© Archyde.com. In the past month, the list of institutional research companies has been released: Mindray Medical has been surveyed by 593 institutions, and Amic and Chacha have received attention

Financial Associated Press, May 6 (Reporter Yang Hui) Under the turbulent market, hot spots are frequently switched. Which industries and which companies are worthy of attention? From the companies that have been researched in the past month, including securities companies, insurance institutions, etc., clues may be found.

After the adjustment since April, the valuations of many industries have reached the historical bottom, and the research interest of institutions on related industries has also continued to rise.

Recently, the industries in which the hot companies surveyed by the institutions have changed. The obvious contrast is that companies in related industries such as electronics, pharmaceuticals, and biology that have undergone a long adjustment cycle have received the attention of institutions. When the market adjusts, it may also be a good opportunity for institutions to adjust their positions and adjust their industrial layout.

18 listed companies were surveyed by 300 institutions, and some fell by 25% in the past month

According to wind data, among the listed companies that have received high-frequency surveys by institutions in the past month (2022.4.6-2022.5.6), 134 listed companies have no less than 100 institutional surveys.

Among them, a total of 593 institutions investigated Mindray Medical, 501 institutions investigated Amic, 484 institutions investigated Qiaqia Foods, Goertek (451), CTI Testing (447), Wingtech (413) ), Trina Solar (364 companies), Hikvision (363 companies), Aohua Endoscopy (362 companies), Zhaoyi Innovation (354 companies), Lianchuang Electronics (353 companies), Luxshare Precision (352 companies) companies), Ziguang Guowei (343 companies), China Micro (342 companies), Stone Technology (333 companies), CVTE (333 companies), Tofflon (319 companies), Lyric Robot (306 companies), Proya (280), Huayang Group (277).

A reporter from the Financial Associated Press noticed that among the top 20 companies surveyed by institutions recently, CVTE shares with the highest increase in the past month reached 15.13%, followed by CTI with a monthly increase of 8.96%. It ranked third with a monthly positive return of 2.51%, and others such as Proya (0.78%), Stone Technology (0.08%), and Mindray Medical (0.01%) have achieved positive returns in the past month.

Others, such as Lianchuang Electronics (-25.03%), Wingtech Technology (-24.90%), and Lyric Robot (-16.18%), showed that institutions’ enthusiasm for research on leading stocks in oversold industries has increased significantly.

Interestingly, the ranking of the number of institutional researchers and the ranking of gold stocks in May recommended by securities companies at the same time do not overlap at all, and it is difficult to judge which is the real “wealth password”.

The reporter interviewed the chief of a leading brokerage research institute. According to the normal process, the securities firm will classify and rate the comprehensive situation of the listed company following investigating the listed company. Because some investigations are involved in non-public research, the public research data is not disclosed. Inaccurate, but it does reflect the company’s attention to a certain extent. The normal interval between research and recommendation will be within one month.

With the obvious change in market style, the direction of institutional research is also changing.

Analysis of the investment logic of the industry to which the listed company belongs, and the investment value is highlighted

From the perspective of the industry distribution of the companies to which institutions gather to investigate, the oversold industries such as electronic components, semiconductor products, and medical care are the most concerned by the institutions, and the industrial machinery and biomedical industries are also the focus of the institutions.

Among them, the electronic components industry has received the most attention, and the “Metaverse” concept leader Goertek, Lianchuang Electronics, Luxshare Precision, and CVTE are the targets that institutions pay the most attention to.

Demand for electronic components is delayed, and pessimistic expectations are expected to bottom

CITIC Securities believes that due to fluctuations in the external environment and the repeated impact of the domestic epidemic, the valuation level of the consumer electronics sector has continued to decline since the beginning of the year. The current PE-TTM is 36 times, close to the historical low of 33 times, and the proportion of industry funds with heavy positions in the sector has dropped to 16.61. %, the lowest level in the past five quarters. As the impact of the domestic epidemic weakens, demand recovers, and new terminals such as smart watches, ARVR, and automotive electronics pull in goods, the valuation of the consumer electronics sector is expected to recover. It is recommended to focus on platform companies with continuous category expansion in the industry and companies in the incremental blue ocean and continuous innovation.

According to the statistics of Guosen Securities, since 2022, the electronics sector as a whole has fallen by 35.83%, the electronic chemicals in the sub-industry have a small decline, down 27.06%, and the consumer electronics has a larger decline, down 39.59%; the current PE (TTM) of the electronics industry is 22.56 times, It is in the 0.4% quantile in the past five years, of which consumer electronics and semiconductor PE (TTM) are 25.90 and 36.40 times, respectively, in the 8.0% and 0.2% quantiles in the past five years.

Orient Securities is optimistic regarding the annual sales volume of the iPhone series and the replacement effect brought regarding by the release of new consumer electronics products. Leading companies in each link are expected to benefit from the performance elasticity brought regarding by the high prosperity of the industry chain. It is recommended to pay attention to the leading enterprises related to the industry chain.

The semiconductor boom continues, and the performance of many companies exceeds expectations

Essence Securities said that among the shareholders of semiconductor equipment companies, the proportion of institutional positions held in Q1 dropped sharply compared with last year’s Q4, which was at a low level, and more institutional positions were concentrated in large-cap companies. The current price-to-sales ratio has been reduced to historically low levels. The median PS (TTM) of statistical semiconductor equipment companies has fallen to a nearly 40-month low.

Founder Securities believes that the shortage of stock prices continues, and the product delivery time is extended once more. The transformation of new energy sources such as oil vehicles to trams and photovoltaic charging piles has greatly stimulated the demand for power semiconductors. The global rare tide of shortages and price increases in the entire supply chain has brought alternative opportunities to domestic power semiconductor manufacturers. At present, overseas manufacturers still occupy a dominant position in the fields of higher value-added automobiles and new energy power generation, while domestic manufacturers have a larger share of space.

Healthcare equipment valuations at near 10-year lows, focus on structural business opportunities

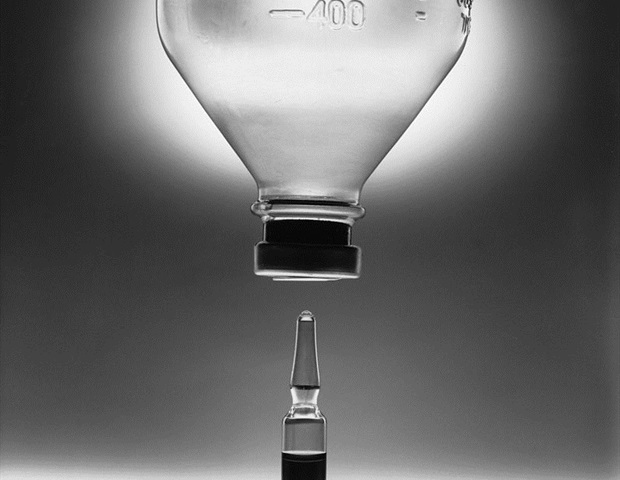

As a sector with a larger decline since 2021, medical equipment has recently been investigated by institutions. Mindray Medical, the leader in medical devices, and Amic, the leader in medical cosmetology, were hit by the “threshold” by institutions, and leaders in sub-sectors such as Aohua Endoscopy also received attention.

Soochow Securities believes that due to the complex macro environment at home and abroad, the pharmaceutical sector has fallen significantly, but the valuation of the sector has fallen to the lowest point in the past ten years. Fundamentals, valuation system and chip structure and other factors support the pharmaceutical sector to stabilize and bottom out. With the improvement of the domestic epidemic situation, medical services and medical beauty are expected to achieve recovery growth.

According to the statistics of Southwest Securities, since the beginning of 2022 (as of 20220430), the Shenwan Pharmaceutical Index has fallen by 23.25%, underperforming the CSI 300 Index by 4.55%, ranking 22nd in the industry since the beginning of the year. As of the end of April 2022, following nearly a year of correction, the valuation of the pharmaceutical sector has been at a historically low level (PE-TTM is 24 times); it is recommended to focus on three main investment lines following the epidemic: 1) Chinese medicine sector; 2) Self-consumption Property sector, 3) Resumption of production and work sector following the epidemic.

Western Securities said that although the pharmaceutical industry has experienced a significant drawdown, the underlying logic of industry investment has not changed. It still focuses on breakthroughs in medical technology, improved R&D efficiency, and satisfied medical needs. Companies that conform to the industry trend are still worthy of long-term optimistic.

Demand for industrial machinery warms up, seize high-end manufacturing opportunities

Guosen Securities is strongly optimistic regarding the growth opportunities of high-end manufacturing under the background of industrial upgrading + independent and controllable. In the long run, it is optimistic regarding the leading companies in China’s machinery industry that are expected to benchmark overseas leading companies with import substitution capabilities and even global competitiveness.

Minsheng Securities suggested that in the case of raw material pressure, repeated epidemics, and mechanical standards still under pressure, attention should be paid to certainty, and the proposed layout: 1) In the context of upstream inflation, deploy mining machinery that benefits; 2) With the anti-epidemic policy Transformation, stable growth, supporting infrastructure and real estate is clear, and construction machinery is expected to benefit from marginal reversal; 3) The detection sector desensitized by the impact of raw material costs; 4) The leading advantage in the subdivision track has been established, and the invisible champion with steady growth; 5) New energy equipment A company with a long-term competitive advantage.

The performance of biotechnology has increased rapidly, and the market in the second half of the year is worth looking forward to

CITIC Construction Investment believes that cell therapy has gone through the proof-of-concept stage and the clinical application stage, and has gradually entered the stage of large-scale commercialization. Industrial chain investment opportunities appear. It is recommended to pay attention to the upstream raw materials, equipment and consumables of cell therapy, midstream CDMOs and downstream innovative pharmaceutical companies.

Pacific Securities proposes that economical, rapid, and effective nucleic acid testing may be an epidemic prevention measure that has the least impact on economic and social development in response to the current novel coronavirus pneumonia epidemic. It is recommended to focus on the new crown nucleic acid detection industry chain: (1) independent third-party medical testing laboratories; (2) nucleic acid detection reagent manufacturers; (3) upstream raw materials such as enzymes, primers, probes, virus sampling tubes, collection swabs, PCR amplification plates and other related consumables, nucleic acid extraction instruments, fluorescent PCR amplification instruments and other testing instruments, nucleic acid sampling workstations and other supporting facilities.