The government of Luiz Inácio Lula da Silva intends to end the import tax exemption for orders of up to US$ 50 (equivalent to R$ 250) destined for individuals. The measure aims to combat fraud and tax evasion by e-commerce companies, such as AliExpress, Shein and Shopee, which have conquered a significant part of the Brazilian market with cheaper products and are accused of unfair competition by local companies.

With the change, the Federal Revenue of Brazil intends to raise up to R$ 8 billion with the taxation of international retail platforms that circumvent the country’s tax rules. The proposal is part of a package of measures that aims to increase revenue by up to R$ 150 billion and reach the fiscal targets established by the government.

How will the new import method work?

In order to make inspection of electronic commerce more effective, the Revenue provides for the obligation of complete and advance import declarations, identifying exporter and importer, with the possibility of a fine in case of underinvoicing or incorrect information. In addition, there will no longer be a distinction in the treatment of remittances by legal entities and individuals, which currently facilitates widespread fraud. The companies mentioned above sent products by individual to individual, thus there was tax exemption for purchases below US$50, according to Law 1804 of 1980. And according to the government, this was a form of smuggling. In addition to this fact, orders regardless of their value were under-invoiced to under $50 to also fit the rule. Now any and all foreign shipments to Brazil will be taxed, whether an individual or legal entity sends goods to you.

new inspection

The new approach will allow the goods to arrive in Brazil already released, being able to go directly to the consumer. That is, the stores need to send the product ready to arrive at your home, the Federal Revenue will no longer need to inspect these products.

The Federal Revenue must provide a system for the exporter to record information regarding the product he is sending, so that a payment form for this tax will be issued. The amount of taxation will remain the same as in Law 1804, in the amount of 60% of the price informed by the exporter.

Everything will be taxed, is the import over?

The Brazilian government’s initiative seeks to ensure a fairer and more balanced environment for local companies, which face competition from international retail platforms, and to reinforce compliance with tax laws in the country.

Now with this new measure, the average value of imported products will be 60% higher, the Xiaomi Redmi Note 12 cell phone, which is priced at R$ 1012, will be raised to R$ 1619.20. Is it really over? See the price difference of these two products.

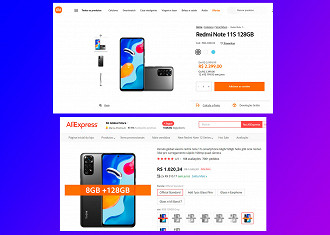

The Redmi Note 11s, a smartphone that was heavily imported, in Brazil costs R$2,399 at the official Xiaomi store, on AliExpress the same smartphone with 128GB costs R$1020.34. Adding the 60% the value would be R$ 1632.54, still costing almost 32% less.

ICMS?

These values still differ, showing that there are chances of importing, but it will no longer be as cheap as before. There is still ICMS taxation, charged by state. As expected, the state government also wants its share of the cake, the rate varies between 17 and 18% in the states today.

I.e, in addition to the 60%, it is likely that you will still pay 18% more under the BRL 1,020.34 totaling the following calculation: BRL 1,020.34 + (612.20) + (183.66) ICMS, totaling BRL 1,816.20, still cheaper than the same product bought in the official store in Brazil.

What do you think regarding it? Comment below.