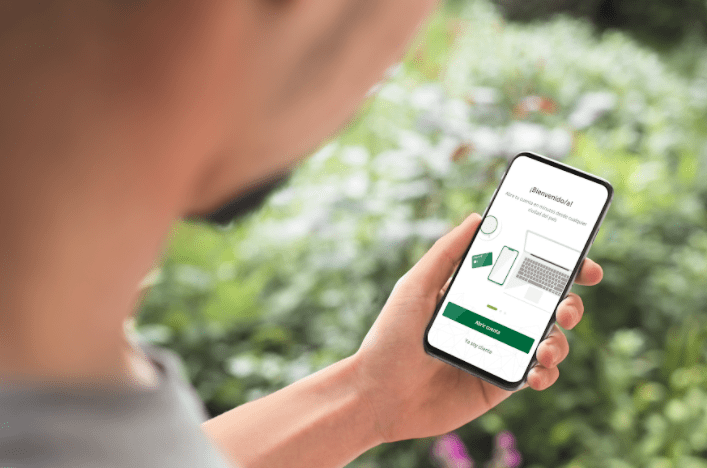

In an effort to modernize its services, several banks in Venezuela now offer the option to open accounts digitally.

This initiative aims to streamline the process and enhance access to banking for a larger number of users. A recent example of this trend is the Active Bank, which announced the ability to open online accounts via its social media channels.

Through its account on X (formerly Twitter), the bank explained that customers must visit its online management site to create an account. The process starts with entering the user’s ID, followed by clicking the “Validate” option.

Banks in Venezuela Offering Digital Accounts

Furthermore, if the user is employed, additional information regarding their employment, such as name and address, will be required. An additional requirement is the provision of the Tax Information Registry (RIF) and a scan of the client’s face.

Once the required information has been submitted, the bank will verify the request and respond to the user via email.

However, in case of technical difficulties, the bank encourages users to go directly to its website and select the “Create your account” option, which will redirect them to the appropriate form.

Which Other Banks Offer This Option?

Other institutions in the country have also embraced this model. The Bank of Venezuela and Plaza Bank have allowed users to open accounts online since 2023.

In this context, the first bank directs customers to use the application BDVApp, where they must scan their identity card and RIF. Once the requirements are fulfilled, users can access the platform using their username and password.

Meanwhile, Plaza Bank provides the option “ON Plaza”, where interested individuals must possess their identity card or passport, an email address, a mobile number, and must not have any previous products with the bank.

Ultimately, this trend towards digitalization in the banking sector of Venezuela aims to enhance the user experience, marking a significant shift in how financial institutions operate in an increasingly technological world.

Visit our section Services

To stay informed, follow our channel on Telegram: https://t.me/Diario2001Online

Follow the 2001online channel on WhatsApp: https://whatsapp.com/channel/0029Va9CHS8EwEk0SygEv72q

Banks in Venezuela Adopting Digital Account Opening Services

In a groundbreaking move to modernize banking services, various banks in Venezuela are now offering the option to open accounts digitally. This initiative aims to streamline the banking process and expand access to financial services for an increasing number of users in the country.

A notable illustration of this trend is the Active Bank, which recently announced the ability to open online accounts through its social media platforms. Using their account on X (formerly known as Twitter), the bank guided potential customers to its online management site, where the process begins with entering the user’s ID and selecting the “Validate” option.

Banks in Venezuela with Digital Accounts

This digital transformation isn’t isolated to just one institution. Other banks have also embraced this modern approach to financial access:

- Bank of Venezuela

- Plaza Bank

Both have begun allowing users to open accounts online since 2023, enhancing user experience and accessibility.

Active Bank Registration Process

For customers interested in opening an account with Active Bank, here are the steps to follow:

- Visit the online management site.

- Enter your ID number.

- Click on the “Validate” option.

- If employed, provide your workplace information—name and address.

- Upload your scanned Tax Information Registry (RIF) and a clear photo of your face.

Once you submit the required data, the bank will verify your request and send you a response via email. In case of any technical difficulties during the process, users are encouraged to visit the bank’s website directly and select the “Create your account” option, which will redirect them to the corresponding form.

Bank of Venezuela Online Account Creation

The Bank of Venezuela provides a streamlined digital account creation process via the BDVApp. Here’s what you need to do:

- Download and install the BDVApp.

- Scan your identity card and RIF.

- After verification, users can log into the platform with their username and password.

Plaza Bank’s Online Account Procedure

At Plaza Bank, users can take advantage of the “ON Plaza” feature. The requirements are as follows:

- Have either an identity card or passport.

- Provide a valid email address.

- Input a mobile phone number.

- Ensure you do not have any previous products with the bank.

Benefits of Digital Banking in Venezuela

Embracing digital banking presents numerous advantages that can significantly improve user experience:

- Accessibility: Users can open accounts from anywhere, at any time, reducing the need to visit physical branches.

- Efficiency: The online process is quicker, allowing for immediate account creation compared to traditional methods.

- Convenience: Users can manage their accounts and conduct transactions online, making banking more convenient.

- Enhanced Security: Digital banking often involves advanced security measures, such as two-factor authentication, protecting user information.

Practical Tips for Opening a Digital Bank Account

Ready to dive into the world of digital banking? Here are some practical tips:

- Research: Compare different banks and their offerings to choose the one that fits your needs.

- Prepare Documentation: Ensure you have all necessary documents ready for a smooth registration process.

- Follow Instructions: Pay close attention to the bank’s guidelines and instructions to avoid any errors during the application process.

- Contact Support: If you encounter issues, don’t hesitate to reach out to customer service for assistance.

Case Studies: Customer Experiences

Here are some firsthand experiences from customers who have navigated the new digital banking waters in Venezuela:

Testimonials

| Customer Name | Bank Used | Experience Rating | Comments |

|---|---|---|---|

| Juan Perez | Active Bank | 5/5 | Quick and easy registration! |

| Maria Lopez | Bank of Venezuela | 4/5 | Nice app, some minor bugs. |

| Carlos Ruiz | Plaza Bank | 5/5 | Seamless experience, highly recommended! |

The Future of Banking in Venezuela

Venezuela’s banking sector is witnessing a significant transformation, with a noticeable shift towards digital services. This trend reflects a broader global movement towards technological integration in finance, enhancing user experience and operational efficiency.

For more information about digital banking services and updates, don’t forget to visit our section on Services.

Stay informed by following our channel on Telegram: https://t.me/Diario2001Online.

Additionally, join the conversation on our WhatsApp channel: https://whatsapp.com/channel/0029Va9CHS8EwEk0SygEv72q.