The entire world is eager to find out when the Federal Reserve (Fed) will commence its interest rate cutting cycle. Therefore, markets will closely analyze Fed Chairman Jerome Powell’s statements on Wednesday regarding US monetary policy following the interest rate decision. Contrary to all predictions, the high interest rate phase in the US persists as economic and labor market data have recently indicated the initial signs of a slowdown. From today’s standpoint, one must question whether the US central bank is, once again, lagging behind in its monetary policy approach. The Fed’s initial interest rate reduction could very well occur alongside a significant downturn in economic activity, a scenario that markets seem to anticipate, betting on quicker declines in interest rates.

To date, Federal Reserve members have refrained from providing clear and reliable indications on when they might first implement interest rate cuts. Nevertheless, numerous signs suggest that the Fed is likely to take action in September.

Is the Fed behind the curve?

Is it correct to say the Fed is behind schedule? This question remains unanswered, but bond traders are wagering on significant interest rate cuts just to be safe.

As reported by Bloomberg, bond traders who are preparing for interest rate cuts beginning in September are increasing their side bets in case of an unexpected collapse in the US economy, which may compel the Fed to adopt even more aggressive measures.

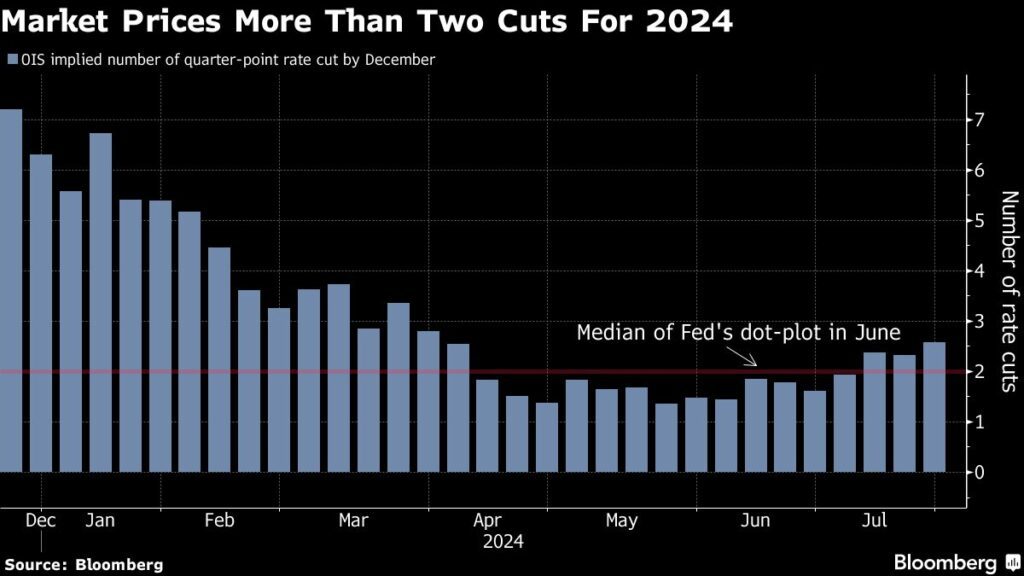

With Treasuries having risen for the third consecutive month, investors are anticipating at least two quarter-point rate cuts this year, slightly more than what Fed officials have indicated. In the derivatives market, certain traders have gone even further, placing bets that would yield profits if central bankers opt for a substantial half-percentage-point cut in mid-September, or begin cutting rates even sooner.

Markets expect more than two Fed rate cuts in 2024Markets expect at least two rate cuts

Markets expect more than two Fed rate cuts in 2024Markets expect at least two rate cuts

While this scenario remains exceptional, speculation over the necessity for such actions has gained traction, as there are indications that both businesses and consumers are feeling the effects of two decades of high interest rates. Although inflation has decreased, investors are increasingly anxious that the labor market is wavering—an issue that Fed officials have stated they will monitor closely. The substantial gap between the July meeting and the September meeting introduces additional risks.

“It’s reasonable to conclude that if the labor market exhibits further signs of weakening, the economy will deteriorate, prompting the Fed to lower rates further,” stated Jack McIntyre, a portfolio manager at Brandywine Global Investment Management. “What remains uncertain is the nature of the cutting cycle.”

The alert level escalated last week when former New York Fed President William Dudley and Mohamed El-Erian cautioned that the Fed risks making a misstep by maintaining rates at excessively high levels for too long—Dudley even suggested a rate cut during this week’s meeting. Both expressed their views as columnists for Bloomberg Opinion.

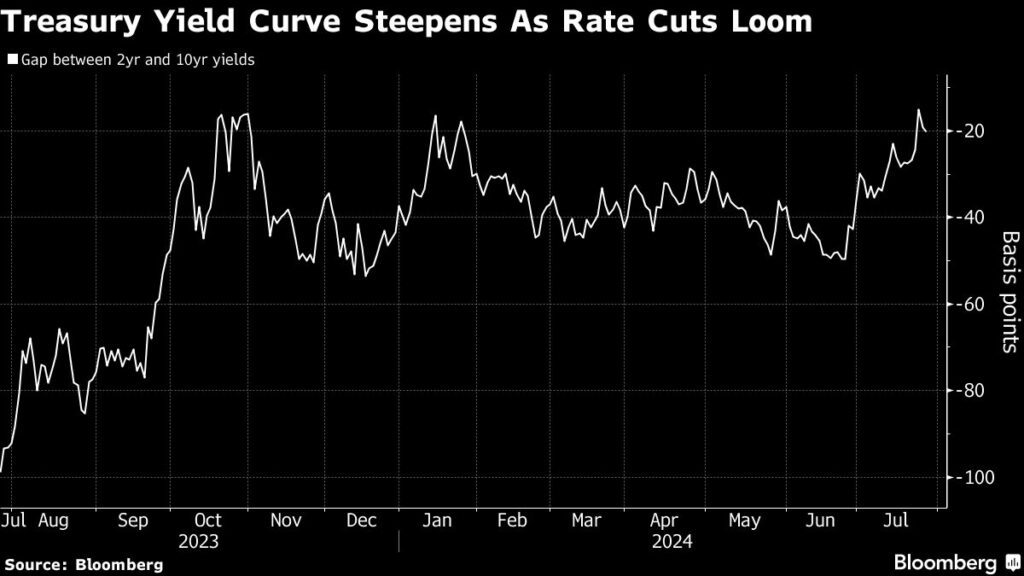

This commentary alone was sufficient to ignite market activity, leading to a drop in monetary policy-sensitive short-term US yields in a typical steepening pattern observed preceding an easing cycle. Nonetheless, mild data regarding jobless claims, US growth, and Consumer spending support arguments for the US Federal Reserve to exercise caution this week.

The latest data “reduces the urgency for the Fed to act,” Michelle Girard, head of U.S. markets at Natwest, informed Bloomberg Television on Thursday. “The Fed wishes to avoid inducing panic.”

Yield curve: Yield curve of government bonds becomes steeper as interest rate cuts loomExpectations of falling interest rates rise

Yield curve: Yield curve of government bonds becomes steeper as interest rate cuts loomExpectations of falling interest rates rise

Anticipations of forthcoming rate cuts have collectively bolstered Treasuries, driving yields sharply down from late-April peaks, despite recent turbulence triggered by the impending U.S. presidential election. The Bloomberg U.S. Treasury index has reached a two-year high this month and is likely to conclude July with a three-month winning streak not seen since mid-2021.

Fed policymakers have maintained their one-year target rate at 5.25% to 5.5% while they await indicators of a sustained cooling in inflation. Since prices appear to be moving in a favorable direction—recent data showed the Fed’s preferred measure of inflation rose only marginally in June—they have started to emphasize the other side of their so-called dual mandate: full employment.

In this context, the upcoming months will be critical, including the jobs report due next Friday. Signs of considerable weakness “could raise new questions about the soft landing and possibly lead the Fed to fall behind the curve and miss the chance to cut rates in July,” said George Catrambone, head of fixed income at DWS Americas.

As the Fed is widely expected to remain cautious, Fed Chair Jerome Powell may utilize his press conference on Wednesday to address new economic concerns or potential policy changes. However, some economists anticipate Powell may announce a rate cut for September.

A significant interest rate reduction would signal deeper cuts to come

However, if the groundwork for more substantial-than-expected cuts begins, it could signal a dire message: only after the dot-com bubble burst in early 2001 and the outbreak of the financial crisis in September 2007 did the Fed implement a half-percentage-point cut, marking the beginning of major easing cycles.

JPMorgan’s Michael Feroli does not foresee such a turnaround. In a note released Friday, he stated he expects Powell “will not point to a specific meeting for the initial rate cut.” If questioned as to why the Fed is opting not to cut rates this month, Powell may assert that central bankers are awaiting additional evidence of progress regarding inflation.

What Bloomberg strategists say:

“Bill Dudley’s latest column advocating for rate reductions this week illustrates a shift in sentiment. Suddenly, it’s not inflation that occupies everyone’s thoughts; rather, it’s the uptick in the unemployment rate.” – Edward Harrison.

George Goncalves, head of U.S. macro strategy at MUFG, anticipates further signs of an economic slowdown by September, which could provoke a preemptive response from the Fed.

“The notion of gradual, steady rate cuts seems illogical given the current data trends,” Goncalves remarked. “The longer you stall, the more you might need to act later.”

Some market participants believe that the level of uncertainty is sufficient to warrant precautionary bets. In recent weeks, traders have opted for options linked to the Secured Overnight Financing Rate, which closely reflects Fed policy expectations, to prepare for more aggressive scenarios, such as a quarter-point rate cut as early as July or a half-point rate cut in September.

“When a 25 basis point cut is fully priced in, only two options remain,” explained Ed Al-Hussainy, a rates strategist at Columbia Threadneedle Investment. “You can position for zero or for 50.” Here are his comments:

FMW/Bloomberg

Federal Reserve’s Interest Rate Cuts: Are We Facing a Shift in Monetary Policy?

Current Landscape of the Federal Reserve’s Monetary Policy

The whole world is still waiting to see when the Fed will finally embark on an interest rate cut cycle. Markets will pay close attention to Fed Chairman Jerome Powell’s statements regarding US monetary policy following the interest rate decision. Contrary to expectations, the high interest rate phase in the US persists, even as recent economic and labor market data signal initial signs of a slowdown. The pressing inquiry remains whether the Fed has fallen behind in its monetary policy decisions. It seems the first interest rate cut might align with a significant decay in economic activity, a scenario that’s gaining traction in market speculation that anticipates quicker rate declines.

Is the Fed Behind the Curve?

Questions surrounding the Federal Reserve’s timing gain momentum as bond traders place their bets on substantial interest rate cuts. According to Bloomberg, traders positioned for cuts beginning in September are also preparing for a potential collapse in the US economy, which could prompt the Fed to adopt more aggressive measures.

Market Expectations for Rate Cuts

As Treasury values rise for three consecutive months, investors project at least two quarter-point rate cuts this year, surpassing the more conservative forecasts from Fed officials. Some traders in the derivatives market have upped the ante by placing bets that would yield returns if the Fed enacts a significant half-percentage-point cut in mid-September or moves even sooner.

The increasing speculation around the necessity of aggressive rate cuts relates to the growing indications of economic strain on businesses and consumers stemming from two decades of elevated interest rates. While inflation levels are declining, concerns arise regarding a potential weakening of the labor market—an aspect Fed officials vow to monitor closely.

Key Indicators to Watch

- Labor Market Data: Ongoing assessments of job reports will prove pivotal in determining any shift in monetary policy.

- Inflation Metrics: Continued observation of inflation trends will shape the Fed’s decision-making process.

- Global Economic Conditions: Broader market conditions will also play a crucial role in possible rate adjustment timelines.

The Role of Economic Indicators

Former New York Fed President William Dudley expressed that the Fed risks errors by prolonging high rates, echoing sentiments shared by economist Mohamed El-Erian, who advocates for action in the upcoming meeting. This commentary alone has ramped up market volatility, resulting in a decline of monetary policy-sensitive short-term US yields, a common precursor to easing cycles.

Recent Economic Developments Impacting the Fed

Despite hints of market anticipation for rate adjustments, benign data on jobless claims and steady US growth adds a layer of complexity. Analysts like Michelle Girard explain that such data may reduce the urgency for the Fed to act, stressing the central bank’s intent to avoid panic.

Yield Curve Dynamics

Expectations surrounding impending rate cuts have contributed positively to Treasuries, which have seen yields plummet from highs observed in late April. The Bloomberg U.S. Treasury Index recently achieved a two-year high, indicating a potential three-month winning streak reminiscent of mid-2021.

Stability Amid Speculation

As the Federal Reserve maintains its target interest rate between 5.25% and 5.5%, they await sustained cooling in inflation figures. Data released recently showed the Fed’s preferred inflation measure rising minimally in June, prompting officials to place additional emphasis on achieving full employment.

The Importance of Upcoming Data Releases

| Data Release | Date | Expected Impact on Rate Cuts |

|---|---|---|

| July Jobs Report | Next Friday | Potential Trigger for Rate Adjustment |

| Inflation Report | Monthly | Influence on Rate Direction |

| Consumer Spending Data | Monthly | Assessment of Economic Health |

Analysts Weigh In: What to Expect Next

Many analysts speculate that August could prove crucial for gauging economic health and its potential effects on the Fed’s decisions. Observations from the market may push Fed Chair Jerome Powell to refine monetary policy strategies in his upcoming announcements.

How Would a Significant Rate Cut Signal Change?

If the Fed begins preparing for cuts deeper than anticipated, it could send alarming signals akin to responses observed in past economic downturns such as the dot-com bubble of the early 2000s and the financial crisis of 2007. Analysts like Michael Feroli from JPMorgan do not foresee substantial changes in the immediate future, suggesting Powell will advocate patience while awaiting further inflation progress.

Shifting Market Sentiment

Market sentiment has shifted significantly, evidenced by Bill Dudley’s recent comments advocating for necessary rate reductions. This reflects changing perspectives as investors move their focus from inflationary concerns toward rising unemployment rates.

Positioning for Uncertainty

Given the considerable uncertainty, some market participants justify employing strategies that hedge against sudden developments. Traders have utilized options linked to the Secured Overnight Financing Rate to brace for aggressive possibilities, factoring in scenarios for rate cuts ranging from minimal adjustments to a significant reduction in September.

Read and write comments, click here