By..Natta Mahatana, CFA Assistant Managing Director

Investment Strategy and Customer Relations Department

Krung Thai Asset Management Co., Ltd.

The overall market is likely to have passed its lowest point in mid-July. We therefore reiterate over the past 3 weeks that Global stocks, commodities, cryptocurrencies return to an uptrend. After the Fed focused on adjusting the mode from the original From “accelerating early interest rates” (front loading) to “data dependent”, liquidity returned to seek returns in the market.

The overall market is likely to have passed its lowest point in mid-July. We therefore reiterate over the past 3 weeks that Global stocks, commodities, cryptocurrencies return to an uptrend. After the Fed focused on adjusting the mode from the original From “accelerating early interest rates” (front loading) to “data dependent”, liquidity returned to seek returns in the market.

Real estate securities that are popular to invest through mutual funds REITs, Infrastructure Fund (IF), Property Fund (PF) have also started to recover. The latest development looks quite interesting!

rent soaring Along with high inflation, which has dragged on longer than expected time and once more and there is no sign that it will go down easily. US job numbers in July reinforce the tight conditions in the labor market. Similar to other supply shortages, UBS senior economist Alan Detmeister said, “Rents aren’t going to stop rising anytime soon,” although the next rate increase won’t be as severe as it was at the beginning of this year. but the slowdown (Increase at a slower rate) going forward is likely to be slow and allow rental rates to remain high until at least the end of 2024.

rent soaring Along with high inflation, which has dragged on longer than expected time and once more and there is no sign that it will go down easily. US job numbers in July reinforce the tight conditions in the labor market. Similar to other supply shortages, UBS senior economist Alan Detmeister said, “Rents aren’t going to stop rising anytime soon,” although the next rate increase won’t be as severe as it was at the beginning of this year. but the slowdown (Increase at a slower rate) going forward is likely to be slow and allow rental rates to remain high until at least the end of 2024.

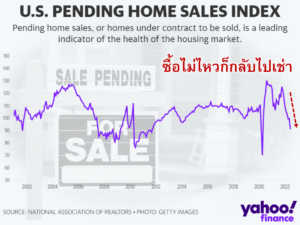

Introductory chapter “Boom Rental” Go back to the time of the new covid epidemic. Americans flock to buy homes at record low interest rates. House prices have soared to a level that many people can’t afford to buy. …have to turn back to rent… The Fed raised interest rates to aggravate the situation. Zillow’s chief economist, Skylar Olsen, argues that volatile housing demand has increased long-term rental demand.

U.S. retail business booms, warehouse rents soar Proologis, the real estate giant in the logistics sector Assess that inventory problems increase due to inflation undermining purchasing power and changing consumer behavior. This would result in an additional 500 million square feet of warehouse storage demand, in addition to long-term structural demand, such as greater inventory efforts than in the past to reduce the risk of “out of stock” if neck conditions occur. Bottle/stall on the supply side (supply-chain bottlenecks/disruptions) is to change the way inventory is managed from just-in-time to just-in-case.

U.S. retail business booms, warehouse rents soar Proologis, the real estate giant in the logistics sector Assess that inventory problems increase due to inflation undermining purchasing power and changing consumer behavior. This would result in an additional 500 million square feet of warehouse storage demand, in addition to long-term structural demand, such as greater inventory efforts than in the past to reduce the risk of “out of stock” if neck conditions occur. Bottle/stall on the supply side (supply-chain bottlenecks/disruptions) is to change the way inventory is managed from just-in-time to just-in-case.

Interest rates are not daunting. Janus Henderson, Principal Fund Management Team KT-PROPERTY Presenting the July view, “Lessons learned: listed REITs’ more prudent approach to leverage”, pointing out that real estate securities traded in markets such as REITs are “strong fundamentals” as debt has dropped considerably compared to the crisis period. The 2008 Global Financial Crisis (GFC) continues, with higher liquidity and uninterrupted access to capital markets. Most REITs lock in long-term interest rates and offer high “investment grade” reliability. Reduces the risk of rising interest rates There may also be an upside from the condition of the difference in prices. “listed REITs” are much cheaper than “non-traded REITs” than usual.

Singapore REIT …The market just celebrated its 20th anniversary… ready to receive high interest for the same reason. “Long interest rates are locked” while the ASEAN economy is likely to recover quite well during the rest of this year.

REIT Thailand Some analysts have begun to point out higher dividend yields compared to bond yields. The spread is widened until it is attractive for investment.

We have a better view on 2 Property Fund

KTAM World Property Fund (KT-PROPERTY) Focus on investing in Horizon Global Property Equities Fund (master fund), which is rated Morningstar 4 stars (Jul 2022). (mainly developed market) Seeking long-term rental growth and asset value, KT-PROPERTY has a policy to pay dividends no more than 4 times a year.

Krung Thai Open-end Fund Property and Infrastructure Flexible (KT-PIF) Focus on investing in real estate and infrastructure securities, both Thai and foreign. 50.27% of NAV as of end-June, mainly Singapore REITs. The fund has been rated by Morningstar 5 stars (Jun 2022). There are two types of “accumulation” (KT- PIF-A) and “dividends” (KT-PIF-D)

#Talk every day, teeth every morning #Fun Today 845

Warning: personal opinion not investment advice past performance It is not a guarantee of future performance. Understand product characteristics Return conditions investment guide and risks before making investment decisions