Stock Market Highlights: AEX Gains, AMX Struggles, and US Markets Closed

Table of Contents

- 1. Stock Market Highlights: AEX Gains, AMX Struggles, and US Markets Closed

- 2. US Interest Rates: A Slight Dip Amid Broader Trends

- 3. Market Overview: A Mixed Bag of Trends and Developments

- 4. Stock Market Highlights

- 5. Commodities and Cryptocurrencies

- 6. Interest Rates and Currency Movements

- 7. Corporate News and Stock Movements

- 8. Looking Ahead

- 9. Biggest Movers in Amsterdam

- 10. Key Takeaways

- 11. Market Trends and Analyst Insights: Key Movers and Shakers

- 12. Recent Market Movements

- 13. Analyst Insights: Stock Picks for 2024

- 14. Notable Performers and Challenges

- 15. Key Takeaways

- 16. Key Economic Updates and Global events for January 10,2025

- 17. Economic Agenda: What’s on the radar?

- 18. US Jobs Report: A Market Mover?

- 19. TikTok’s Fate: A Supreme court Decision

- 20. Global Headlines: What Else Is Happening?

- 21. Retail Woes: Bankruptcies Hit Shopping Streets

- 22. AI Disruption: Banking Jobs at Risk

- 23. California Wildfires: Los Angeles in Crisis

- 24. Tech Milestone: The iPhone’s Legacy

- 25. Conclusion

- 26. Why European Shares Are Gaining Traction in 2025

- 27. What’s Driving the Interest in European Markets?

- 28. Why Now Is the Right Time to Invest

- 29. Key Takeaways for Investors

- 30. What are some of the reasons European shares are attracting attention in 2025?

- 31. Why European Shares Are Attracting Attention

- 32. Robbert Manders’ Perspective

- 33. Key Sectors to Watch

- 34. challenges Ahead

- 35. Conclusion

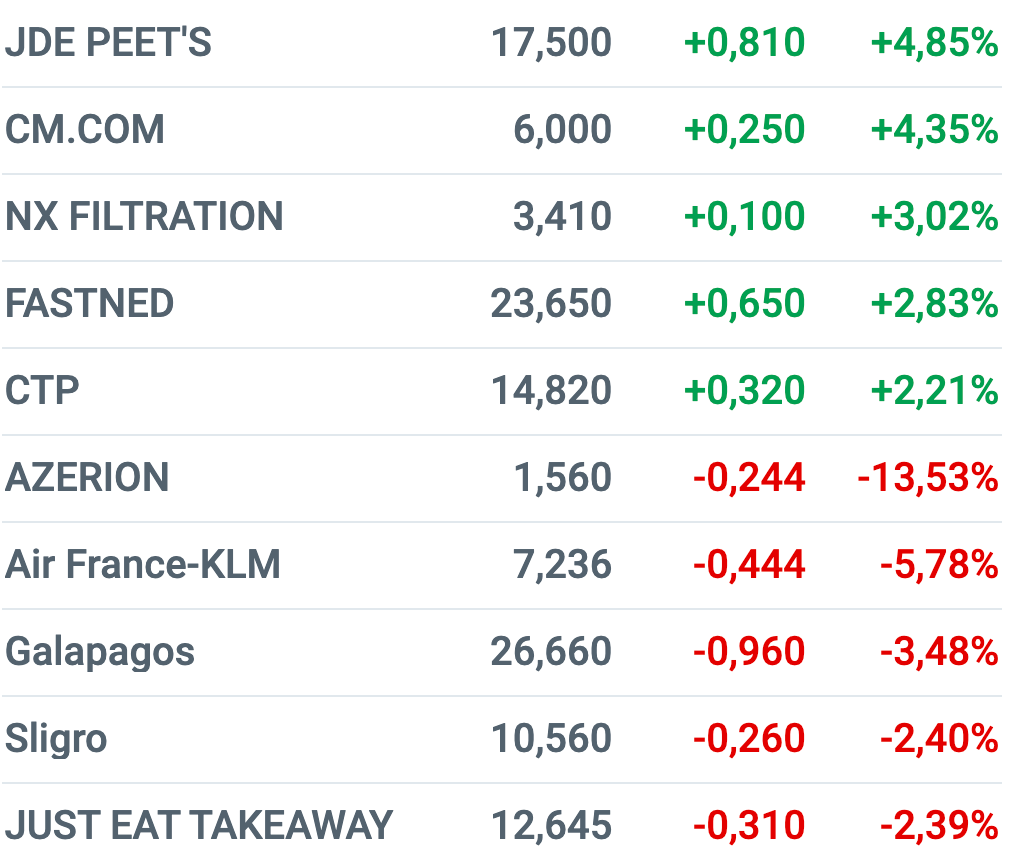

Key developments from Thursday, January 9:

- The AEX index started the day flat but climbed steadily as the day progressed.

- US stock markets remained closed in observance of former President Jimmy Carter’s state funeral.

- Tech stocks initially dipped but showed signs of recovery later in the day.

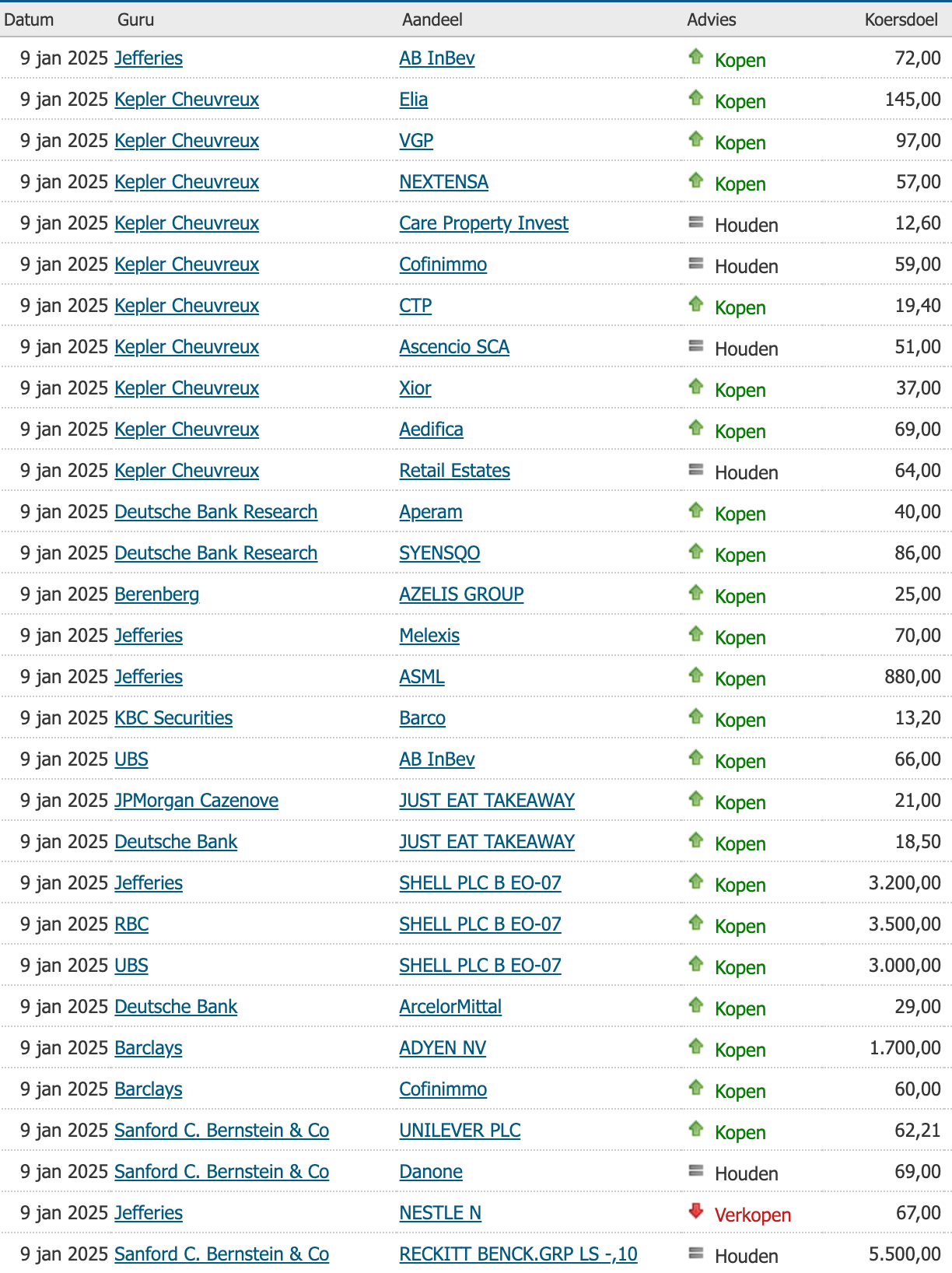

- Positive analyst recommendations boosted shares of Unilever, ArcelorMittal, Shell, and DSM-Firmenich.

- Despite upbeat advice,Just Eat Takeaway’s stock price declined.

- JDE Peets, a coffee and tea retailer, rebounded significantly after months of losses, while Air France-KLM faced a steep decline.

- The AEX closed with solid gains, mirroring trends across most European exchanges.

With Wall Street closed for the day, European markets took centre stage. Trading was relatively subdued, as is often the case when US markets are inactive. However, the AEX managed to carve out a positive trajectory, defying the quiet atmosphere.

The AEX began the day on a neutral note but soon gained momentum. Early resistance from tech stocks was eventually overcome, allowing the index to push higher.Stocks like DSM-Firmenich, Unilever, Shell, and ArcelorMittal saw notable price increases following favorable analyst reports.

In the AMX index, which typically trails the AEX, coffee giant JDE Peets (+4.84%) enjoyed a significant rebound after months of decline. Market chatter suggests that takeover speculation and rising coffee sales fueled investor interest.Bargain hunters,drawn to the stock’s low price point,likely contributed to the uptick.

On the flip side, Air France-KLM (-5.87%) had a rough day, with its stock price plummeting to an all-time low. The airline’s shares have already dropped more than 10% this year. As one forum member aptly put it, ”This stock never disappoints, at least on the short side.” Factors such as soaring oil prices and unresolved disputes with pilots are believed to be behind the sharp decline.

US Interest Rates: A Slight Dip Amid Broader Trends

Interest rates remain a focal point for investors, especially considering recent economic policies. The Federal Reserve’s cautious approach to rate cuts, driven by concerns over inflation, has kept markets on edge. As early December, the US ten-year bond yield has risen by 50 basis points, reaching 4.66%. Though, today saw a slight dip in US rates, while European bond yields edged higher. Here’s a snapshot of key rates as of 5 p.m.:

- US ten-year: 4.666% (-2.7 bp)

- Dutch ten-year: 2.757% (+0.5 bp)

- German ten-year: 2.526% (+0.2 bp)

- British ten-year: 4.854% (+2.1 bp)

- French ten-year: 3.382% (+2.5 bp)

- Japanese ten-year: 1.178% (+0.3 bp)

the AEX had a strong showing,while the AMX and ASCX indices,which focus on smaller companies,ended the day in negative territory. The divergence highlights the challenges faced by smaller stocks in a market dominated by larger players.

Market Overview: A Mixed Bag of Trends and Developments

The financial markets today presented a blend of cautious optimism and notable shifts across various sectors. From European stock exchanges to cryptocurrency movements, here’s a complete look at the key highlights shaping the day.

Stock Market Highlights

European markets kicked off with a subdued tone, reflecting a mix of regional developments and global influences. The AEX index in Amsterdam opened slightly higher, buoyed by positive sentiment despite Wall Street remaining closed. Meanwhile, Asian markets struggled, with most indices trading in the red, reflecting ongoing concerns about economic growth and inflation.

In Germany, industrial production showed signs of resilience, with output rising modestly. This was complemented by an increase in the country’s trade surplus, signaling robust export activity. Though, China’s inflation data painted a contrasting picture, with prices barely rising, underscoring the challenges faced by the world’s second-largest economy.

Commodities and Cryptocurrencies

Bitcoin faced headwinds early in the day, dropping nearly 3% to $92,200 before recovering slightly. Analysts remain divided on the cryptocurrency’s near-term trajectory, with some pointing to a lack of momentum in the broader crypto market. On the commodities front, oil and gold both edged higher, with gold gaining particular attention. According to TA analyst Wouter Slot, gold is poised for a “new upward momentum” in the coming years, driven by macroeconomic factors and investor sentiment.

Interest Rates and Currency Movements

European bond markets saw divergent trends,with UK gilt yields hitting their highest levels since the 2008 financial crisis,reaching 4.86%. This spike reflects growing concerns about inflation and monetary policy tightening. In contrast, the dollar and euro remained relatively stable, while the British pound continued its downward slide. Despite the currency’s weakness, the FTSE 100 index in the UK posted strong gains, although smaller-cap stocks struggled.

Corporate News and Stock Movements

Several companies made headlines today, with DSM-Firmenich leading the pack after receiving a buy proposal from Stifel, an American investment bank. The stock rose 2.08%, reflecting investor confidence in the firm’s growth prospects.insurers ASR and NN also saw modest gains, with ASR climbing 1.45%.

On the flip side, Aperam faced downward pressure after Deutsche Bank lowered its price target for the steel manufacturer. Meanwhile, Sika reported robust sales growth across all regions, highlighting the company’s strong market position. In the renewable energy sector, Alfen attracted attention as Acadian reported initial interest in the company, signaling potential growth opportunities.

Looking Ahead

As the trading day progresses, investors will be closely monitoring macroeconomic indicators and corporate earnings reports for further cues. With gold and oil showing resilience,and interest rates continuing to rise in certain regions,the markets remain in a state of flux. For those seeking deeper insights, the full stock market agenda and detailed analysis are available here.

Biggest Movers in Amsterdam

Key Takeaways

- European markets opened flat, with the AEX showing slight gains.

- Bitcoin dipped before recovering, while gold and oil posted modest gains.

- UK gilt yields hit a 15-year high, reflecting inflation concerns.

- DSM-Firmenich and ASR were among the top performers, while Aperam faced downward pressure.

Stay tuned for further updates as the markets continue to evolve in response to global economic trends and corporate developments.

Market Trends and Analyst Insights: Key Movers and Shakers

Recent Market Movements

The stock market continues to reflect a mix of optimism and caution, with several companies experiencing significant shifts. Here’s a closer look at the latest developments:

- Air France-KLM (-5.87%) has faced turbulence recently, with unresolved pilot agreements and oil price concerns adding to its challenges.

- Arcadis (-0.55%) struggled to maintain momentum, as its focus on sustainability clashes with the potential return of fossil fuel-friendly policies.

- Galapagos (-3.48%) saw a sharp decline following its announcement of a corporate split and workforce reduction, despite earlier gains.

- Munich Re (-1.92%) highlighted the growing impact of natural disasters, projecting €300 billion in global damages by 2024, which could drive premium hikes.

- Volkswagen (+0.65%) bucked the trend among European car manufacturers, rising despite fears of Chinese trade retaliation.

Analyst Insights: Stock Picks for 2024

As the new year unfolds,analysts are actively updating their recommendations,with a focus on growth opportunities. Here are some standout stocks:

- ASML: A semiconductor leader with a price target of €880, driven by its critical role in the tech supply chain.

- Just Eat Takeaway: Analysts predict a price range of €18.50 to €21, despite recent investor skepticism.

- Shell: with targets between £3,000 and £3,500, the energy giant remains a top pick despite recent challenges.

- Adyen: The fintech innovator is expected to reach €1,700, reflecting its strong position in digital payments.

- Unilever: Bernstein’s buy recommendation and a €62.21 target underscore its resilience in consumer goods.

On the flip side, nestle and Danone have drawn cautionary notes, with analysts flagging potential headwinds.

Notable Performers and Challenges

- Heineken (-0.47%) announced its exit from an indian state amid a dispute with local authorities, while Ab Inbev (+0.46%) fared better.

- GOES Peets (+4.84%) rebounded after a steep decline, though high coffee prices continue to pressure margins.

- IMCD (+1.14%) gained traction as its competitor, Azelis, drew investor attention.

Key Takeaways

As the market navigates a complex landscape, investors are advised to stay informed about both opportunities and risks. From sustainability-driven firms like arcadis to tech leaders like ASML,the year ahead promises to be dynamic and full of potential.

Key Economic Updates and Global events for January 10,2025

As the world gears up for a busy Friday,January 10,2025,several significant economic updates and global events are set to shape the day. From corporate earnings to critical government decisions, here’s a comprehensive look at what to expect.

Economic Agenda: What’s on the radar?

Friday’s economic calendar is packed with key data releases and corporate updates. Here’s a breakdown of the major events:

- 00:00: InPost, the Amsterdam-listed Polish parcel locker operator, will release its Q4 trading update.

- 06:30: Industrial production figures for November in the Netherlands will be published.

- 08:45: France will report its November industrial production data.

- 13:00: Delta Air Lines will kick off the US earnings season with its Q4 2024 financial results.

- 14:30: The US December jobs report (Banenrapport) will be released, offering insights into employment trends.

- 16:00: The preliminary Michigan consumer Confidence Index for January will provide a snapshot of consumer sentiment.

US Jobs Report: A Market Mover?

All eyes will be on the US non-farm payrolls report, a critical indicator for the Federal Reserve’s dual mandate of price stability and full employment. Economists predict an unemployment rate of 4.2%, consistent with the previous month. While slightly above the Fed’s target, it remains within acceptable limits. Job growth is expected to slow to 150,000, down from November’s 227,000, with hourly wages rising by 4% annually and 0.3% monthly.

However, the Fed’s focus may shift as the inauguration of Donald Trump as the 47th US president approaches on January 21. His management’s policies are likely to have far-reaching implications for the US and global economies.

TikTok’s Fate: A Supreme court Decision

On Friday, the US Supreme court will deliberate on the TikTok case. The government has mandated that ByteDance, TikTok’s parent company, either sell its US operations or cease activities by January 19. This decision is strongly opposed by ByteDance, setting the stage for a high-stakes legal battle.

Global Headlines: What Else Is Happening?

Retail Woes: Bankruptcies Hit Shopping Streets

More and more vacancies in shopping streets: bankruptcies are the culprit https://t.co/Vtpf7uTmao

— NU.nl (@NUnl) January 9,2025

AI Disruption: Banking Jobs at Risk

Global banks are expected to cut as many as 200,000 jobs in the next three to five years as AI encroaches on tasks currently carried out by human workers,according to Bloomberg Intelligence https://t.co/pE8z059INt

— Bloomberg Economics (@economics) January 9, 2025

California Wildfires: Los Angeles in Crisis

Maps: See how large the California wildfires are https://t.co/DDeL1nEQ2K

— Yahoo News (@YahooNews) January 9, 2025

Tech Milestone: The iPhone’s Legacy

On this day in 2007: the iPhone was unveiled.https://t.co/Ux42vKSq

— Apple History (@AppleHistory) January 9, 2025

Conclusion

January 10, 2025, promises to be a pivotal day for global markets and economies. From corporate earnings and employment data to legal battles and environmental crises, the events unfolding will have lasting impacts. Stay tuned for updates as these stories develop.

Why European Shares Are Gaining Traction in 2025

As we step into 2025, the financial landscape is buzzing with renewed interest in European shares. Analysts and investors alike are turning their attention to the continent, citing its potential for growth and stability. Among the voices championing this trend is robbert Manders, a seasoned analyst at Antaurus, who recently emphasized the value of investing in European markets.

Invest in European shares, says analyst Robbert manders of Antaurus https://t.co/vAFMtgYaRe And he’s not the only one with this tip: https://t.co/pUcpYD8v7k in https://t.co/rrS8PwBLdM @RobbertManders @beursanalist @Juvyns_Vincent @Antaurus

What’s Driving the Interest in European Markets?

Europe’s economic recovery has been steady, with key industries such as technology, renewable energy, and manufacturing showing robust growth. The region’s commitment to sustainability and innovation has also made it an attractive destination for global investors. According to Manders, “Investing in European shares is not just a short-term play; it’s a strategic move for long-term gains.”

This sentiment is echoed by other financial experts, who point to Europe’s resilient infrastructure and progressive policies as key factors driving its appeal. The continent’s ability to adapt to global challenges,such as climate change and digital transformation,has further solidified its position as a promising investment hub.

Why Now Is the Right Time to Invest

timing is everything in the world of investments, and 2025 seems to be the perfect moment to explore European shares. With markets stabilizing post-pandemic and new opportunities emerging in sectors like green energy and AI, the potential for returns is significant. As Manders aptly puts it, “The European market is ripe with opportunities for those willing to take a calculated risk.”

Moreover, the region’s regulatory habitat is becoming increasingly investor-friendly, offering a sense of security that is often hard to find in more volatile markets. This combination of growth potential and stability makes European shares a compelling choice for both seasoned investors and newcomers.

Key Takeaways for Investors

- Diversify Your portfolio: Adding European shares can help balance risk and reward, especially in uncertain times.

- Focus on Emerging Sectors: Look for opportunities in technology, renewable energy, and sustainable industries.

- Stay Informed: Keep an eye on market trends and expert insights to make well-informed decisions.

As the financial world continues to evolve, European shares are proving to be a luminous spot in the global market. Whether you’re a seasoned investor or just starting out, now is the time to explore what Europe has to offer.

So invest in European shares

Disclaimer: The details provided in this article is for educational purposes only and should not be considered professional investment advice. Always consult with a financial advisor before making investment decisions.

What are some of the reasons European shares are attracting attention in 2025?

2025

Several factors are contributing too the growing interest in European shares: Robbert Manders, an analyst at Antaurus, has been vocal about the potential of european markets. In a recent interview, he highlighted the following points: “European markets are currently undervalued compared to their US counterparts. With the continent’s focus on sustainability and innovation, there are ample opportunities for growth. Investors should consider diversifying their portfolios to include European shares, particularly in sectors like technology, renewable energy, and healthcare.” Manders also pointed out that the European Central Bank’s (ECB) monetary policies are likely to remain supportive,providing a favorable environment for equity investments. Investors looking to capitalize on the european market should keep an eye on the following sectors: While the outlook for European shares is positive,there are challenges that investors should be aware of: As 2025 unfolds, European shares are emerging as a compelling investment opportunity. With strong economic fundamentals, attractive valuations, and a focus on innovation and sustainability, the continent is well-positioned to deliver solid returns. Though, investors should remain vigilant about potential risks and stay informed about market developments. As Robbert Manders and other analysts suggest, now may be the time to consider adding European equities to your portfolio.Why European Shares Are Attracting Attention

Robbert Manders’ Perspective

Key Sectors to Watch

challenges Ahead

Conclusion