarter following quarter, Desktop Metal succeeds in lowering cash burn. In the 4e quarter of this year, the group is still expected to break even. Fulop is excited regarding the deal with Stratasys because of the synergy in technology, materials and software. At the same time, the proposed merger will allow Desktop Metal to benefit from Stratasys’ strong distribution network, an industry powerhouse according to Ric Fulop.

Together active in 65 countries

On the other hand, Desktop Metal has key account teams that can help with shop floor penetration for series production. Ric Fulop: “Together we have a global footprint by being present in 65 countries with more than 400 support and application employees.” Yoav Zeif adds that the teams of both companies have already dived deep into the technology together and that this has resulted in many ideas to take steps both in terms of innovation and efficiency. And scale is the most important aspect if you want to achieve maximum profitability, says Ric Fulop.

By $1 billion in sales by 2025

What kind of group will be created if the merger goes ahead? Combined, the two will post $885 million in revenue this year; by 2025, the merged group should already have $1.1 billion in sales and an EBITDA margin of 10 to 12%. Synergy benefits might reach $50 million by 2025. And then the real party has yet to begin, because according to Ric Fulop, the $18 billion AM market was big last year means that only 0.1 percent of all production technology spending worldwide is spent is on additive manufacturing. He maintains that the total AM market will grow to $100 billion by 2030. The growth will also come from the dental market, where digitization is gaining momentum.

End-to-end solution from design and prototyping to following market

“Together we can offer customers an end-to-end solution from design and prototyping to tooling and serial production to following-market activities by using additive manufacturing.” In particular, the step to the real manufacturing industry, to the shop floor, is quickly within reach with the merger, the two CEOs emphasise.

Customers are looking for strong counterparties

Yoav Zeif says that customers are concerned regarding making the real move to additive manufacturing and changing their production lines, because they don’t think the counterpart is powerful enough. Together, the two companies can offer the scale that large manufacturing companies want. Customer opinion is therefore one of the pillars of the decision to merge, said the Stratasys CEO. The production of finished parts is currently the fastest growing segment in the AM industry. The merger group must accelerate this breakthrough, expect both CEOs, because the manufacturing industry can turn to a group for metal, plastics, ceramics and wood.

The merger plan is now before the shareholders and the financial authorities. The aim is for the end of 2023 as the merger date. In the Benelux you can find Stratasys at Seido Solutions and for the Desktop Metal products Visiativ 3D Printing a Buhlmann.

1685299894

#Merger #Desktop #Metal #Stratasys #needed #breakthrough