Trump, Trade Wars, and the Malaysian Dilemma

Well, folks, it seems we’ve got ourselves a real plot twist in the global economy—welcome back to the stage, Donald Trump! With his first act as president paving the way for a massive reshuffling of trade practices, we saw a flurry of Chinese companies packing their bags faster than a contestant on *The Amazing Race*. But this isn’t just some slapstick foreign policy; it’s a comedy of errors where recruitment agencies like Joseph Cheng’s have been dancing a high-stakes tango with tariffs.

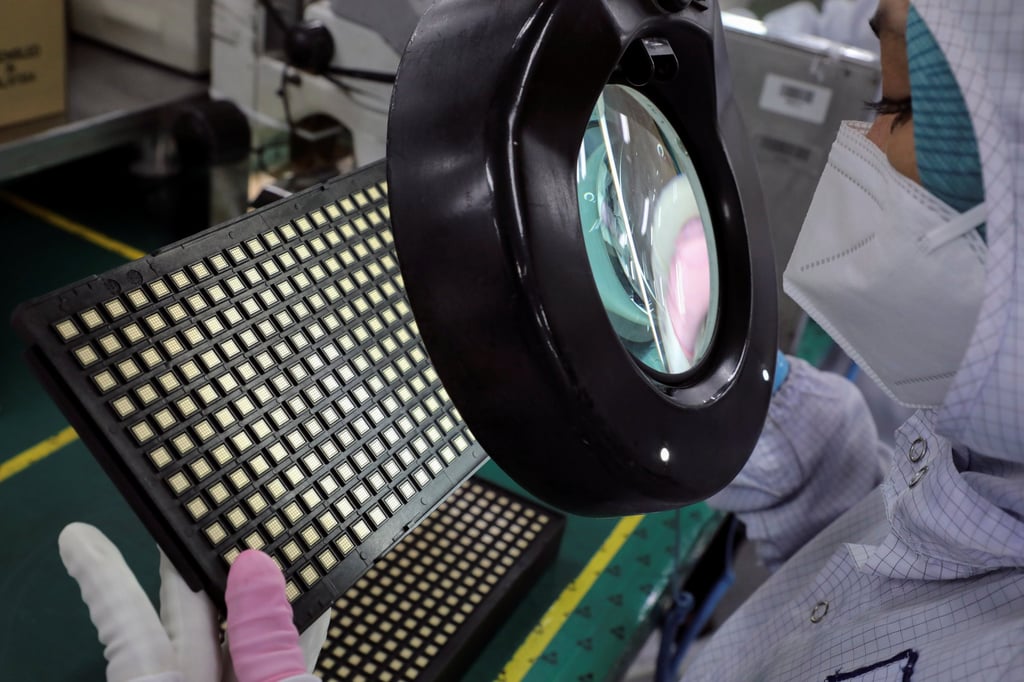

A worker inspects semiconductor chips at a packaging plant in Ipoh, Malaysia. Photo: Reuters

When Trade Wars Give You Lemons

Cheng, who runs the recruitment agency Agensi Pekerjaan TSM, must have thought his luck had turned when companies started relocating to Malaysia to dodge those titanic tariffs unleashed during the Trump-China trade war. “They sent their goods here to be repackaged…then off they went to the U.S.,” he said. Think of it as the global supply chain playing Monopoly, where Malaysia is the coveted property that everyone rushes to land on—before the police (a.k.a. the U.S. tariffs) crash the party.

This manufacturing exodus didn’t just benefit Malaysia; countries like Thailand, Vietnam, and India were also in on the action, with Chinese firms trying to disguise the origins of their goods like a bad magician at a kids’ birthday party.

But Wait—There’s More!

Now, as the long-reflected shadow of Trump looms larger with a potential second term, Cheng’s optimism has taken a nosedive. This time, he fears the tariffs could be “more crazy”—and when you’re talking about tariffs, that’s like saying the plot of *Game of Thrones* had a few too many twists.

As the “China hawks” prepare for a fresh take, the stakes have risen. 20% tariffs on imports from countries with hefty trade surpluses with the U.S. could soon loom over Malaysia like a dark cloud. And let’s not forget strategic sectors like semiconductors and electric vehicles—because nothing says “welcome to the future” like your chips being charged like they’re at an all-you-can-eat buffet.

The Dire Implications

For the people of Malaysia, the implications could be nothing short of catastrophic. Imagine foreign investors sulking away, exports taking a nosedive, and new industries caught in a bureaucratic limbo. It’s a precarious balancing act, like trying to walk a tightrope with one too many sausages for breakfast—you’re bound to fall off eventually!

In a nutshell, as strife continues between giants, it’s the little guys—like Malaysia—that are left catching the flak. So, let’s watch this space as Trump potentially returns like a bad sequel. Here’s to hoping the next act offers a bit more comedy and a lot fewer tariffs!

Stay tuned for more updates, and remember: when it comes to trade wars, it’s usually the spectator that gets the best seat. Unless you’re Malaysia—they’re just stuck in the front row without popcorn!

“They sent their goods here to be repackaged … and then sent them onto the US,” recounted Cheng, director of Agensi Pekerjaan TSM, reflecting on the bustling activity and the frantic efforts to recruit staff to meet the overwhelming demand.

Now, as Trump prepares for a potential second term, Cheng’s outlook has shifted from optimism to genuine concern. He fears that the next round of tariffs could escalate to unprecedented levels, leaving Southeast Asian economies with diminished prospects for gain amid American protectionist policies.

For nations like Malaysia, the potential consequences could be severe: a withdrawal of foreign investments, a dramatic decline in exports, and a stalling of emerging industries.

How do semiconductors influence the production and performance of electric vehicles (EVs)?

“BaseLink-renderAnchor-StyledAnchor”>semiconductors and electric vehicles. This looming threat could transform the landscape of international trade, reversing the gains Malaysia and its neighbors had previously enjoyed.”

The Forward Path

Cheng, like many business leaders in the region, is watching the developments closely. The potential re-imposition of stringent tariffs could shift the dynamics once more, compelling Malaysian companies to innovate and adapt quickly. It becomes essential for businesses to rethink their strategies, perhaps by diversifying supply chains or exploring alternative markets that may be less affected by U.S. policies.

The uncertainty surrounding Trump’s potential return and subsequent trade actions raises significant questions about the future of ASEAN economies. As they grapple with these challenges, the hope remains that regional collaboration and innovation can provide the resilience needed to weather the impending storms. Cooperation among ASEAN member states may emerge as a viable strategy to mitigate the adverse effects of escalating tariffs and maintain economic stability.

As we look ahead, it’s clear that the impact of political shifts in the U.S. will resonate across the globe, and navigating these changes will require both foresight and adaptability from nations like Malaysia. Stay tuned as we continue to track these developments and their implications for the global economy.