Fantasy Baseball SP Roundup: 4/21 Maxterpiece Theater

Okay, I’ll create a draft blog post based on the provided HTML, adhering to the requirements: Title: max Meyer Shines, Hunter Brown Heats Up, and

Okay, I’ll create a draft blog post based on the provided HTML, adhering to the requirements: Title: max Meyer Shines, Hunter Brown Heats Up, and

NBA Trades: Redefining Careers, Rewriting Narratives, and the Wizards’ Calculated Risk The NBA’s trade landscape is a high-stakes game of chess where one wrong move

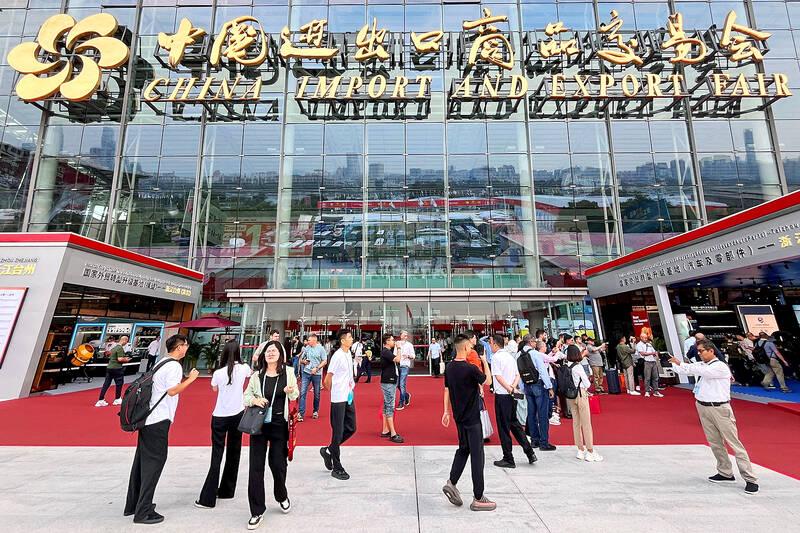

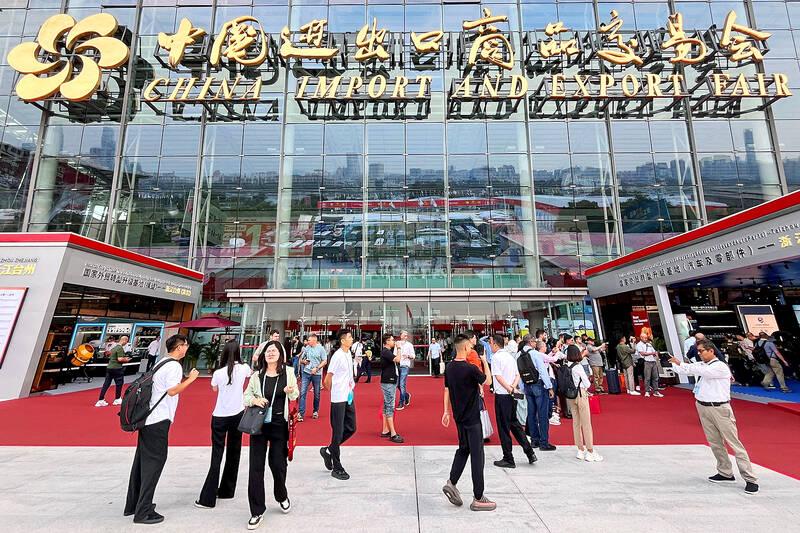

china Courts Taiwan with Business Events Amidst Rising Tensions April 22,2025 As tensions simmer across the Taiwan Strait,China is employing a dual strategy of military

Dengue, Chikungunya, and Zika Cases Surge: A Warning for the U.S.? By Archyde News Service April 18, 2025 An Aedes mosquito, the primary vector for

Okay, I’ll create a draft blog post based on the provided HTML, adhering to the requirements: Title: max Meyer Shines, Hunter Brown Heats Up, and

NBA Trades: Redefining Careers, Rewriting Narratives, and the Wizards’ Calculated Risk The NBA’s trade landscape is a high-stakes game of chess where one wrong move

china Courts Taiwan with Business Events Amidst Rising Tensions April 22,2025 As tensions simmer across the Taiwan Strait,China is employing a dual strategy of military

Dengue, Chikungunya, and Zika Cases Surge: A Warning for the U.S.? By Archyde News Service April 18, 2025 An Aedes mosquito, the primary vector for

© 2025 All rights reserved