20 years ago, we met Ma Win and invested in 5 minutes, once a 3700 times jackpot symbol of success

孫 – Ma Win, at the greatest crossroads of his business life… FT “Alibaba sale is the end of an era”

“SoftBank made a huge loss of 5 trillion yen (regarding 49 trillion won) in half a year.”

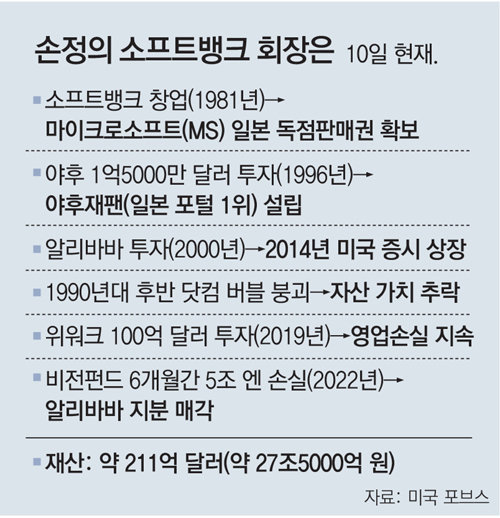

On the 8th, at the SoftBank Group headquarters in Minato-ku, Tokyo, Japan, the voices of SoftBank Chairman and President Son Jeong-eui announcing the financial statements for the first quarter (April to June) were divided. Son’s choice to deal with the massive loss was to sell his stake in Alibaba, China, the world’s largest online shopping company. According to Japan’s Nihon Keizai Shimbun on the 11th, SoftBank decided to secure 4.6 trillion yen (regarding 44.5 trillion won) by lowering its stake in Alibaba from 23.7% to 14.6%.

Marwin

MarwinThis is the game of Chairman Son, who is facing the biggest crisis in 41 years since its founding as the Vision Fund, which was created for investment in information technology (IT) companies, incurs more than 65 trillion won in losses in the first half of this year due to the recent drop in global stock prices. It is also expected to affect the relationship between the two, which began when he met Ma Win, the founder of Alibaba, who was a startup 20 years ago and invested 20 million dollars.

○ “Take my money” in 5 minutes

The life of Chairman Son, who was born in Saga Prefecture, Japan in 1957 as a third-generation Korean-Japanese, is reminiscent of the drama ‘Pachinko’. His grandfather and grandmother from Daegu, who came to Japan during the Japanese colonial period, worked as mine workers, respectively, and settled down by carrying food waste with handcarts. His father made his fortune in the loan business and the pachinko business.

After graduating from the University of California at Berkeley at the age of 16, Son went to study in the United States, returned to Japan, and founded SoftBank in 1981, running on a successful path. After the collapse of the ‘dot com bubble’ in the late 1990s, Chairman Son, whose assets were cut by one-tenth, met Ma Win in 2000, his second year in business. Chairman Son said following listening to Ma’s business presentation for 5 minutes. He said, “I got it. Take my money.”

At an event in 2019, Chairman Son said, “(Alibaba investment) was purely by sense. We were both a little crazy,” he recalled. Ma also praised Chairman Son, saying, “We didn’t just talk regarding money, we shared the same philosophy and vision.”

After receiving a large investment from Chairman Sohn, Ma has emerged as a global founding star at once. In 2014, when Alibaba was listed on the New York Stock Exchange, the value of Chairman Son’s stake increased to $74.7 billion (regarding 97 trillion won). After 14 years of investment, the value has risen more than 3,700 times. Chairman Son and Ma were ranked among the richest men in Japan and China, respectively.

○ Son and Ma Win, respectively, withdrew from each other’s board of directors

The same goes for Ma, who is standing at the crossroads of his business life. After criticizing the government’s regulations in public in 2020, the $34 billion IPO was canceled with 48 hours left before execution. Alibaba’s current market cap has fallen to a third of what it was in late 2020. Chairman Sohn and Win Ma gave up their positions on Alibaba and SoftBank, respectively. SoftBank denied rumors of discord, saying that it would “maintain a good cooperative relationship with Alibaba,” but the British Financial Times (FT) evaluated that “SoftBank’s sale of Alibaba (share) means the end of an era.”

As a result of Chairman Son’s decision, Alibaba was excluded from SoftBank’s affiliates, resulting in a significant reduction in the accounting deficit (the sale of shares), and 4.6 trillion yen was recorded as a profit on the books. Kirk Boudry, an analyst at Redex Research, a market research firm, selected e-commerce company Coupang and others as potential sale candidates, Archyde.com reported. However, some predict that it will not be easy to improve earnings as SoftBank’s options for securing cash are shrinking due to a fall in share prices.

Tokyo = Correspondent Lee Sang-hoon [email protected]

![Loss of 65 trillion won [인물 포커스]](https://dimg.donga.com/a/180/120/95/2/wps/NEWS/IMAGE/2022/08/12/114924656.1.jpg)