By..Natta Mahatana, CFA Assistant Managing Director

Investment Strategy and Customer Relations Department

Krung Thai Asset Management Co., Ltd.

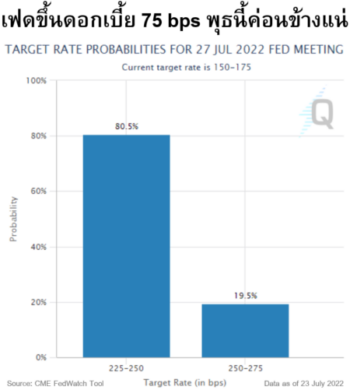

The ECB was forced to “shock the market” to raise the policy rate 50 bps to 0%, the end of the negative interest rate era. It was a stronger-than-expected move to halt inflation. The European Central Bank also canceled its forward guidance, considering interest rates at a meeting-by-meeting basis, and unveils ready-made measures on the yield of indebted member nations such as Italy, which Named Transmission Protection Instrument (TPI), it unlocks the traditional asset purchase criterion. Increased flexibility when intervening in the market The euro surged in surprise, then fell sharply during chairman Lagarde’s press conference, then slowly regained its standing at $1.02, similar to the pre-meeting period.

Mario Draghi resigns as Italian Prime Minister Just a few hours before the interest rate rises. A new round of political turmoil has begun in the Eurozone’s third largest economy following a long (unusual) silence… President Sergio Mattarella leaves Draghi and dissolves parliament … uncertainty ensues… Because I don’t know whether the new government following the election will act as a “good boy”, implementing a “sustainable” fiscal policy according to the ECB’s order in terms of buying bonds or not?

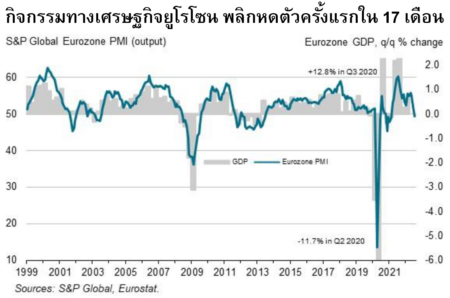

“Count one to the end” Eurozone PMI Jul (preliminary) < 50, reversed contraction for the first time since Feb 2021, the main cause was inflation that deteriorated purchasing power. …The bad economy caused the ECB to tighten for a long time, so it tried to front load the interest rate sharply, "shock the market", hoping for inflation to fall quickly (it hurts but it's over), and soon it would have to prepare to cut interest rates back down to cure the recession.

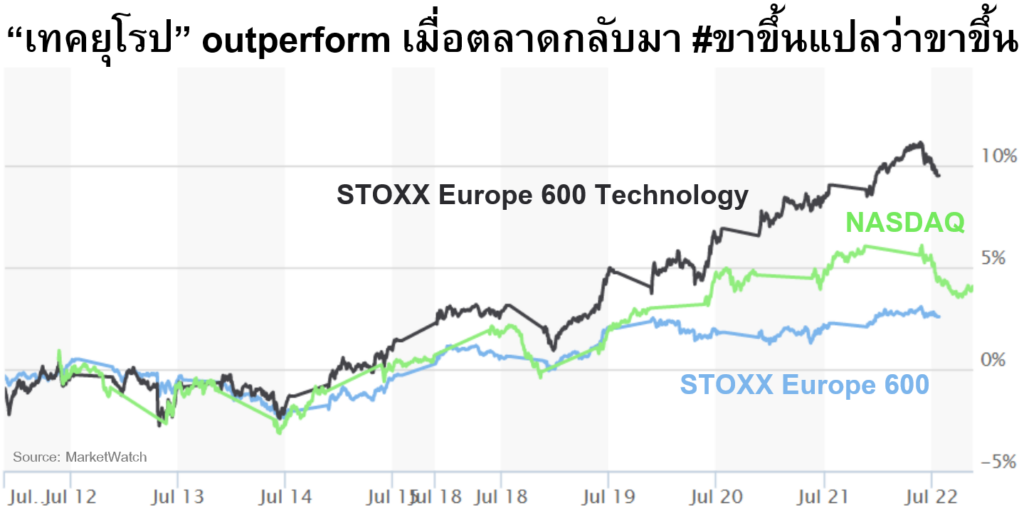

cross over to america Tech stocks soar to lead green index Despite being sold on Friday, the last week’s conclusion was strong. reinforcing our view “The bottom has passed.” Stock markets, commodities, crypto. Driven by liquidity returning to the market following clear Fed policy

The Fed has raised interest rates for a long time. The ECB has just kicked off amid all kinds of downside risks and demand has shrunk. not enough energy plus political turmoil The market then went into a “countdown” mode, beginning to speculate on when the Fed would stop raising interest rates and the ECB to retreat its policy back to easing.

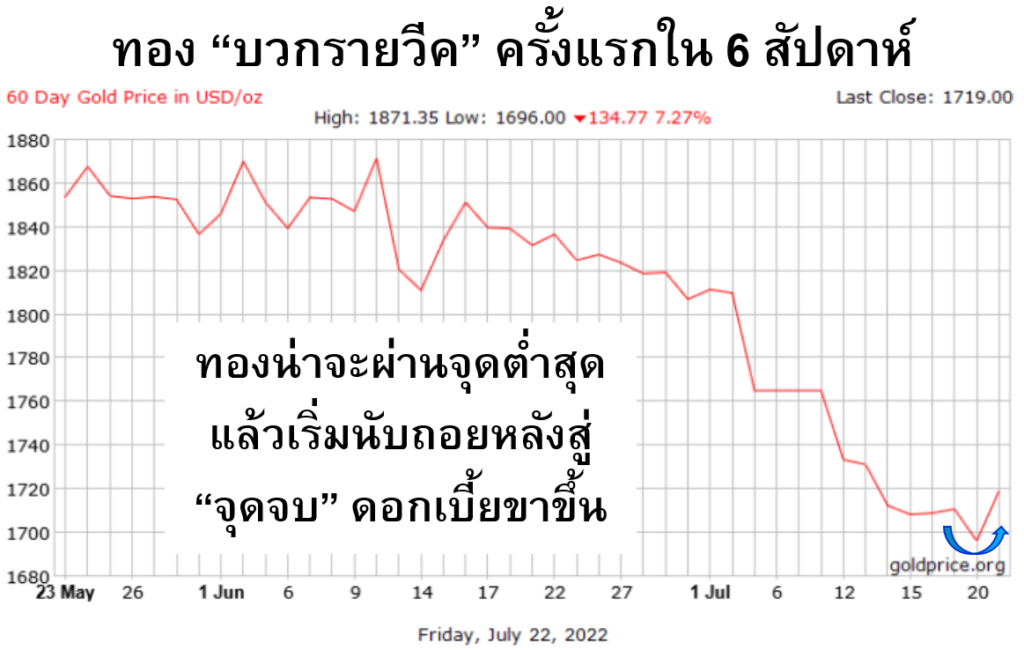

Stagflation risk The risk of economic contraction in high inflation remains attached to the western world. as a factor supporting gold

asset price (which looks forward) would reflect the future timeline “countdown to lower interest rates” We reiterate the opportunity to buy gold-related funds on the consensus side by accumulating gradually. KT-GOLD and KT-PRECIOUS

“European stocks” more attractive to invest With catalysts, the key is the possibility that the EU may begin seeking mediation with Russia ahead of winter. (Because the energy is not enough to create warmth), we choose to collect. KT-EUROTECH Mainly because it is rich in stocks, quality growth, world class technology, at such a low price, you might not be able to buy it in normal conditions.

Mutual Fund Ideas Available Every Day Interested parties are invited to visit. Fund Today by KTAM Every business day starting at 8:45 a.m., you can type questions via Facebook Live: KTAM Smart Trade, Youtube: KTAM TV ONLINE, or listen and talk in the Clubhouse: KTAM Smart Trade. You can also watch back clips on Youtube and Facebook

#Talk every day, teeth every morning #Fun Today 845

คำเตือน: ความเห็นส่วนบุคคล ไม่ใช่คำแนะนำการลงทุน ผลการดำเนินงานในอดีต มิได้เป็นสิ่งยืนยันถึงผลการดำเนินงานในอนาคต ทำความเข้าใจลักษณะสินค้า เงื่อนไขผลตอบแทน คู่มือการลงทุน และความเสี่ยงก่อนตัดสินใจลงทุน