A Homecoming: Beverly Investment Advisors Acquired by SEIA

Los Angeles-based registered investment advisor Signature Estate & Investment Advisors (SEIA), with $23.8 billion in assets, has welcomed back a familiar face with the acquisition of Beverly Investment Advisors. The Beverly Hills, Calif.-based RIA, managing roughly $300 million in assets, was led by Canon Price. For Price, the move marked a full-circle moment, returning to the firm where her financial services career began three decades ago.

Price’s journey began at SEIA, where she was recruited by CEO Brian Holmes. He became a mentor, guiding her through the licensing process to become a wealth management specialist. After seven years absorbing knowledge and experience at SEIA, Price felt the pull to forge her own path.

"Leaving was kind of like leaving a family, but I knew that in order to grow, I had to try to do this on my own," she said.

That leap into entrepreneurship proved to be rewarding. Within the first year, Price’s clients followed her, and she tripled her income. Her firm blossomed, serving clients in diverse sectors like entertainment, business ownership, law, and medicine. Her expertise extended to pension consulting as well.

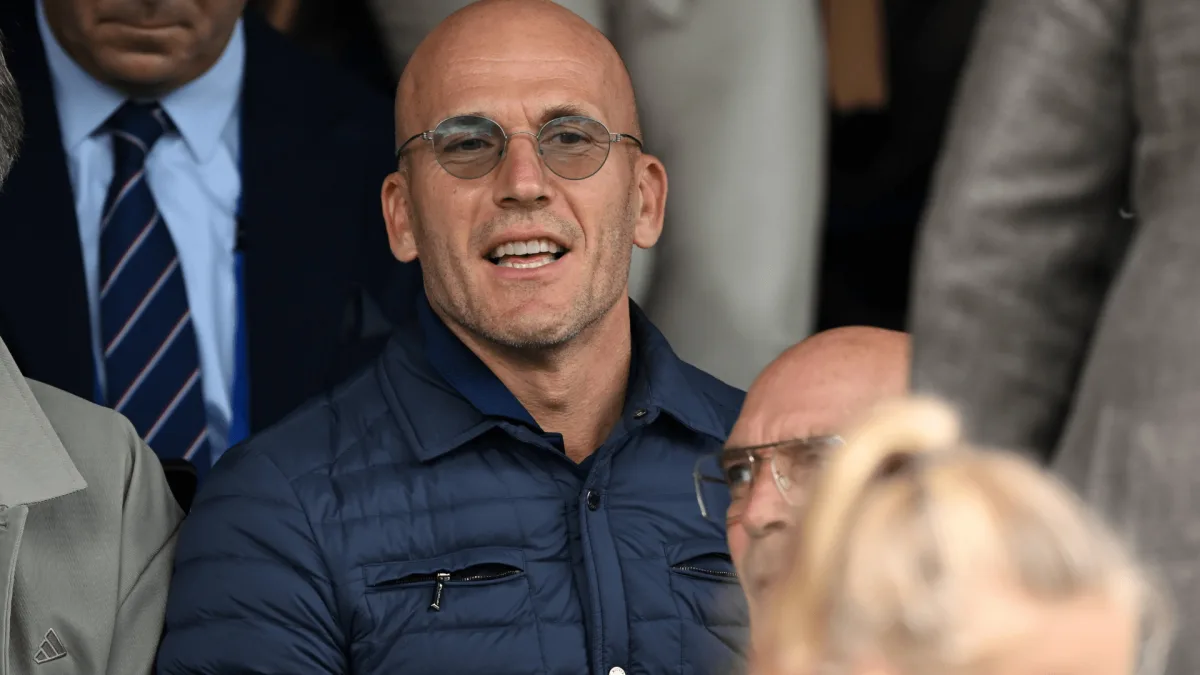

Canon Price

But as her business matured after 22 years, Price recognized that she’d reached a capacity point.

"I realized I needed assistance in order to maintain the level of service that I wanted to provide for my clients," she explained.

Price, at 58, also wanted to establish a secure contingency plan.

"I’m just not getting any younger," she said. "God forbid I’m hit by a bus, I want my clients taken care of. I also want a path for retirement so that I could make sure to transition my clients over when I’m ready to stop working to a firm that I respect and people that I respect.”

While she already had two SEIA members as part of her existing contingency plan, the acquisition offered a solid solution for all her goals.

This acquisition was particularly significant since SEIA itself underwent a period of significant change in 2022. New York-based private equity firm Reverence Capital Partners took a stake in the business. Osaic, a broker-dealer platform owned by Reverence, also made a minority investment in SEIA.

Previously, SEIA used Royal Alliance, one of Osaic’s broker-dealers (which has since been consolidated), for its brokerage business. SEIA now leverages its own broker-dealer, Signature Estate Securities. This integration aligns perfectly with the strategic vision of both Reverence and SEIA, enabling the firm to expertly serve a wide range of clients while fostering organic growth.

What factors contributed to Canon Price’s decision to return to SEIA after being away for many years?

## SEIA Welcomes Home Beverly Investment Advisors

**Host:** Welcome back to the show. Today we’re joined by Canon Price, the founder of Beverly Investment Advisors, which was recently acquired by SEIA, the firm where Canon began her career. Canon, welcome to the show.

**Canon Price:** Thank you for having me.

**Host:** Canon, this acquisition marks a full-circle moment for you. Tell us about your journey that has led you back to SEIA.

**Canon Price:** It’s been an amazing journey. I started my career at SEIA over 30 years ago under the mentorship of Brian Holmes, the CEO. He took me under his wing, guiding me through the licensing process and helping me become a wealth management specialist. I spent seven years at SEIA, absorbing as much knowledge as I could.

**Host:** And then you decided to strike out on your own.

**Canon Price:** Exactly. While leaving SEIA was difficult – it felt like leaving family – I knew I had to grow and build something myself. So I founded Beverly Investment Advisors.

**Host:** It sounds like that decision paid off.

**Canon Price:** It really did. Within a year, my clients followed me, and my income tripled. We served diverse sectors like entertainment, law, medicine, and business. It was incredibly rewarding.

**Host:** Now, why was returning to SEIA the right move at this point in your career?

**Canon Price:** After building something successful, I felt the pull to join forces with a larger team again. SEIA has always been a place of innovation and growth, and I’m excited to contribute my experience and expertise to help them continue thriving. Plus, it feels good to be back “home.” [[1](https://www.barrons.com/advisor/articles/wealth-manager-seia-makes-first-acquisition-buying-cleveland-ria-cedar-brook-0b138a38)]

**Host:** Wonderful. Canon, thank you for sharing your story with us today. We wish you and SEIA continued success.