2023-06-17 10:20:00

The price of Bitcoin is experiencing a significant recovery, with a notable rebound over $1,500 from critical $25,000 support level. This sudden upward movement sparked speculation on the shares of influential market players known as “whales”who might take advantage of lower prices to accumulate Bitcoin.

As the cryptocurrency market continues to garner attention, it is crucial to examine recent events that might potentially impact Bitcoin’s trajectory. This article will therefore dig deeper into these developments and their potential effects on the future outlook for Bitcoin.

Over $1.2M worth of BTC transferred following 13 years of inactivity

Importantly, more than $1.2 Million worth of Bitcoin that had sat idle for over 13 years was suddenly moved. According to blockchain data, a whale transferred 50 BTC to another wallet on Thursday. These tokens were originally placed in June 2010 and have remained untouched since then.

This movement follows a recent trend. So, in Aprilan investor who had kept his coins for a decade has transferred $7.8 million from Bitcoin to new wallets. A few days later, one or more other long-term investors have transferred for $11 million from BTC following 11 years of inactivity.

These long-dormant bitcoin moves raise questions regarding the motives behind these transfers. But, these movements, given their importance, can also influence the dynamics of supply and demand, and potentially affect the overall price of Bitcoin in the short term.

Bitcoin Price Prediction

Bitcoin regains height in gaining almost 4% over 24 hours to currently trade at $26,575. Technically, looking at the four-hour chart, thee Bitcoin broke above the significant resistance level of $26,000. This level has both psychological meanings and is supported by a downtrend line.

The close of the candles above the $26,200 level indicates a prevailing bull market sentiment. Additionally, Bitcoin peaked at around $26,450 and experienced a minor bearish correction, finding support at the previously tested resistance level of $26,250, which is now acting as a support level. With the candles closing above the $26,200 levelthere is a potential for a continuation of the uptrend, targeting the next resistance level at $26,850.

When considering the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), theBoth indicators remain in the buy zone. Additionally, the 50-day exponential moving average (EMA) provides additional support for the possibility of a continuation of the uptrend. If Bitcoin price stays above the $26,200 level, there is potential for upward movement towards $26,850. Conversely, a break below the $26,200 level might push the price lower towards $25,500.

Top 10 Alternatives to Bitcoin and Ethereum to Watch

Cryptonews Reviewed top 10 cryptocurrencies for 2023. If you are looking for a higher potential investment opportunity, there are many other projects worth considering.

Disclaimer: This linked article presents the views of crypto industry players and is not part of the editorial content of Cryptonews.com.

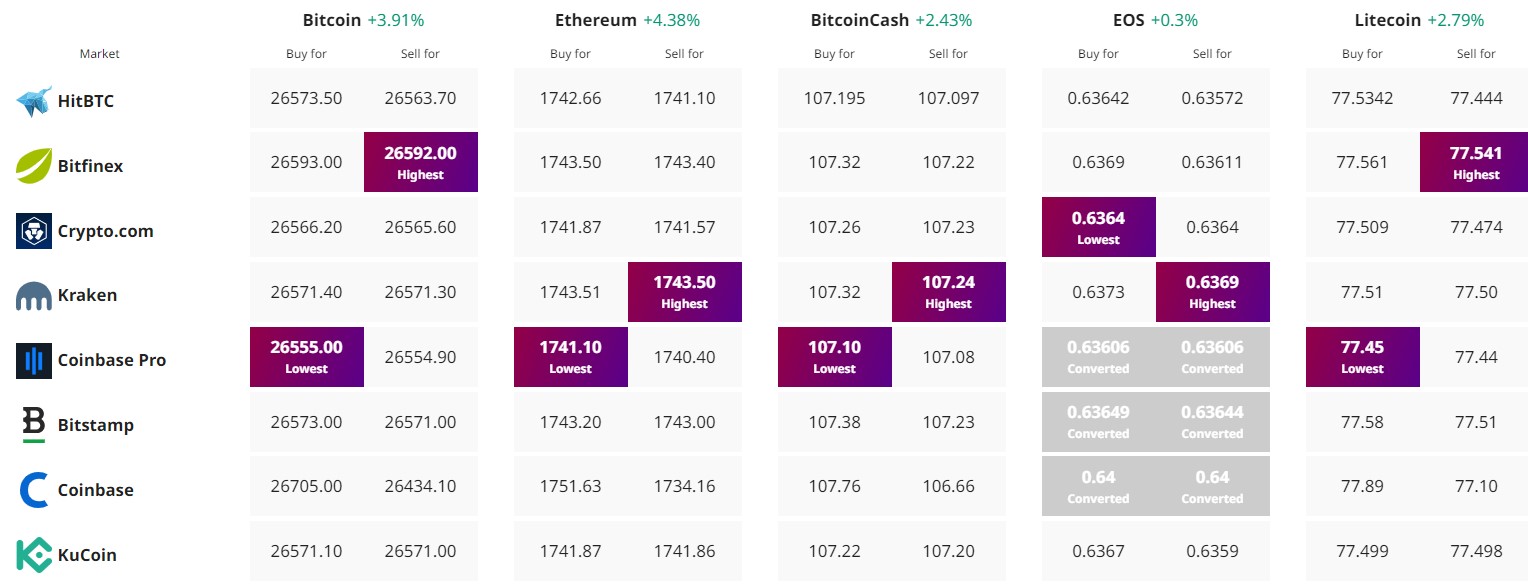

Find the best price to buy/sell cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

1687007410

#Bitcoin #price #prediction #shows #rise #day