This Friday (July 15), the United States announced two important economic data and recorded better-than-expected results. The three major U.S. stock indexes closed up across the board. It rose 2.2% but the three major indexes all recorded negative lines for the week.

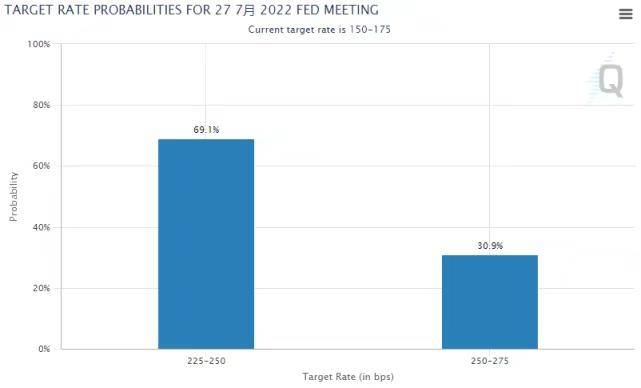

Earlier this week, as the market weighed the financial reports of several major Wall Street banks, as well as important economic data such as CPI and PPI, the probability of the interest rate adjustment market betting on the Fed raising interest rates by 1% this month soared to 80%. That probability has fallen sharply to 30% on Friday. In other words, the market expects that the Fed will only raise interest rates by 0.75% this month.

As of Friday’s close, the Dublin Index rose 658.09 points, or 2.2%, to 31288.26; the S&P 500 rose 72.78 points, or 1.9%, to 3863.16; the Nasdaq rose 201.24 points, or 1.8%, to 11452.42 from. For the week, the Dow Jones Industrial Average fell 0.2%, the S&P 500 fell 0.9%, and the Nasdaq fell 1.6%.

Data released on Friday showed that the University of Michigan consumer confidence index in the United States in July was 51.1, expected to be 50, and the previous value was 50. In terms of sub-indices, the initial value of the consumer current situation index in July was 57.1, the largest monthly increase since April 2021, with an expected 53.7 and the previous value of 53.8; the initial value of the consumer expectations index in July was recorded at 47.3, a slight drop from the previous month , expected 47, former value 47.5.

However, in terms of inflation expectations, which are closely watched by the market, the final value of the one-year inflation expectation of the University of Michigan in July was recorded at 5.2%, lower than the expected 5.3%, and the previous value was 5.3%. Earlier this year, the short-term inflation expectations index once reached 5.4%, a new high since 1981; the initial five-year inflation expectations were recorded at 2.8%, a 12-month low, expected 3%, the previous value of 3.1%.

“While the recent drop in U.S. oil prices may give consumers some respite, we believe consumers Confidence is unlikely to materially improve in the near term, and U.S. households have yet to significantly cut back on spending, but with rising interest rates, a decline in the purchasing power of money due to high inflation, and rising economic uncertainty, there might be a surge in the coming months. It will dampen consumer confidence for a while.”

On Wednesday, the U.S. Labor Department announced that the U.S. CPI rose 9.1% year-on-year in June, the largest increase since the end of 1981. However, following the release of the latest University of Michigan consumer confidence data on Friday, and several Fed hawks in the past few days have cooled their expectations for a 1% rate hike this month, the market has reacted to the Fed’s violent 1% rate hike in July. It is expected that the CPI plummeted to 30.9% from close to 80% following the announcement a few days ago.

Expectations for the Fed to raise interest rates by 1 percentage point this month fell sharply from 80% to 30.9%.

The Fed’s hawkish senior official and St. Louis Fed President Bullard on Friday poured cold water on raising interest rates by 1% this month, saying that it may not make much difference whether it is 0.75% or 1% now, and that he is skeptical that the U.S. economy will decline. manner. He favors a 0.75% hike.

The U.S. dollar and U.S. Treasury yields turned lower on Friday as expectations for an aggressive 1 percent rate hike by the Federal Reserve “receded.” The U.S. dollar index fell below 108.00 in intraday trading, down more than 1% from the nearly 20-year high set on Thursday. The 10-year U.S. Treasury yield dropped as low as 2.9 percent at one point, away from Thursday’s high of regarding 3 percent. The two-year U.S. Treasury bond yield, which is more sensitive to interest rates, continued to fall following turning lower during the session on Thursday, at one point down 20 basis points from Thursday’s high, but the yield was still higher than that of the 10-year U.S. Treasury note and the 10-year U.S. Treasury bond. The yield curve continues to invert. Supported by the fall of the US dollar, the exchange rate of the euro once morest the US dollar temporarily stayed away from the trough of nearly 20 years, and did not continue to fall below the parity of 1 to 1 once morest the US dollar, and 1 euro was 1.0087 US dollars.