Enter 2022.04.30 07:00

Edited 2022.04.30 07:00

Times Square advertisement. photo = NYSE

It was revealed that Massachusetts Institute of Technology (MIT), the world’s No. 1 university, was losing 300 billion won following investing its donations in Coupang stock. The University of Washington also lost 100 billion won in Coupang stock. When Coupang’s stock price plummeted, American universities panicked.

As a result of analyzing the ‘Investment Report (13F)’ submitted to the US Securities and Exchange Commission (SEC) on the 29th, 106 institutions purchased new Coupang stocks or increased their shares in the third and fourth quarters of last year. New investments include universities, as well as the charities of Microsoft founder Bill Gates.

Coupang was listed on the New York Stock Exchange on March 11 last year at an offering price of $35. After soaring to $69 on the first day of listing, it continued to decline and plunged to $13.63 as of the closing price on the 29th. American universities have been intensively accumulating Coupang since the third quarter of last year, when the stock price fell below the offering price.

Coupang stock price. photo = NYSE

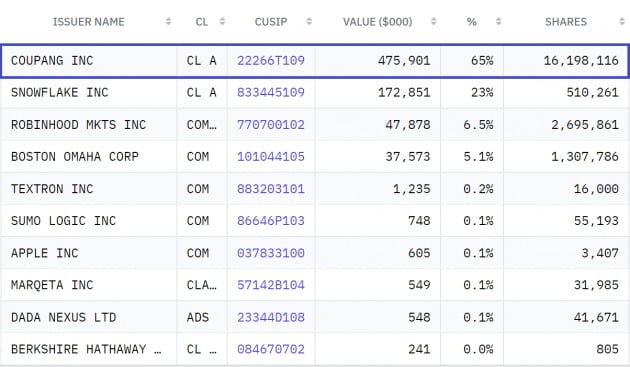

MIT newly purchased 16.19 million shares (worth 593.9 billion won) in the fourth quarter of last year. It accounts for 65% of the total assets under management. The University of Washington purchased 5.43 million shares (worth 199.3 billion won) over the third and fourth quarters of last year. At the University of Washington, Coupang accounts for 45% of its total assets.

But as the stock price plummeted, more than half of the donations were lost. The purchase price of MIT is estimated to be $29.38. Considering that the current share price is $13, the loss amounts to 300 billion won. The average purchase price of the University of Washington is $28.62.

Bill & Melinda Gates Foundation, Bill Gates’ charitable organization, invested 350 billion won (5.71 million shares) in the first quarter of last year, when the stock price peaked. The average purchase price is $49.35. As the stock price plummeted, the Bill Gates Foundation’s Coupang valuation loss recorded 250 billion won.

MIT Tech’s stock portfolio. Coupang accounts for 65% of the total. Photo = U.S. Securities and Exchange Commission

If the stock price does not recover, universities will face an unprecedented situation in which donations such as blood taxes are blown away. MIT’s loss of 300 billion won is enough to provide full scholarships to all students (4638 undergraduate students) for one year. If it was Korea, all the school executives would have taken off their clothes.

It is not clear exactly why a prestigious American university with the world’s best brains invested in Coupang. However, if you follow the research and articles of these universities, you can infer why they even gave up donations to Coupang.

MIT Technology Review, a technical analysis magazine published by MIT, published an in-depth article comparing Coupang and Amazon in June of last year. In the article, MIT wrote that half of the Korean people use the Coupang app, and Coupang’s ‘rocket delivery’ overwhelms Amazon, the originator of online shopping.

MIT Technology Review tweeted that Coupang is dominating Amazon.

There are also analyzes that the business structure itself has elements that foreigners will like. “Coupang is a high-tech platform company that combines UPS (Rocket Delivery), Door Dash (Coupang Eats), and Netflix (Coupang Play) with Amazon,” said Lydia Jet Vision Fund Manager, who was a member of the Coupang Board of Directors.

There is also an interpretation that the company lost its investment in public offering stocks and suffered a loss by pursuing it. In the United States, the listing organizer has ‘full power’ in the allocation of IPO shares, but Coupang has selected 25 institutions as an exception. This is why Coupang was called ‘out of stock’ when it was listed in March last year.

It’s not just American universities who have been bitten by Coupang. Numerous institutions, such as Bailey Ridford, Duquesne Capital, and US investment masters are suffering huge losses from Coupang. Rosebud Advisor, an American asset management company, filled all of its assets under management in the fourth quarter of last year with Coupang stocks.

In Korea, the evaluation is positive, but it is not. Some analysts say that the masters would not have invested in Coupang for no reason, and that now is a buying opportunity when the stock price has plummeted. If the stock price fails to recover, it will be recorded as a rare case where investment legends have suffered losses one following another.

Dealing with the news of the Yeouido stock market and the stories of ants is published every Saturday. By subscribing to the press page below, you can receive articles without missing out.

By Park Eui-myeong, staff reporter [email protected]