Enter 2022.05.04 16:27

Edit 2022.05.04 16:27

Hantoo Securities “The return on ‘boy ants’ is higher than that of their parents…because of long-term investment”

“The number of underage customers is increasing and the average age is getting younger”

In volatile stock markets, it has been found that underage investors have higher returns than adult investors.

Korea Investment & Securities announced on the 4th that as a result of analyzing the investment status of all underage customers who held stock accounts from the beginning of last year to the first quarter of this year, the rate of return was 1.51%.

During the same period, the rate of return for customers in their 30s and 40s was -0.64%.

Although both generations had relatively high returns until the end of last year, Korea Investment & Securities explained that the rate of decline in the returns of the underage generation was small during the stock market correction at the beginning of this year.

During this period, the number of orders for each underage customer was 19.1, which was 12% of the customers in their 30s and 40s.

In the case of underage accounts, it is analyzed that the difference in returns is attributed to the fact that they are more of a long-term investment than short-term trading.

The holdings of each generation were similar: Samsung Electronics, Samsung Electronics’ preferred stock, Kakao, and Kakao Bank.

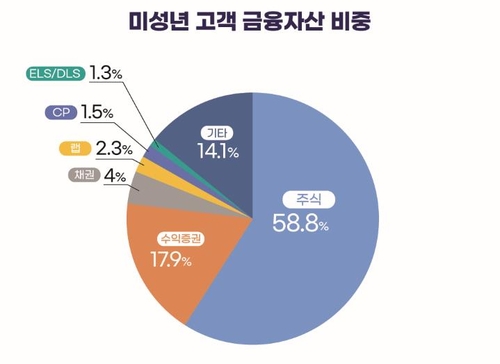

As for the financial asset type of underage customers, stocks accounted for the most at 58.8%, followed by beneficiary certificates (funds) 17.9%, bonds 4%, wrap accounts (comprehensive asset management) 2.3%, commercial papers (CP) 1.5%, stock-linked securities ( ELS) and derivative-linked securities (DLS) were followed by 1.3%.

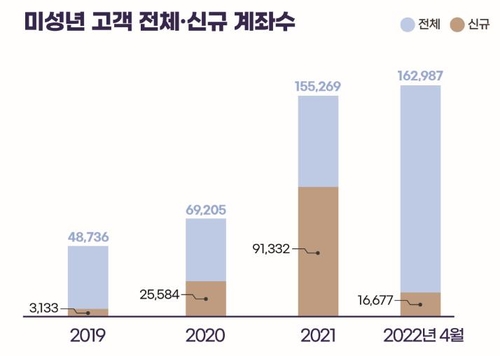

The number of underage customers of Korea Investment & Securities was 163,000 as of the end of last month, a 234% increase from the end of 2019.

During this period, the average age of underage customers decreased from 12.7 years to 10.8 years.

During the same period, the stock balance in the accounts of minors increased by 385.7% from 127.4 billion won to 618.6 billion won, significantly exceeding the growth rate of the stock balance of those in their 30s and 40s (189.7%).

An official from Korea Investment & Securities said, “As the accessibility of financial investment improves and the proportion of investment by the younger generation increases, the number of underage customers will continue to increase.” .

/yunhap news

ⓒ Hankyung.com, unauthorized reprinting and redistribution prohibited