Some believe that the Bank of Canada is partly responsible for the current inflationary surge. Yes, absolutely, it is clear

answered without hesitation Jean-François Perrault, chief economist of Scotiabank, on the show Economy zone Thursday evening. There has been a misdiagnosis of inflation in the previous months. It’s true for the Bank of Canada and it’s true for other central banks

he argued.

Ce misdiagnosis

thus exacerbated the inflationary expectations of the population. Not only is inflation high, but public projections are fueling inflation.

The big culprit right now is the Bank of Canada, the Federal Reserve

said the economist and senator Clément Gignac on Wednesday evening at Economy zone. He shares the opinion of Jean-François Perrault: They took too long to raise interest rates. It’s not lost, there’s still time to recover, but we’ll have to get going more forcefully, faster, to counter inflationary expectations.

We must act quickly, says Mr. Gignac, with marked increases of 50 basis points, perhaps even 75 basis points, at the next meeting of the leaders of the Bank of Canada, on 1is June. Economists tend to favor rapid increases to curb inflation and avoid a recession, as former US Federal Reserve Chairman Alan Greenspan did in the 1990s.

It is rare to see such criticism of a central banker. Of course, the big boss of the US Federal Reserve, Jerome Powell, was repeatedly attacked by President Donald Trump for pursuing a policy of rate hikes. The reprimands of the former president of the United States were factually far-fetched and driven by interests of a political nature that had nothing to do with economic facts.

US Federal Reserve Chairman Jerome Powell.

Photo: Archyde.com/Kevin Lamarque

Today, criticism of Bank of Canada Governor Tiff Macklem is far more serious and comes from credible sources. As Jean-François Perrault explained, the governor made a mistake last fall by continuing to consider inflation as a transitory phenomenon when his counterpart in the United States had already begun to change his tune.

Governments have a role to play

As the Bank of Canada prepares to step on the accelerator in its rate hike, it is also becoming urgent for governments to better target their interventions. With new elections approaching in Quebec and Ontario, it is tempting to distribute checks to everyone. However, when you do that, you fuel inflation.

Support should be targeted to people who really need help: tenants, low-income people, seniors who need the guaranteed income supplement and single parents who have to cope with heavy loads, for example.

The approach of the government of François Legault in the 2022-2023 budget, which was presented in March, was deemed inflationary by several economists. It is nevertheless, it should be remembered, that 3.2 billion dollars are being injected into the economy by the government at the moment with the distribution of a check for $500 to 94% of the adult population.

It is not a sum injected over 12 months, over two years or over five years. That’s $3.2 billion invested in the economy in April and May 2022. It’s immediate and it’s necessarily inflationary.

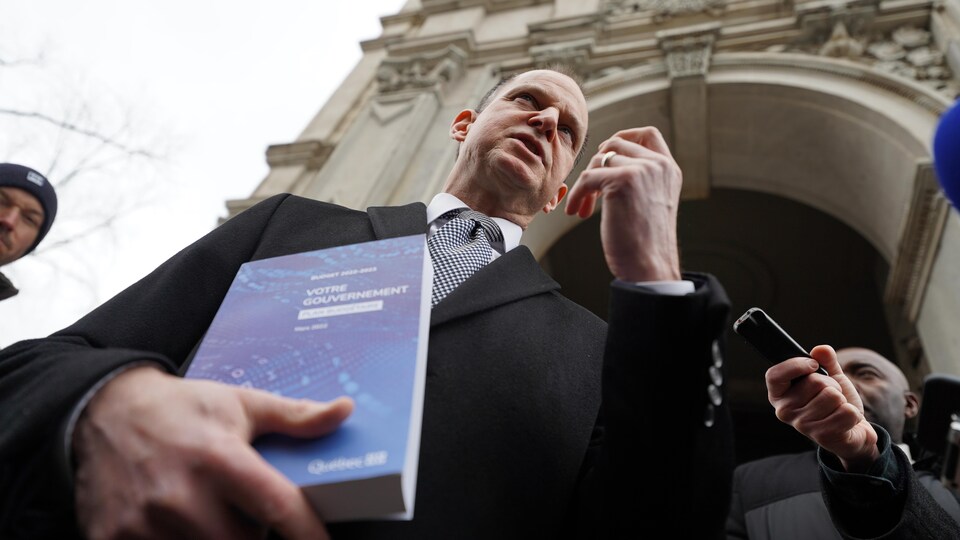

Quebec Finance Minister Éric Girard

Photo : Radio-Canada / Sylvain Roy Roussel

According to Clément Gignac, the financial injection of the Legault government in 2022 would represent 0.6% to 0.8% of gross domestic product (GDP). According to data from the National Bank of Canada, the new government initiatives contained in Éric Girard’s budget amount to $22.7 billion over six years. It is 4.2% of gross domestic productSTART.

If we compare this with Chrystia Freeland’s federal budget, the financial injection in 2022 would represent 0.2% to 0.3% of the gross domestic productSTARTby 1.2% in five years with initiatives whose cost is estimated at 30 billion dollars.

The example of France

We have to look at the choices that have been made in France. The Macron government has opted for a price shield which aims to freeze gas prices and cap electricity price increases.

This temporary measure allowed France to post an inflation rate of 4.5% in March, while inflation reached 6.7% in Canada7.3% in Germany and 8.5% in the United States.

This approach seems more efficient. And if the Bank of Canada and the Federal Reserve have been slow to act, governments should not throw oil on the fire. Today, the objective must be to bring inflation down without pushing the economy into recession.

If rates are raised too quickly, the economy might seriously slow down. If this is not done and inflation gallops further, it is also possible that the economy will plunge into recession. This is a very delicate situation which requires a far-sighted approach on the part of central banks and governments.

:max_bytes(150000):strip_icc():focal(999x0:1001x2)/allison-holker-stephen-tWitch-boss-052924-14eb467c3bc54d9293066f3743d8a624.jpg)