“She economy” promotes the change and innovation of new consumer brands.

The March 8th Festival is one of the important nodes of brand sales, and it is also a critical moment to show the brand’s attitude. The popularity of “her marketing” content has also risen accordingly.

7or9 high-heeled shoes has insight into the intimate relationship between dancing and shoes, sells romance in a new way, and sincerely invites everyone to dance. In this short film, 7or9 high heels allow women of different identities and ages to dance briskly, thus conveying the courage and strength of daily dancing.

Neiwai NEIWAI’s brand short film “Ten Questions regarding the Body” presents the real dilemma of women being restrained in words and deeds, being kidnapped by morality, etc. The posters launched at the same time powerfully answer the ten questions in the video, encouraging women to take the initiative in their bodies , Be brave enough to be yourself.

These two short films coincidentally point to women’s power and women’s autonomy, which is also an important manifestation of the continuous display of women’s value and power in the context of diversified social development. In the entire consumer field, “her power” is not only reflected in the fight once morest the commercial wave, but also in the grasp of the rising track.

01、Her leadership: a changemaker at the forefront

The female founders are distributed in all walks of life and of different ages. While taking care of their careers and families, they are also emerging and shining in the business wave.

Mi Wenjuan, the founder of VIPKID, Liu Nan, the founder of Mia, Peng Xin, the founder of Naixue’s Tea, Lin Xiaoxian, the founder of Xiaoxian Stew, Qu Fang, the founder of Xiaohongshu, Chen Anni, the founder of Kuaikan Manga, etc. A well-known representative of successful female entrepreneurs in the industry.

But it has to be mentioned that under the surge of new consumption, cutting-edge forces have also begun to appear frequently.

MAIA ACTIVE, a designer sportswear brand specially designed for Asian women, was co-founded by two women, Ouyi Rou and Wang Jiayin. It has hit the market with several explosive products. In 2021, its omni-channel sales have exceeded 300 million. It has only been established for 7 years. It is already the leading brand in this track.

▲ Maya founder/design director Ou Yirou (left) co-founder/CEO Wang Jiayin (right)

In 2009, when 99% of people still knew perfume as “flower dew”, Lou Xiaozhi, the founder of Scent Library, embarked on the entrepreneurial road of perfume and fragrance. From the very beginning, she “didn’t know how to make money” and “didn’t know what a hot sale is”, and gradually found the main theme of the product – the unforgettable taste of being a new generation of young people in China.

▲ Lou Xiaozhi, the founder of Smell Library

Wang Shenghan, the founder of Drunken Goose Niang, started his business in 2014. From wine content self-media, to video self-media, social e-commerce, then to e-commerce with its own brand, and finally to brand companies, the company has experienced many years It has undergone several transformations in different stages, and has also grown and grown in constant transformation.

▲Wang Shenghan, the founder of Drunken Goose Girl

YIN Yin, a cutting-edge high-end jewelry brand in China, was co-founded by former Ogilvy and Mather Ayur Wu Yin and Dora Yin He. Different from traditional gold jewelry, YIN enters the market with 18K real gold minimalist gold jewelry, which is specially designed for highly educated women in the workplace. It is currently the only new brand in the TOP10 K gold category on Tmall.

▲Wu Yin Ayur, founder and CEO of YIN

Yao Jing, the founder and CEO of Wangbaobao, took advantage of the dividends of the Internet celebrity economy and the rapid rise of domestic brands. Yao Jing, together with her friends He Yaxi and Xu Danqing, founded Wangbaobao, a ready-to-eat cereal brand. From Weibo operation to Taonei operation, and then to talent resources through platforms such as Xiaohongshu, Douyin, and Bilibili, Wang Baobao quickly opened up various platforms, and these distribution channels also brought explosive growth to Wang Baobao. increase.

In the established sportswear field, female power has also begun to enter the stage. In May last year, Patrik Frisk (Patrik Frisk), who served as CEO of Under Armor for less than two and a half years, suddenly announced his resignation. Even more surprising is that Under Armor announced that it will hand over the banner to Stephanie Linnartz (Stephanie Linnartz).

Linerz joining Under Armor is a big crossover in itself. In 1997, she joined Marriott as a financial analyst, step by step to the position of president. Apart from helping Marriott establish multi-year partnerships with the NFL, NCAA and AMG Petronas FI team, he has almost no other sports-related experience, which is unusual in both the tourism industry and the sports brand industry.

▲Under Armor President and CEO Stephanie Linerz

But even more unusual is the emergence of a female CEO in a sports brand that has always been dominated by men, and it also happened at Under Armour. Although it has made efforts in the female market in recent years, Under Armour’s brand image has always been branded as a “straight man of steel”. Having a female CEO is somewhat in contrast to the brand image.

But in fact, among the head sports brands, whether it is Nike, Adidas and other comprehensive sports brands with more male users, or lululemon, which uses yoga pants to cut into the women’s market, its CEOs are all men, so Linerz is not only Ander She is the first female CEO since the establishment of Ma, and also the first female CEO of a head sports brand.

The footwear media Footwear News spoke highly of this: “Through this appointment, it marks a transformation in the historically male-dominated industry of sports shoes and outdoor products.”

More and more Chinese women are shining in the business world, and they are becoming outstanding entrepreneurs, executives or investors. According to McKinsey data, Chinese women contribute as much as 41% to the economy. Women’s entrepreneurship has not only become a social norm, but more importantly, they have become the backbone of the business world.

02、Her consumption power: the leader of radical changes

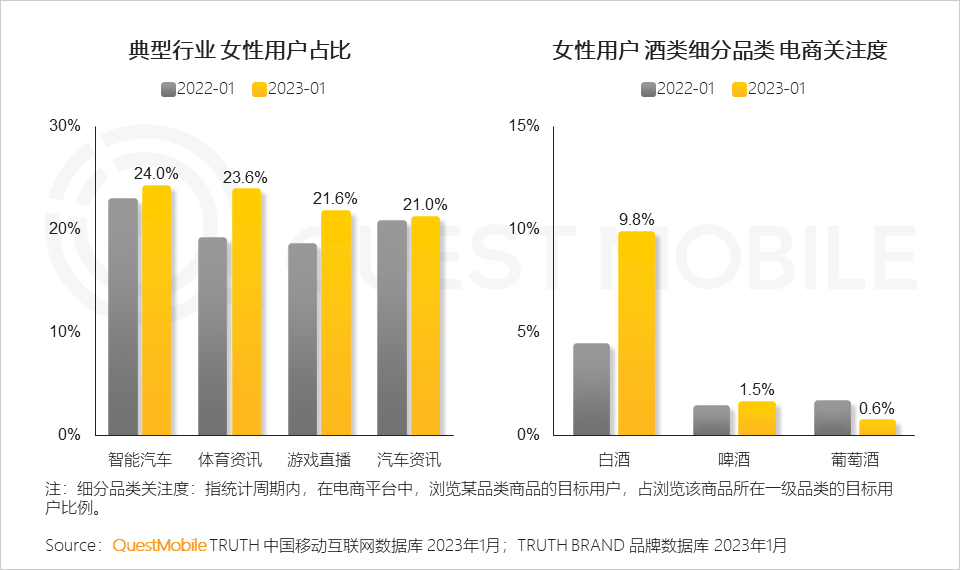

QuestMobile’s 2023 “She Economy” insight report shows that there are nearly 600 million female active users, and their willingness to spend and spending power are much higher than those of men. , e-sports and other industries with a high concentration of men, the proportion of female users is also increasing.

▲In industries with a high concentration of men, such as automobiles, alcohol, sports, and e-sports, the proportion of female users continues to increase. Image source: QuestMobile 2023 “She Economy” Insight Report

In fact, judging from the development trend of various consumer sub-sectors in recent years, women’s leadership in the consumption track has become stronger, and the consumption boundary has continued to expand.

1. Underwear leap: Keen to capture new demands, precise strategic positioning

The era of “no steel rims” has been popular for several years. Now it has developed into the post-era, and emerging brands and mature brands have begun to “compete”.

The emerging brand Ubras is the first to create “no-size underwear”, and Jiaonei is the first to propose the concept of “no-sense underwear”. Traditional brands are catching up. Aimer, Maniform, and Cosmo Belle have abandoned sexy labels such as lace and steel rings, and are moving towards soft steel rings and steel-free underwear.

If the new forces of underwear represented by Nei Nei Nei Nei Nei, Jiao Nei, Ubras, Suji Liangpin, TheBlender, Relief, Li Sex, etc. have started a market iteration with the keyword “freedom and comfort”, there will inevitably be new underwear brands in the future. The underwear revolution with the core of concept and material. In the red ocean market of underwear, they are churning forward.

2. Chinese tone of feminine fragrance: dark fragrance floating, chasing head-on

The outside world’s perception of the Chinese fragrance market has undergone many changes. From China’s failure to develop a large perfume brand, to the “perfume index” becoming the new “lipstick index”, and now there is a new saying that under the dual stimulation of consumer demand and national self-confidence, it is now the Chinese perfume industry. Good times for atmosphere brands.

Local fragrance brands such as Smell Library, THE BEAST, Wenxian, Guanxia, BOITOWN, Dr.lreanEras, groundle, Liuhuashu, Wuduoli, Beast Youth, pekopeko, etc. have successively entered the public eye , they interpret the new generation of Chinese fragrance brands from different angles.

Women’s demand for fragrance track is more diverse and subdivided, from aromatherapy essential oils for body care, fragrance shampoo, shower gel, oral care, to aromatherapy candles for relaxation, perfumes that show identity, and then for Home fragrances with different choices in different spaces… The unique advantages of “Chinese fragrance” and “Oriental plant tone” will become a strong wind, sweeping the entire new consumer market for women.

3. Slightly drunk alcoholic: good taste, low calorie and beauty

Data released by various platforms in recent years have shown that women’s drinking data is on the rise. Statistics show that women account for 47% of the total alcohol consumption of high-net-worth individuals in China. According to the “2020 Young People’s Alcohol Consumption Insight Report” released by China Business News, female consumers following 90/95 have already accounted for half of the country.

Meijian, Bainiao, Bingqing and other slightly drunk wine brands have sprung up like mushrooms following rain, and quickly started to attack cities around different scenes. Young people are obsessed with being slightly drunk, and capital also prefers low-alcohol alcohol. New low-alcohol alcohol brands have greatly accelerated in terms of financing frequency and scale. Fast-rising new brands such as Berry Sweetheart, 10:15, Zouqiqingniang, Kongka, and Ma Ton have received 2-3 rounds of financing in a row.

In the case of new cutting-edge brands staking land, traditional alcohol brands have also joined the battle.

According to a report by China Business News, female consumers are more willing to accept beer with a light taste, especially for fruity beer and other categories. Therefore, it has become an industry trend in recent years for beer brands to launch fruity beers. For example, the fruit beer launched by Yanjing; Budweiser launched two fruit-flavored beers targeting female consumers; the recent Snow Beer has also launched a new beer for women; Qingdao has also begun to enter the bureau of fruit-flavored craft beer…

Secondly, female consumers are more interested in products with low calories and beauty functions. Therefore, some beer brands have promoted slogans such as “low calories” and “added collagen” in order to attract female users. For example, the fat-reducing beer launched by Kirin in Japan; the beauty beer launched by Suntory, which claims to be beautiful following drinking, has added collagen ingredients…

At present, women’s drinking has become a very common daily event. How to correctly meet women’s drinking needs still has a lot of space waiting for exploration by wine companies.

4. Girlfriend force MAX: Popeye or sports bourgeoisie?

Popeye or Athleisure Petty? Girlfriend can’t do multiple-choice questions and asks for all of them. On this stage, they continue to expand the territory of female roles, achieve a comfortable self, and present a diverse and blooming attitude.

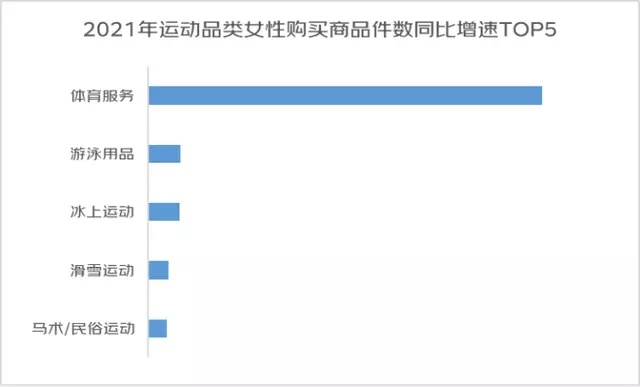

As early as 2021, JD.com’s consumption data showed that women’s purchases of sports services, swimming, ice sports, skiing and equestrian/folk sports increased significantly year-on-year. Among them, the number of purchases of sports services increased by 8.4 times year-on-year.

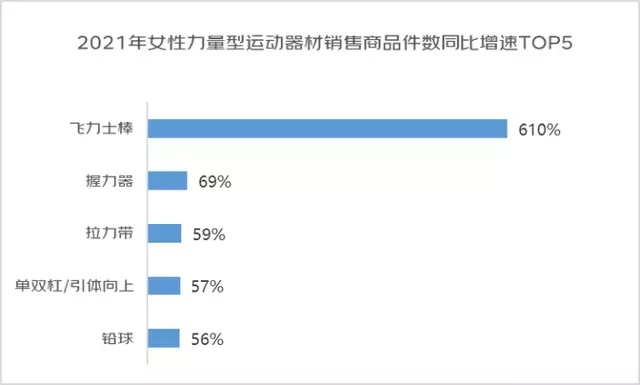

In addition, the number of sales of strength sports equipment among female users increased by 65% year-on-year. Among them, the categories with the fastest growth in the number of items purchased by female users are Felix sticks, grips, tension bands, single and parallel bars/pull-ups, and shot puts. Among them, Felix sticks have become an important option for women to choose strength training, and the number of purchased items is year-on-year Increased by 6.1 times.

In addition to strength training, recently emerging niche sports: frisbee, paddle board, rugby, etc., also frequently appear women, which makes sportswear brands such as MAIA ACTIVE, Lululemon and more outdoor sports brands have a “soul”. “The place to put it. If combined with the above mentioned, the appointment of Under Armor’s first female CEO, the transformation of women’s outdoor sports is bound to be more exciting.

The above is just the tip of the iceberg of women’s consumption. TOPHER has previously given a prediction on women’s consumption trends. Although it seems to be a minority at present, it is also forward-looking and representative.

TOPHER believes that Metaverse Internet celebrities will become new KOLs that affect women’s consumption. In addition, listening experience upgrades, mixed reality (Mix Reality) experiences, sustainable food, functional “super water”, the rise of longevity diets, and the expansion of the emotional health industry will also Occupy an important position in the “her economy”.

The traditional paradigm is constantly being broken, her economy has more possibilities, the open market is waiting for more brands, and more female entrepreneurs are swimming in it.