Gold Prices Soar Amidst Trump’s Trade War

Gold Gleams as Trump-Era Trade Tensions Roil Markets Safe Haven Donald Trump’s policies create global market anxieties, driving gold prices upward. April 11, 2024 In

Gold Gleams as Trump-Era Trade Tensions Roil Markets Safe Haven Donald Trump’s policies create global market anxieties, driving gold prices upward. April 11, 2024 In

Ancient Wisdom Flows Anew: Dujiangyan Water-Releasing Festival Celebrates Millennia of Irrigation Dujiangyan, Sichuan Province, China – The Dujiangyan Water-Releasing Festival commenced on April 4, 2025,

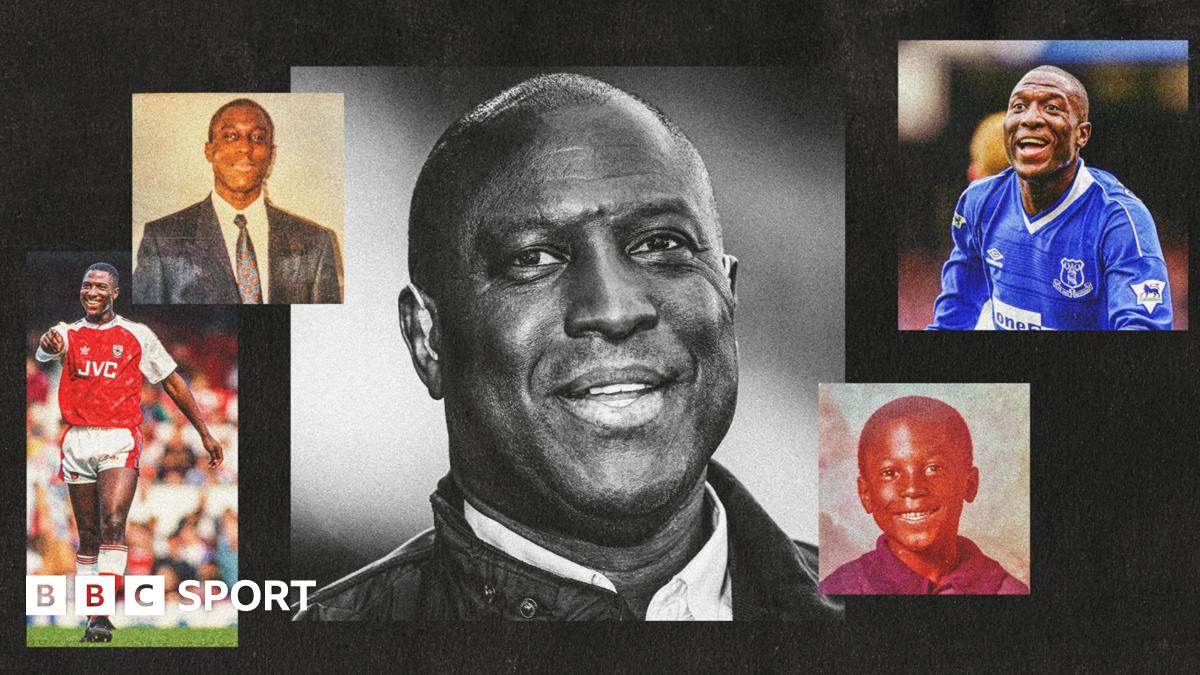

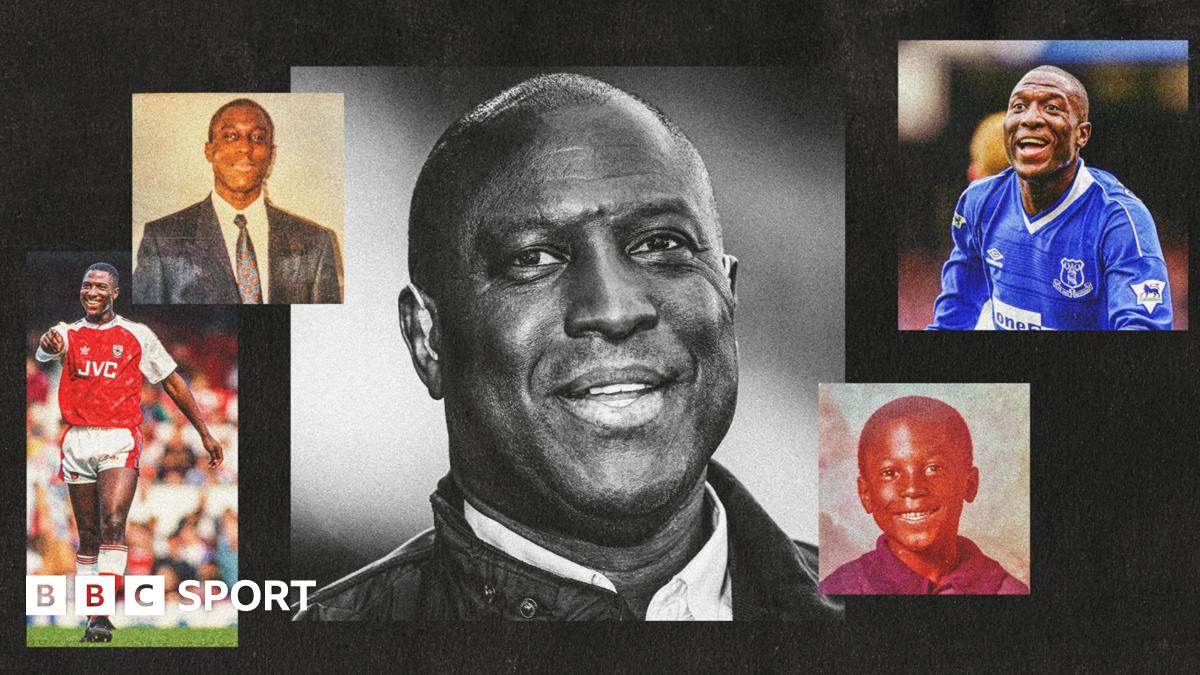

Inquest into Kevin Campbell’s Death Highlights NHS Challenges Amidst Funding Concerns An inquest into teh death of former Premier League footballer Kevin Campbell has shed

AI-Generated “Dolls” Take Over Social media: A Harmless Trend or a Cause for Concern? By News Journalist June 4, 2024 If you’ve been online lately,

Gold Gleams as Trump-Era Trade Tensions Roil Markets Safe Haven Donald Trump’s policies create global market anxieties, driving gold prices upward. April 11, 2024 In

Ancient Wisdom Flows Anew: Dujiangyan Water-Releasing Festival Celebrates Millennia of Irrigation Dujiangyan, Sichuan Province, China – The Dujiangyan Water-Releasing Festival commenced on April 4, 2025,

Inquest into Kevin Campbell’s Death Highlights NHS Challenges Amidst Funding Concerns An inquest into teh death of former Premier League footballer Kevin Campbell has shed

AI-Generated “Dolls” Take Over Social media: A Harmless Trend or a Cause for Concern? By News Journalist June 4, 2024 If you’ve been online lately,

© 2025 All rights reserved