Companies are going through a tunnel of ‘zero clock’ due to soaring interest rates and exchange rates. An employee is checking the indicators at the Kookmin Bank dealing room in Yeouido, Seoul on the 23rd, when the won-dollar exchange rate fell 40 days ago to 1,409 won 30, and the KOSPI index dropped 1.81% to 2290.00. Reporter Kim Beom-jun “/>

The U.S. central bank’s (Fed) hike in the benchmark interest rate and the resulting strong dollar are pouring into domestic companies. As the cost of raw materials and logistics soared this year and the exchange rate soared, each company is startled and convening an emergency response meeting to respond to the high exchange rate. The high exchange rate has been a factor in enhancing the competitiveness of export products, but the current high exchange rate is a sign of economic recession. There is growing concern that corporate profitability may deteriorate significantly due to the sudden high interest rate and high exchange rate as soon as it leaves the low interest rate zone for a long period of time.

○ Busy in preparing countermeasures once morest sharp fluctuations in the exchange rate

According to the business world on the 23rd, major companies are busy analyzing scenarios according to exchange rates and preparing countermeasures. In particular, with the forecast that the exchange rate might rise to 1,500 won per dollar early next year, companies are struggling, saying that they have to discard all existing business plans and make new ones.

An official from the electronics industry said, “The market is moving far beyond the expected exchange rate and interest rate figures. He sighed, saying, “Let alone next year’s business plan, we are in a position to re-examine the plan for the fourth quarter, which starts a week later, from the beginning.” An official from LG Energy Solutions said, “The dollar volatility is a bigger problem than the exchange rate rises. It is very difficult to make a stable business plan.”

In particular, companies that have to pay raw material prices in dollars have a lot of trouble. One of them is the food manufacturing industry, which imports raw materials such as wheat, oils and fats, and coffee beans from overseas and processes and sells them. Many companies regret delaying purchasing raw materials because the won has been rising all the time. An official from the food industry said, “In the first half of the year, international grain prices jumped due to the war between Russia and Ukraine, and the purchase of ingredients was delayed.

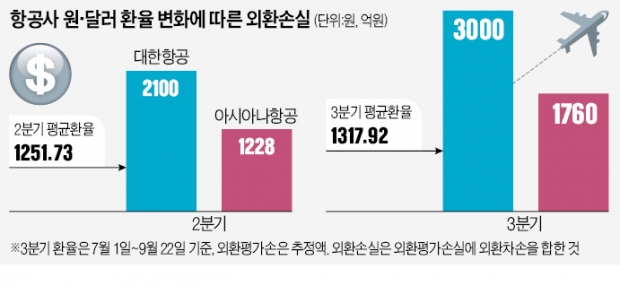

The airline industry, which owes a lot of dollar debt for the import of aircraft, is also a representative industry that suffers from high exchange rates. If the exchange rate rises by 100 won, only Korean Air and Asiana Airlines will lose more than 600 billion won in foreign currency valuation. Asiana Airlines and low-cost carriers (LCC), which operate mainly in Asian countries, are in a situation where interest rates rise and high exchange rates are ‘tangled up’ while traffic with China and other countries is not sufficiently resolved.

The steel industry, which buys iron ore and coal from overseas, and the oil refinery, which imports and refines crude oil, have also been hit hard. The price of iron ore imported by POSCO stood at $126 per ton in the second quarter, up 31.2% from the fourth quarter of last year ($96). As raw material prices fluctuated and the exchange rate soared, the cost of purchasing raw materials is highly likely to rise further in 3Q.

○“The topic for next year is cost reduction”

Businesses agree that the strong dollar will not change easily. This is because the Fed has a strong will to control inflation, and there are many reasons why the dollar has no choice but to strengthen, such as the Russia-Ukraine war and the US-China conflict. Kim Hyung-joo, senior research fellow at LG Business Research Institute, said, “The current high exchange rate is not due to a liquidity crisis as it was during the foreign exchange crisis or the financial crisis.

Companies that benefit from the sharp rise in the exchange rate are also not as bright. Automobile, shipbuilding, and semiconductor-related industries with a high proportion of exports. In the second quarter, Hyundai Motor recorded 2.154 trillion won in sales and 641 billion won in operating profit as a result of the exchange rate appreciation. However, a Hyundai Motor official said, “The bigger problem is that the car does not sell no matter how much money is paid in dollars. ” he worried. Sung-tae Jeong, a researcher at Samsung Securities, said, “In a situation where demand is shrinking due to the economic downturn, the sense of crisis caused by the overall recession is greater than the immediate exchange rate gains and losses.”

Companies are defending once morest exchange rate risk in various ways, such as diversifying supply chains, diversifying payment currencies, and subscribing to derivatives. SPC Group announced that it is considering a plan to pay for raw materials imported from outside the US, such as French butter and Australian wheat, in local currency instead of dollars.

Lee Sang-eun/Park Han-shin/Hankyung Correspondent [email protected]