2024-03-04 15:48:00

The inflation es one of the main evils that afflicts Argentinians. After a government of Alberto Fernández with a Consumer’s price index of the 931% accumulated during his mandatethe government of Javier Miley He arrived at the Casa Rosada with the promise of lower it “with a slingshot.” However, the numbers for December (25.5%) and January (20.6%) They were very high and the libertarian cabinet already announced that this scenario would remain this way until, at least, April.

In this framework, a recent report by the Center for Economic and Social Studies ‘Scalabrini Ortíz’ (CESO) He put the focus on himself, indeed, the “shock plan” applied by Freedom Advances is enough to defeat the rise in prices or if, on the contrary, it does not attack the root of the problemwhile leaving workers, retirees, children and the population as a whole without the tools to cope.

Milei delegated control of the trust funds to Caputo: they represent close to US$ 20 billion

Fiscal, salary, exchange and monetary approach: Milei’s pillars to seek a reduction in inflation

According to the work of the entity, the economic program It is based on four fundamental pillars. First of all, it highlights a tax approach which, during January, implied a cut in real terms of 40% in primary expenditures, with a mainly targeted adjustment, unlike what was mentioned in the campaign, to transfers to the provinces and to income to retirees and public sector employees.

To be specific, and according to the owner of the Argentine Institute of Fiscal Analysis (IARAF), Nadín Argañarazretirement benefits They contributed 33% of the adjustment. For their part, energy subsidies increased by 14%, real direct investment, such as public works, by 12%, transfers to provinces, by the same number, and public salaries by 11%.

In the case of older people, the “blender”generated from the lack of updating of amounts that retirees and pensioners receive monthly, and that in the first month of the year it amounted to $105 thousand, implied a sharp drop in purchasing powergiven that With the same pesos they were able to buy a smaller amount of goods and services in the midst of a more than adverse inflationary framework that hits, mainly, to the most vulnerable sectors.

Secondly, a salary adjustmentespecially in the public sector. The latter is important as “that, on the one hand, contributes to the success of the fiscal anchor, and on the other hand tries to act as a discipline for private sector workers“, indicated the letter, taking into consideration that, beyond the progress in joint negotiations in certain sectors, there are others where, at the mercy of the business chambers, the increases have been below the CPI or, directly, no increase has been carried outfreezing income, in these cases, since December of the recently ended year, symbolizing a severe blow to the pockets.

According to CESO“these two pillars They seek to reduce monetary emission and cause a recession to control demand”, which can be translated, in other words, in the search for a decrease from a drop in consumptionwith a sharp decline in the last two months, As demonstrated by recent figures from the Argentine Confederation of Medium Enterprises (CAME)with an abrupt drop of 27% in the index that records retail sales, with food and medicine as the main items affected.

Thirdly, for its part, there is a exchange anchor. After an initial devaluation of 118% in the first hours of government, the Government adopted a strategy of daily micro devaluationsalso known as crawling peg, of the order of 2%. However, according to the Center, “it doesn’t seem sustainable”since, considering the objective of keeping prices stable, “as soon as the pace accelerates or a new exchange rate jump is chosen, we will see a new jump” inflationary.

“As the months approach when the thick harvest is liquidated, and the current exchange rate loses compared to inflation, Pressures will appear from the different exporting groups for a new devaluation. In fact, the International Monetary Fund has already gone ahead and suggested speeding up the crawling peg from 2% to 8% monthly“he warned.

Those who finance the fiscal surplus: stories behind the reduction of State expenses

While, finally, a “unconventional” monetary-financial strategyas cataloged CESOstarting from the “implementation of an interest rate that is substantially below inflation“, currently in order of 9% monthly, and “the liquefaction of the stock of pesos in the economy.”

“Again, thinking that this reduction in the monetary base will contribute to reducing present and future inflation“, he highlighted, a theory that he sought to contradict by highlighting that “in a scenario like the current onethe inertial factor is a key component and if it is not combated it will be difficult for inflation to decline sustainably.“, emphasizing that “none of the anchors mentioned seem to address this problem.”

“In a regime of high inflation, any price shocks on key variables (such as a sharp rise in the dollar or rates) accelerates inflation not only in the present, but also in the future since it is perpetuated by the inertial components (indexation of contracts and expectations)”, he argued.

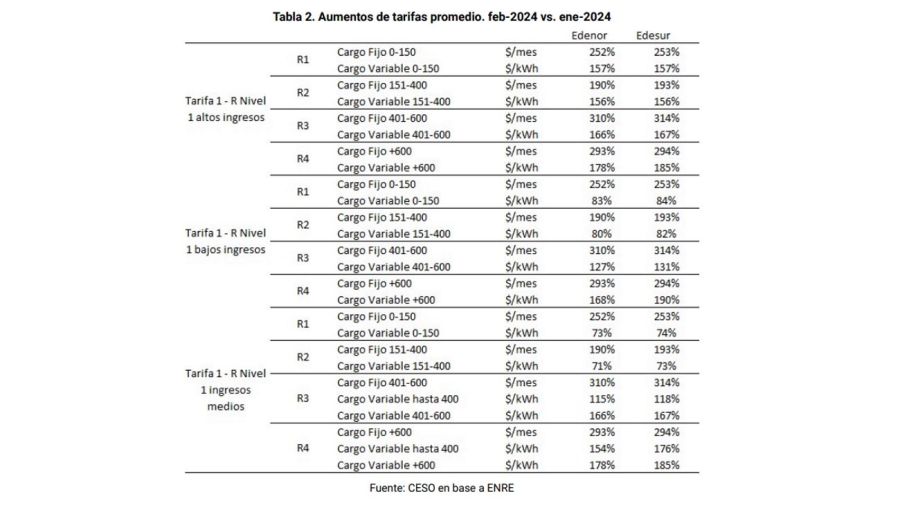

In this sense, the report emphasizes in increases in public service ratesas those of electrical energywhose schemes have already been published and, therefore, “these increases will have a strong impact on inflation in the coming months”. The same ones, as he remarked CESO, “range from 71% to 190% in the case of variable charges, and up to 310% in fixed charges”. “In addition, the public hearing held last week anticipates a reduction in subsidies that would imply 1% of GDP that homes and businesses will have to face,” he added.

All of this will effectively have its impact on prices through an increase in the costs of producing goods or developing services. According to the president of the association Argentine Industrial SMEs, Daniel Rosatothe increase for businesses It would be around 30%. “On the January invoice There was a 40% increase in the Wholesale Electricity Market (MEM)arranged by Cammesa. To this we must add increases in February and April, which will accumulate 314% for the industry; what will mean a 30% increase in gondola“, argument.

May Pact: the business sector unanimously celebrated the call for dialogue

Is dollarization the only way to lower inflation?

Based on this adverse panorama, and looking to the future, CESO addressed two possible variables: the continuation of the adjustment adding a new devaluation that allows them to continue accumulating reserves, sustaining high inflation and appealing to the “tolerance” of an already severely punished society due to the loss of purchasing power, face himAs the President of the Nation expressed on repeated occasions, the dollarization of the economy.

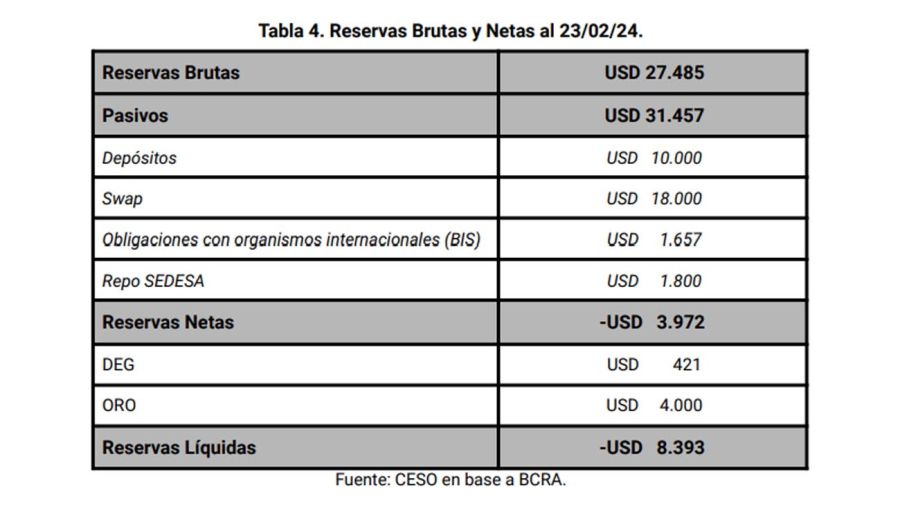

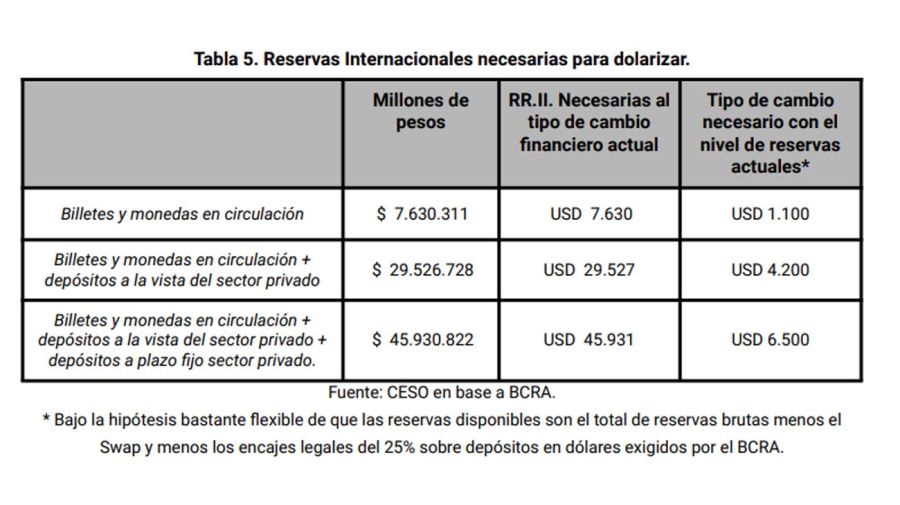

However, This issue also has its edges and, of course, complexities.. “On the near horizon appear more unknowns than certainties. The truth is that if the current government decides to undertake full dollarization (converting all peso bills and deposits into dollars), It should have a quantity of available reserves that it decidedly does not have today.; or apply a strong prior exchange rate jump,” the letter said.

The alternatives that appear, then, are “face a precarious dollarization” using “part of the reserves that correspond to private sector deposits in bankseven under a hypothesis of insolvency in the event that China requests the non-renewal of the swap”, in a scenario in which, according to Milei himself, “it would only be enough to cover the bills and coins in circulation” at the parallel exchange rate, a figure close to the US$7,000 million“O well implement a ‘currency competition’ regime”, as the president advanced in recent interviews or as one of his mentors, Domingo Cavallo, mentioned in his blog in recent days.

This would give rise to a prior exchange rate unification and the end of the stockssomething that he anticipated at the recent opening of ordinary sessions in Congress.

However, according to Center for Economic and Social Studies ‘Scalabrini Ortíz’ “neither of the two alternatives is without problems” given that “the liberation of exchange restrictions” necessary to implement one of the two theoretical frameworks “it will surely imply a new devaluation giving rise to a new jump in prices”, so inflation would not go down; quite the opposite, would go up even more.

LR

1709568165

#Mileis #shock #plan #inflation